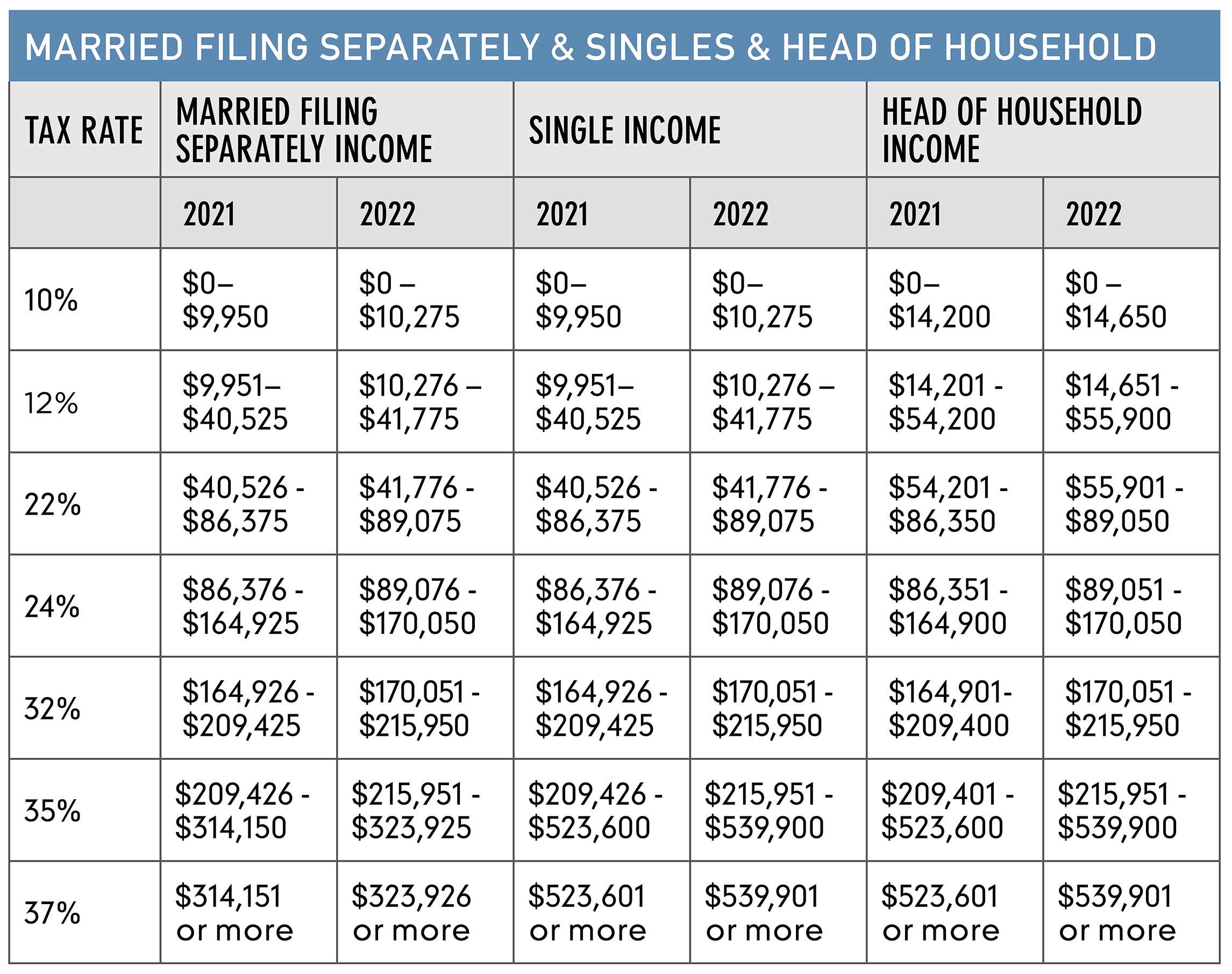

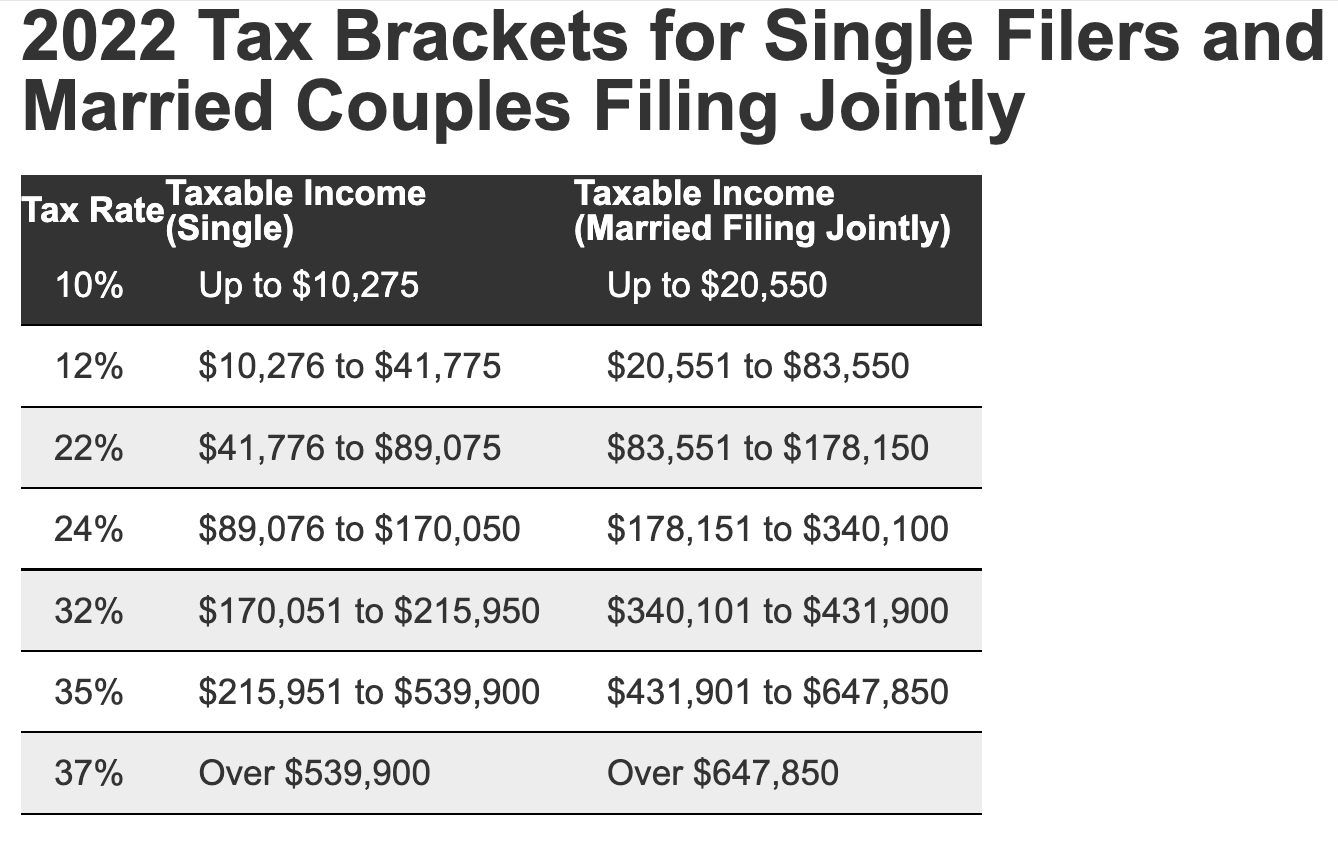

Federal Tax Brackets 2022 Married Filing Separately Web Tax Brackets for 2022 Individuals Marginal Rate Single Married Filing Joint Head of Household Married Filing Separate 10 0 10 275 0 20 550 0 14 650 0 10 275

Web Nov 11 2021 nbsp 0183 32 For 2022 the maximum zero rate taxable income amount will be 83 350 for married couples filing jointly and for surviving spouses The amount for heads of household is 55 800 For a married Web 2022 Federal Income Tax Brackets Tax Rate Single Married filing jointly Married filing separately Head of Household 10 0 to 10 275 0 to 20 550 0 to 10 275 0 to

Federal Tax Brackets 2022 Married Filing Separately

Federal Tax Brackets 2022 Married Filing Separately

Federal Tax Brackets 2022 Married Filing Separately

https://i2.wp.com/wpdev.abercpa.com/wp-content/uploads/2018/06/married-filing-jointly-tax-brackets.png

Web Married Filing Separately is the filing type used by taxpayers who are legally married but decide not to file jointly using the Married Filing Jointly filing type There are a number

Pre-crafted templates provide a time-saving option for developing a diverse range of files and files. These pre-designed formats and layouts can be utilized for various individual and expert tasks, consisting of resumes, invites, leaflets, newsletters, reports, presentations, and more, improving the material creation procedure.

