Federal Tax Brackets For 2022 Married WEB Nov 11 2021 nbsp 0183 32 The standard deduction for married couples goes up to 25 900 for tax year 2022 Single filers and married individuals who file separately will get a 12 950 standard deduction and heads of

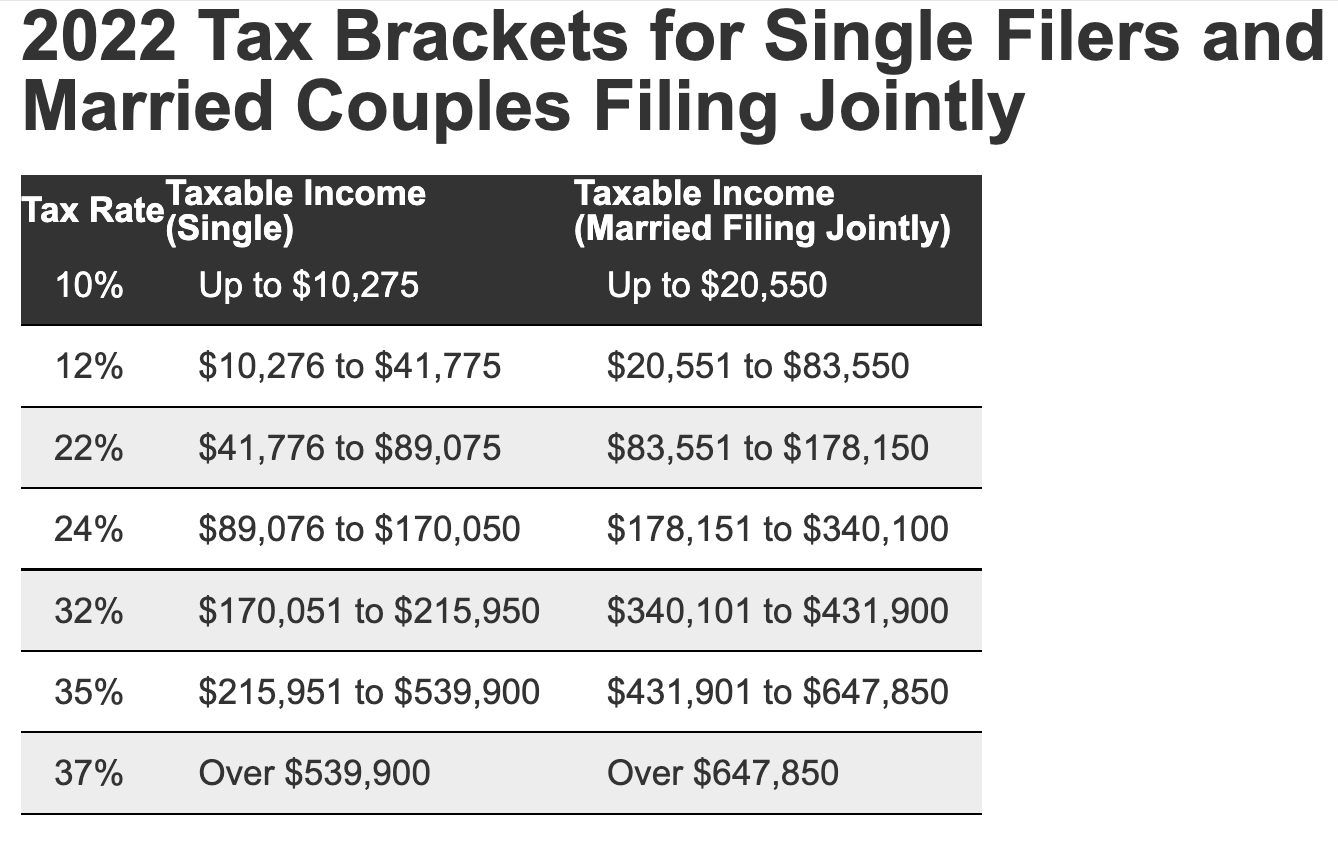

WEB Nov 10 2021 nbsp 0183 32 The standard deduction amounts will increase to 12 950 for individuals and married couples filing separately 19 400 for heads of household and 25 900 for married couples filing jointly and WEB Nov 13 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2022 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your tax bracket depends on

Federal Tax Brackets For 2022 Married

Federal Tax Brackets For 2022 Married

Federal Tax Brackets For 2022 Married

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

WEB Nov 10 2021 nbsp 0183 32 The 2022 tax brackets affect the taxes that will be filed in 2023 These are the 2021 brackets Here are the new brackets for 2022 depending on your income and filing status For married

Pre-crafted templates offer a time-saving service for developing a varied variety of files and files. These pre-designed formats and designs can be used for various personal and professional jobs, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, simplifying the content production procedure.

Federal Tax Brackets For 2022 Married

2021 Tax Brackets Irs Calculator

2022 Federal Tax Brackets And Standard Deduction Printable Form

2022 Tax Brackets Married Filing Jointly

Income Tax 2022 Filing

2022 Tax Tables Married Filing Jointly Printable Form Templates And

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

https://taxfoundation.org/data/all/federal/2022-tax-brackets

WEB Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539 900 for single filers and above 647 850 for married couples filing jointly

https://www.irs.com/en/2022-federal-income-tax...

WEB Feb 21 2022 nbsp 0183 32 These are broken down into seven 7 taxable income groups based on your federal filing statuses e g whether you are single a head of household married etc The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket

https://www.irs.gov/newsroom/irs-provides-tax...

WEB Nov 10 2021 nbsp 0183 32 The standard deduction for married couples filing jointly for tax year 2022 rises to 25 900 up 800 from the prior year For single taxpayers and married individuals filing separately the standard deduction rises to 12 950 for 2022 up 400 and for heads of households the standard deduction will be 19 400 for tax year 2022 up 600

https://www.irs.gov/pub/irs-prior/i1040tt--2022.pdf

WEB married filing jointly and read down the column The amount shown where the taxable income line and filing status column meet is 2 628 This is the tax amount they should enter in the entry space on Form 1040 line 16 If line 15 taxable income is And you are At least But less than Single Married filing jointly Married filing sepa

https://bradfordtaxinstitute.com/Free_Resources/...

WEB Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts 1

WEB Oct 27 2020 nbsp 0183 32 In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1 The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples filing jointly WEB Apr 16 2024 nbsp 0183 32 The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37

WEB Nov 1 2022 nbsp 0183 32 Federal Income Tax Brackets for Tax Year 2022 Filed in 2023 In the table below you can find the tax rate and the income brackets for three different filing statuses The tax rate only applies to the income you earn within that bracket