Federal Tax Brackets 2022 Married Filing Jointly Calculator Web You can use our Federal Tax Brackets Calculator to determine how much tax you will pay for the current tax year or to determine how much tax you have paid in previous tax years To do so all you need to do is Select a tax year Select a filing status either single or joint Enter your income amount Click quot Calculate quot

Web Jan 1 2024 nbsp 0183 32 Federal Income Tax Calculator 2023 2024 lt xml version quot 1 0 quot encoding utf 8 gt Federal Income Tax Calculator Estimator for 2023 2024 Taxes Your Details Done Overview of Federal Income Taxes Income in America is taxed by the federal government most state governments and many local governments Web The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2023 and 2024 The 2024 tax values can be used for 1040 ES estimation planning ahead or comparison Income Person 1 Husband Earned Income

Federal Tax Brackets 2022 Married Filing Jointly Calculator

Federal Tax Brackets 2022 Married Filing Jointly Calculator

Federal Tax Brackets 2022 Married Filing Jointly Calculator

https://scrn-cdn.omnicalculator.com/finance/[email protected]

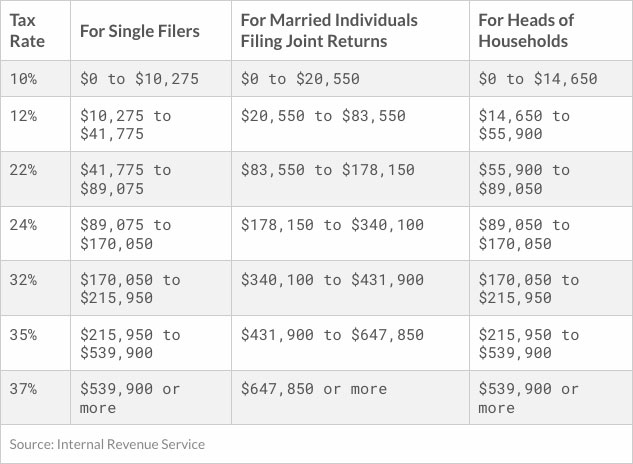

Web Feb 21 2024 nbsp 0183 32 There are seven federal income tax rates and brackets in 2023 and 2024 10 12 22 24 32 35 and 37 Taxable income and filing status determine which federal tax rates apply to

Pre-crafted templates provide a time-saving service for creating a varied series of documents and files. These pre-designed formats and layouts can be used for different personal and professional tasks, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, enhancing the material creation process.

Federal Tax Brackets 2022 Married Filing Jointly Calculator

Irs Tax Table 2022 Married Filing Jointly Latest News Update

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2022 Tax Tables Married Filing Jointly Printable Form Templates And

2022 Tax Brackets Married Filing Jointly Myrtle Parsons Viral

Incredible Us Tax Brackets 2021 References Finance News

2022 Income Tax Brackets And The New Ideal Income

https://www.calculator.net/marriage-calculator.html

Web The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2024 federal income tax brackets and data specific to the United States For tax purposes whether a person is classified as married is based on the last day of the tax year which

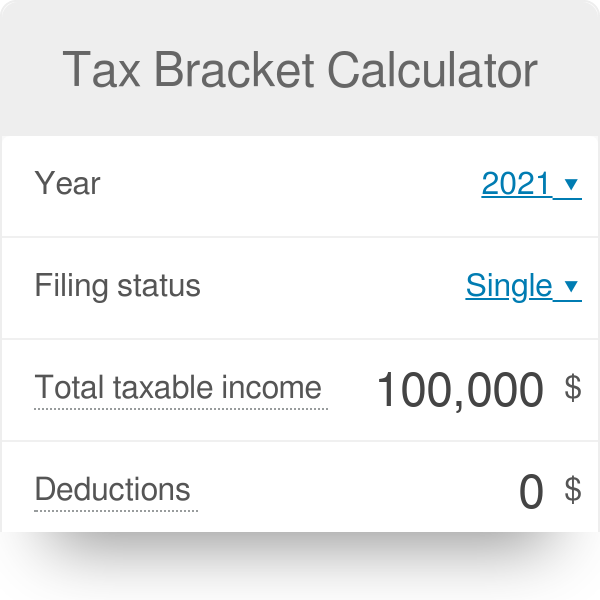

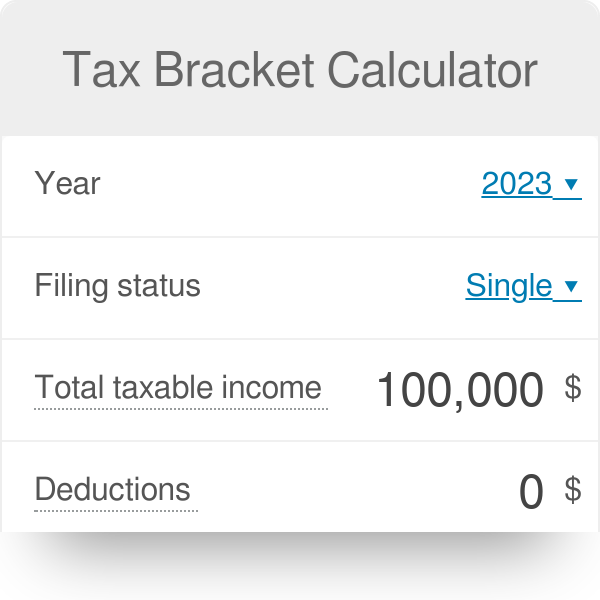

https://www.omnicalculator.com/finance/tax-bracket

Web Jan 18 2024 nbsp 0183 32 With our tax bracket calculator you can easily check which tax bracket you are in and find the federal income tax on your income Besides for better insight you can check how the final amount is computed and the final tax rate applied to your net income

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households Tax Rate For Single Filers For Married Individuals Filing Joint Returns For Heads of Households 10 0 to 10 275 0 to 20 550 0 to 14 650 12 10 275 to 41 775 20 550 to 83 550 14 650 to

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web Jan 31 2024 nbsp 0183 32 Head of household See the tax rates for the 2024 tax year Taxable income Page Last Reviewed or Updated 31 Jan 2024 Share See current federal tax brackets and rates based on your income and filing status

https://www.irs.com/en/2022-federal-income-tax...

Web Feb 21 2022 nbsp 0183 32 Single Unmarried Individuals Married Filing Jointly or Qualifying Widow Widower Married Filing Separately Head of Household gt gt Start Your FREE E File Calculating your 2022 tax bracket Being in a certain tax bracket doesn t mean that all your income will be taxed at that rate

Web Jan 3 2023 nbsp 0183 32 Updated to include income tax calculations for 2022 form 1040 and 2023 Estimated form 1040 ES for status Single Married Filing Jointly Married Filing Separately or Head of Household Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas Web Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for married couples filing jointly The other rates are 35 for incomes over 215 950 431 900 for married couples filing jointly

Web Jan 18 2022 nbsp 0183 32 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing jointly and 125 000 for married couples filing separately Jan 18 2022 4th installment deadline to pay 2021 estimated taxes due