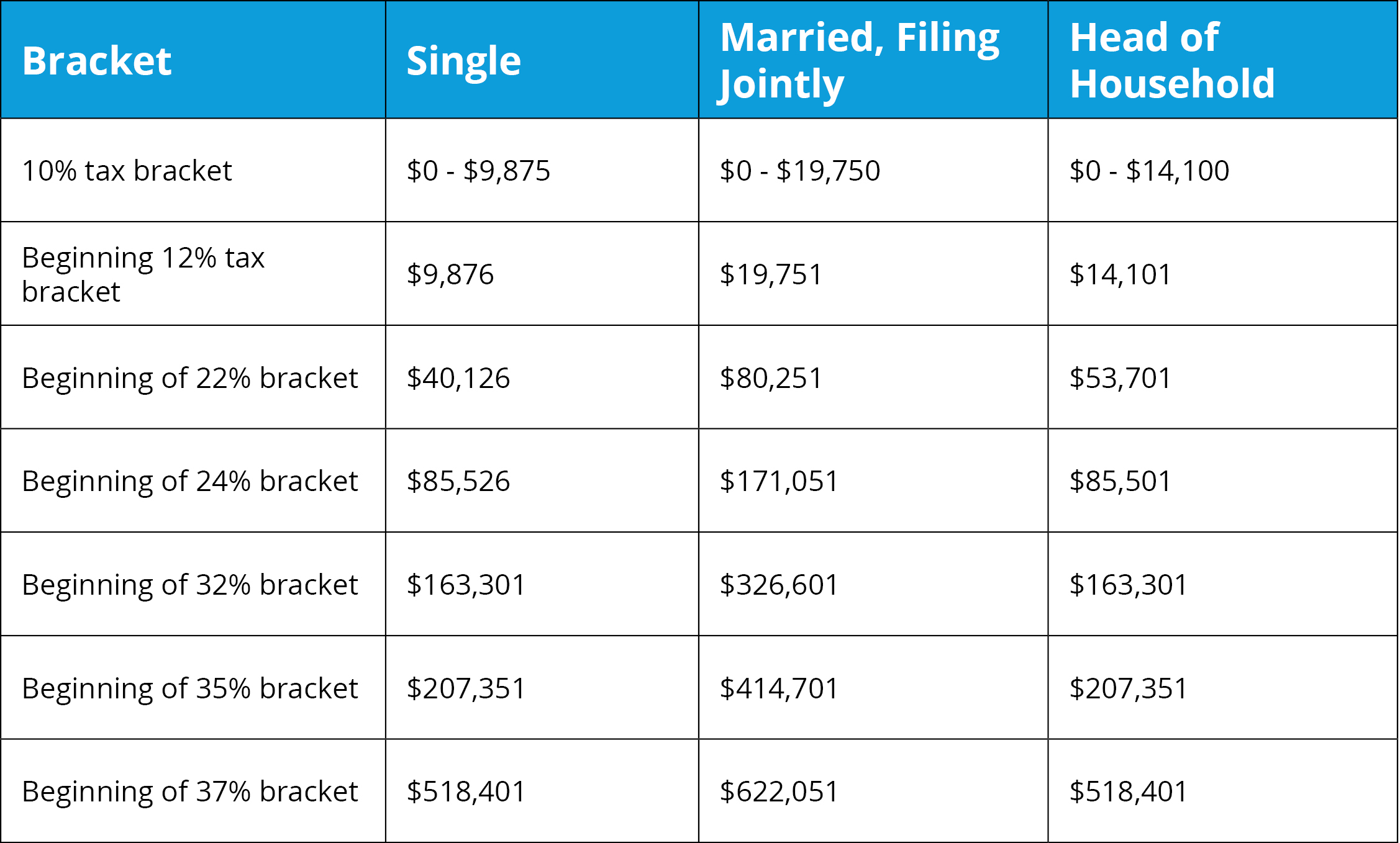

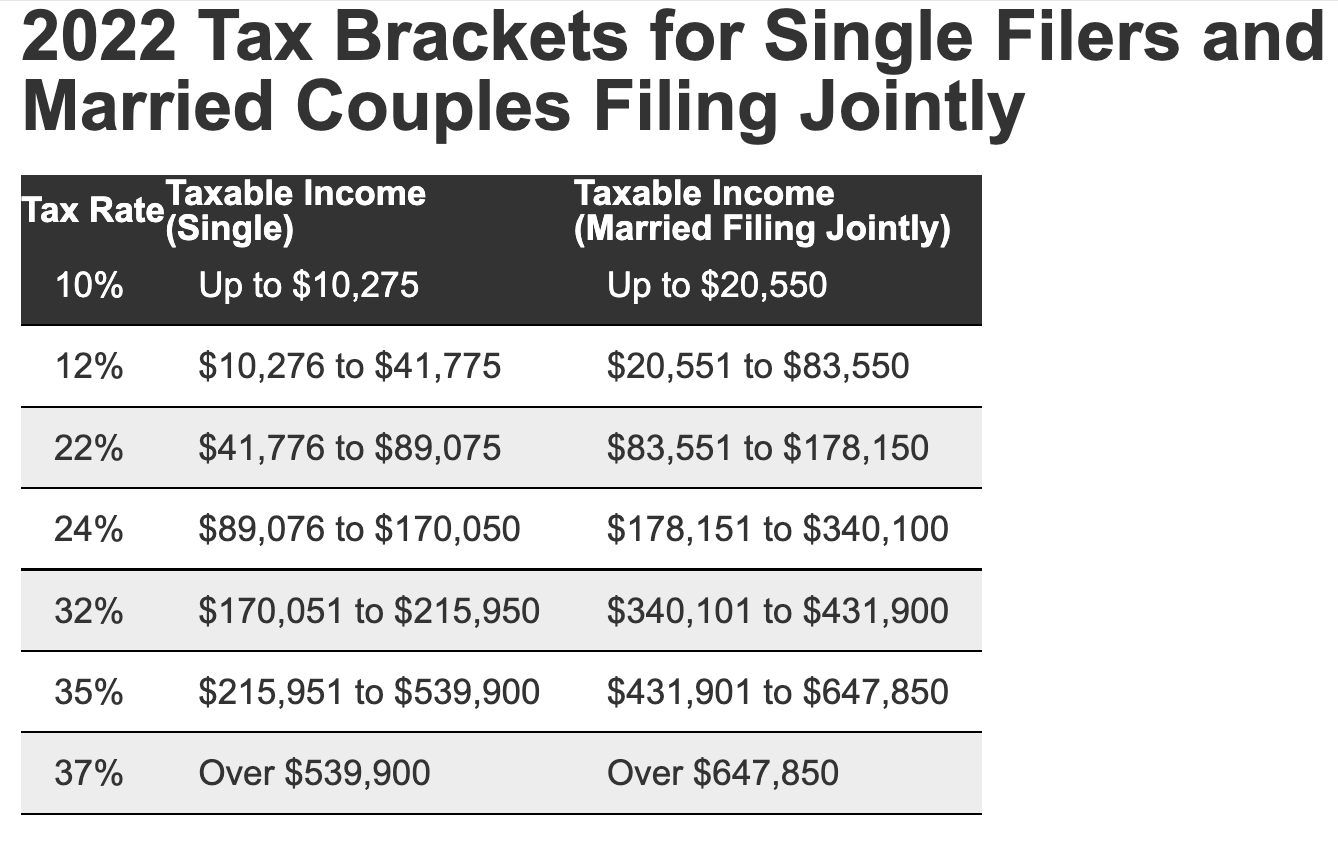

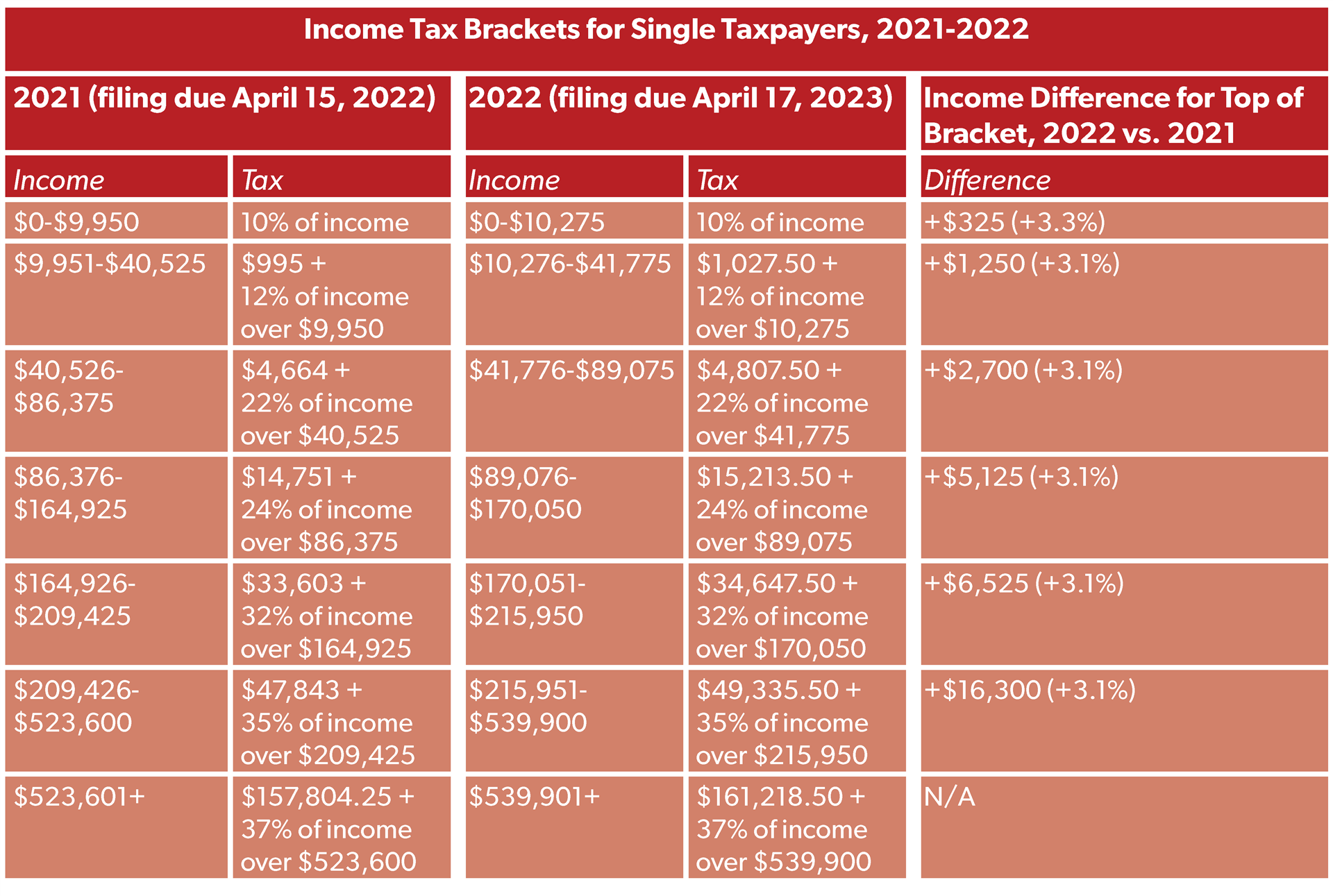

Federal Tax Brackets 2022 Individual WEB Nov 10 2021 nbsp 0183 32 Here are the new brackets for 2022 depending on your income and filing status For married individuals filing jointly 10 Taxable income up to 20 550 12 Taxable income between 20 550 to

WEB Jan 23 2024 nbsp 0183 32 Federal Individual Income Tax Brackets Standard Deduction and Personal Exemption 1988 to 2024 This report tracks changes in federal individual income tax brackets the standard deduction and the personal exemption since 1988 All three tax items have been indexed for inflation since 1981 WEB 2022 Tax Rate Schedule Standard Deductions amp Personal Exemption HEAD OF HOUSEHOLD For taxable years beginning in 2022 the standard deduction amount under 167 63 c 5 for an individual Kiddie Tax all net unearned income over a threshold amount of 2 300 for 2022 is taxed using the brackets and rates of the child s parents

Federal Tax Brackets 2022 Individual

Federal Tax Brackets 2022 Individual

Federal Tax Brackets 2022 Individual

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

