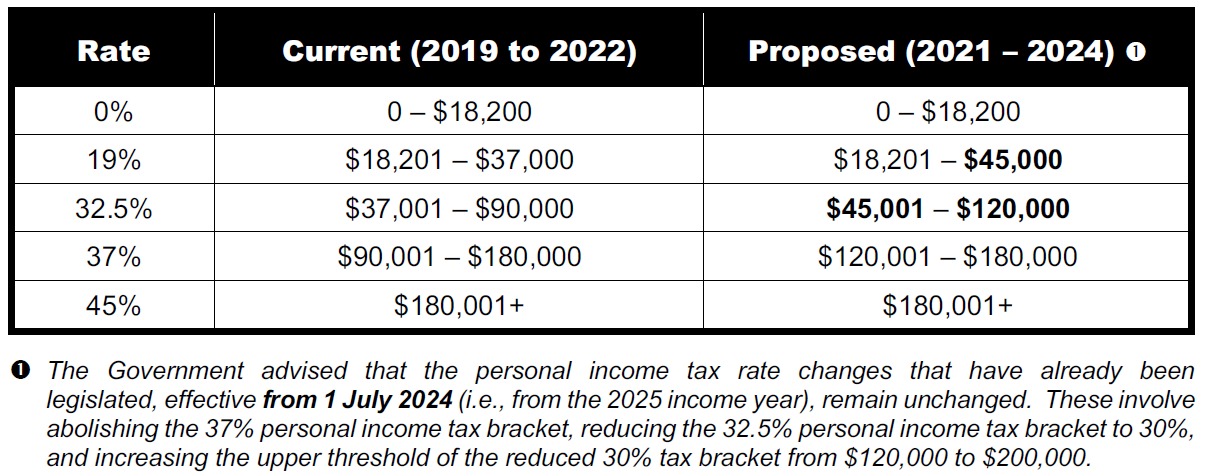

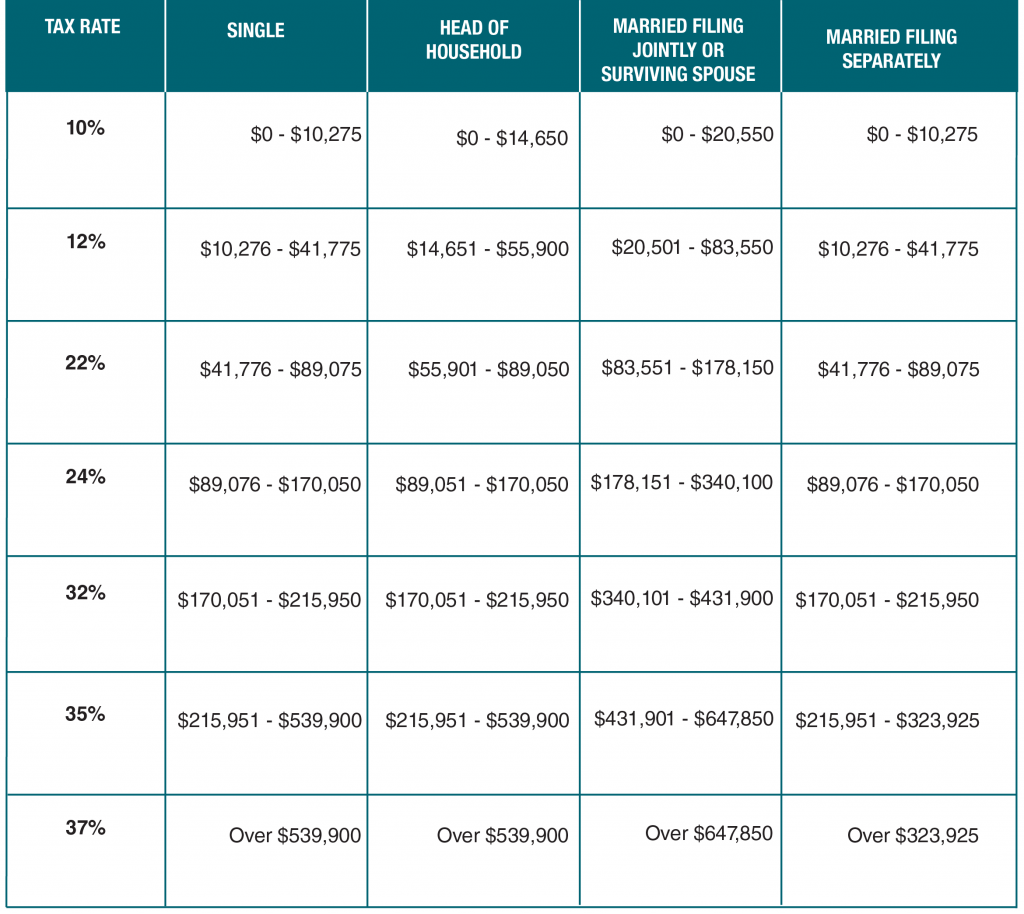

Federal Income Tax Rates 2022 Web Jan 27 2023 nbsp 0183 32 Personal income tax rates begin at 10 for the tax year 2022 the return due in 2023 then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37 Each tax rate applies

Web For example for 2023 the 22 tax bracket range for single filers is 44 726 to 95 375 while the same rate applies to head of household filers with taxable income from 59 851 to 95 350 Web Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits

Federal Income Tax Rates 2022

Federal Income Tax Rates 2022

Federal Income Tax Rates 2022

https://i0.wp.com/www.whitecoatinvestor.com/wp-content/uploads/2020/12/tax-brackets-2022-img-1024x597.jpg

Web 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing jointly and

Pre-crafted templates offer a time-saving option for creating a varied series of files and files. These pre-designed formats and layouts can be utilized for numerous individual and expert jobs, including resumes, invitations, flyers, newsletters, reports, discussions, and more, simplifying the content production process.

Federal Income Tax Rates 2022

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law Firm

Federal Income Tax Brackets 2021 Ladegseattle

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Understanding The Tax Code USGOPO Com

2022 Tax Brackets Ca

2022 Tax Brackets PersiaKiylah

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web Jan 31 2024 nbsp 0183 32 See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 2022 Tax Bracket and Tax Rates There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status

https://taxfoundation.org/data/all/federal/summary...

Web Jan 20 2022 nbsp 0183 32 Summary of the Latest Federal Income Tax Data 2022 Update January 20 202241 min read By Erica York Download Data The Internal Revenue Service IRS has

https://www.investopedia.com/irs-announce…

Web Nov 11 2021 nbsp 0183 32 Standard deductions and about 60 other provisions have been adjusted for inflation to avoid bracket creep The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021

Web Jan 29 2024 nbsp 0183 32 There are seven federal income tax rates and brackets in 2023 and 2024 10 12 22 24 32 35 and 37 Your taxable income and filing status Web 2022 tax brackets and federal income tax rates Thanks for visiting the tax center Below you will find the 2022 tax rates and income brackets 2022 tax brackets are here Get

Web Oct 18 2022 nbsp 0183 32 On your 11 001st dollar you will start paying a 12 percent rate on each dollar until you reach the next bracket at 44 725 Here s how a sample tax calculation