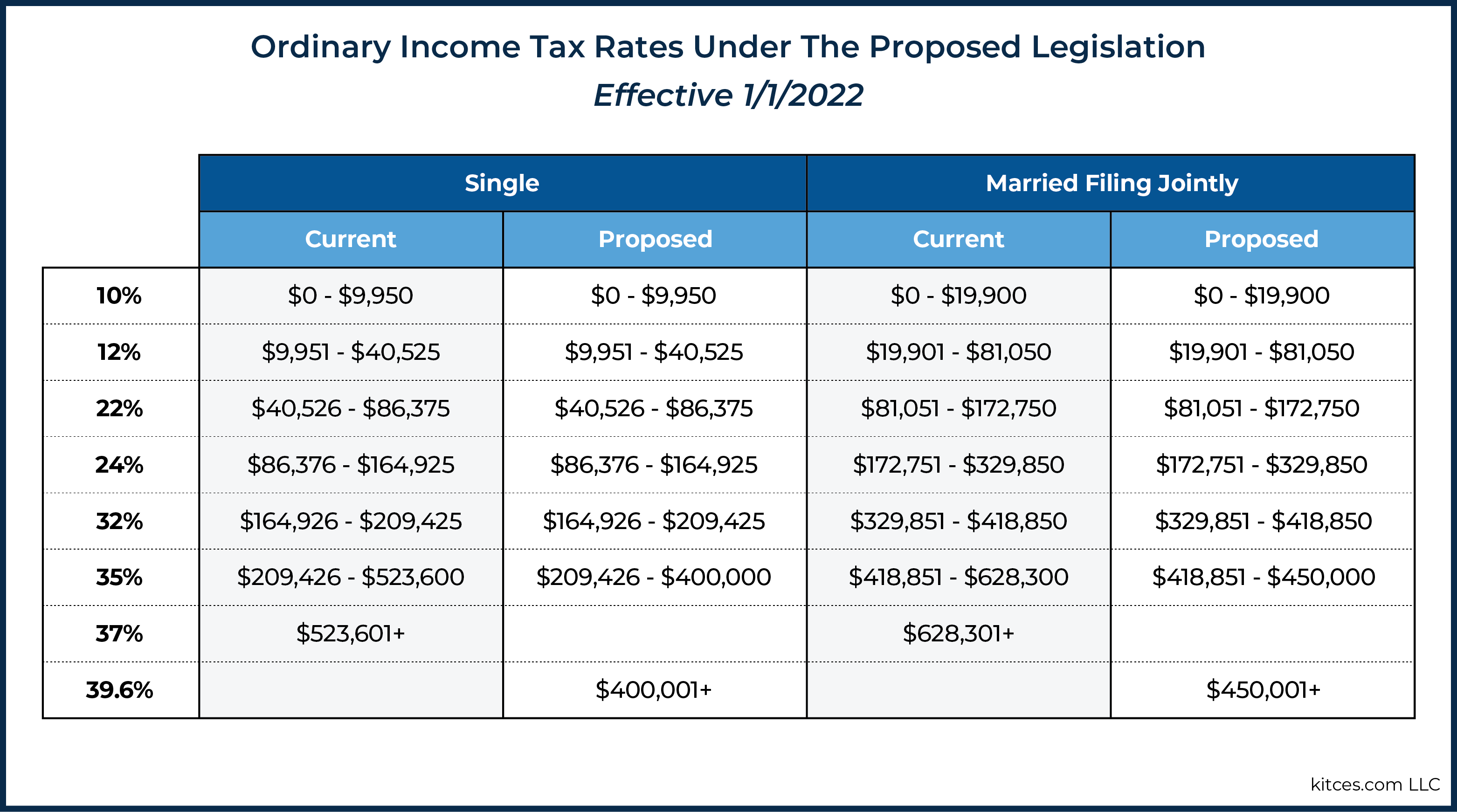

Federal Income Tax Brackets For 2022 Single Web Result Nov 10 2021 nbsp 0183 32 There s one big caveat to these 2022 numbers Democrats are still trying to pass the now 1 85 trillion Build Back Better Act and the latest November 3 legislative text includes income tax

Web Result 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing jointly and 125 000 for married couples filing separately Jan 18 2022 4th installment deadline to pay 2021 estimated taxes due Web Result income on Form 1040 line 15 is 25 300 First they find the 25 300 25 350 taxable income line Next they find the column for married filing jointly and read down the column The amount shown where the taxable income line and filing status column meet is 2 628 This is the tax amount they should enter in the entry space on