WEB Mar 14 2024 nbsp 0183 32 The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37 Your filing

Templates are pre-designed documents or files that can be utilized for different functions. They can save effort and time by offering a ready-made format and design for creating different sort of content. Templates can be used for individual or expert projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Federal Tax Brackets 2022 Individual

Irs Tax Table 2022 Married Filing Jointly Latest News Update

Tax Brackets 2022 Chart

2022 To 2023 Tax Brackets TAX

Here Are The Federal Tax Brackets For 2023 Vs 2022 Narrative News

2022 Federal Tax Brackets And Standard Deduction Printable Form

2021 IRS Tax Brackets Table Federal Withholding Tables 2021

https://taxfoundation.org/data/all/federal/2022-tax-brackets

WEB Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB Mar 18 2024 nbsp 0183 32 Individuals Federal income tax rates and brackets You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income

https://www.forbes.com/sites/ashleaebeling/2021/11/...

WEB Nov 10 2021 nbsp 0183 32 The Internal Revenue Service has announced annual inflation adjustments for tax year 2022 meaning new tax rate schedules and tax tables and cost of living adjustments for various tax

https://www.irs.gov/newsroom/irs-provides-tax...

WEB Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for married couples filing jointly The other rates are 35 for incomes over 215 950 431 900 for married couples filing jointly

https://www.irs.gov/pub/irs-prior/i1040tt--2022.pdf

WEB MUST be removed before printing Sep 27 2022 Cat No 24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040 SR FreeFile is the fast safe and free way to prepare and e le your taxes See IRS gov FreeFile Pay Online

WEB Mar 12 2024 nbsp 0183 32 The seven federal income tax brackets for 2023 and 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status WEB Nov 13 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2023 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your tax bracket

WEB Jan 20 2022 nbsp 0183 32 The top 1 percent of taxpayers paid a 25 6 percent average individual income tax rate which is more than seven times higher than taxpayers in the bottom 50 percent 3 5 percent The share of reported income earned by the top 1 percent of taxpayers fell to 20 1 percent from 20 9 percent in 2018