Federal Tax Brackets 2022 Married Filing Separately

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Irs Tax Table 2022 Married Filing Jointly Latest News Update

2021 Tax Brackets Irs Calculator Orientierungsreiten

10 2023 California Tax Brackets References 2023 BGH

Capital Gains Tax Rate 2021 And 2022 Latest News Update

IRS 2021 Tax Tables Deductions Exemptions Purposeful finance

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As your income

https://taxfoundation.org/data/all/federal/2022-tax-brackets

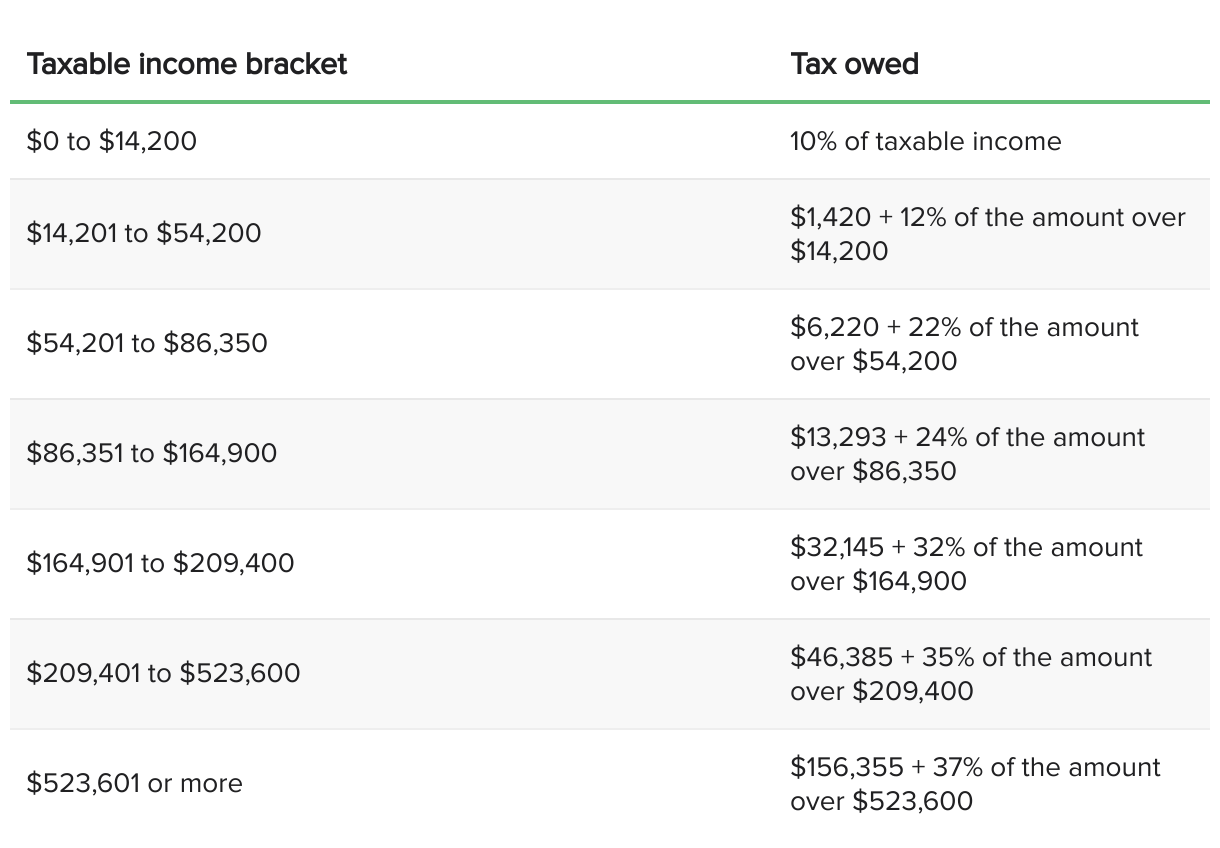

Web Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households Tax Rate For Single Filers For Married

https://bradfordtaxinstitute.com/Free_Resources/...

Web Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married

https://www.forbes.com/advisor/taxes/t…

Web Jan 9 2024 nbsp 0183 32 2023 Tax Brackets Married Filing Separately

https://turbotax.intuit.com/.../tax-bracket

Web 8 rows nbsp 0183 32 The seven federal tax bracket rates range from 10 to 37 2023 tax brackets and federal income tax rates 2022 tax brackets and federal income tax rates 2021 tax brackets and federal income tax rates View

Web 1 day ago nbsp 0183 32 Only single people can file single and their tax brackets are different in some cases from the ones that will apply to you if you re married and filing separately Web Feb 21 2024 nbsp 0183 32 There are seven federal income tax rates and brackets in 2023 and 2024 10 12 22 24 32 35 and 37 Taxable income and filing status determine

Web Next Year 2023 Federal 2023 Single Tax Brackets Federal 2023 Married Filing Separately Tax Brackets Federal 2023 Married Filing Jointly Tax Brackets Federal