Federal Income Tax Brackets For 2022 Single

Federal Income Tax Brackets For 2022 Single

Federal Income Tax Brackets For 2022 Single

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

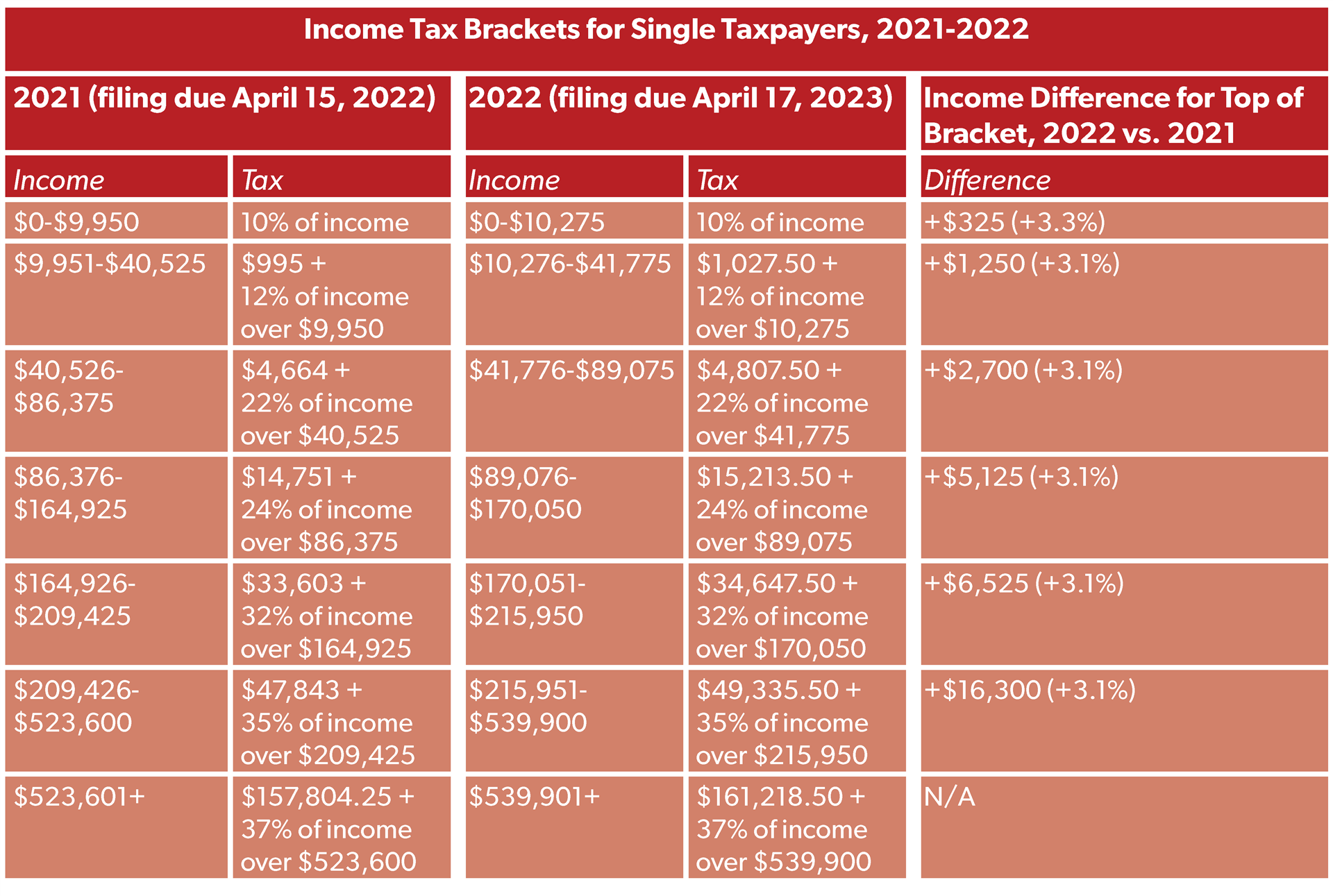

Web Result Nov 1 2022 nbsp 0183 32 There are seven tax rates that apply to seven brackets of income 10 12 22 24 32 35 and 37 For tax year 2022 the lowest 10 rate applies to an individual s income of 10 275 or less while the highest 37 rate applies to an individual s income of 539 900 or more Income brackets adjust

Pre-crafted templates offer a time-saving service for creating a varied series of files and files. These pre-designed formats and designs can be made use of for various personal and expert tasks, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, simplifying the material development procedure.

Federal Income Tax Brackets For 2022 Single

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Capital Gains Tax Rate 2021 And 2022 Latest News Update

Irs Tax Table 2022 Married Filing Jointly Latest News Update

2023 Irs Tax Brackets Chart Printable Forms Free Online

2021 IRS Tax Brackets Table Federal Withholding Tables 2021

Tax Filing 2022 Usa Latest News Update

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web Result Jan 31 2024 nbsp 0183 32 For a single taxpayer the rates are Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Married filing jointly or qualifying surviving spouse Married filing separately Head of household See the tax rates for the

https://www.irs.com/en/2022-federal-income-tax...

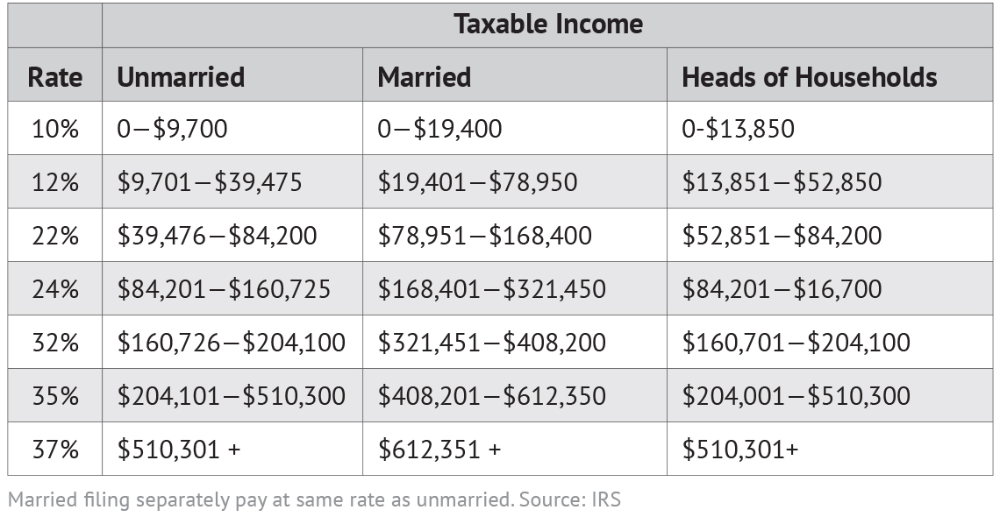

Web Result Feb 21 2022 nbsp 0183 32 Different tax brackets or ranges of income are taxed at different rates These are broken down into seven 7 taxable income groups based on your federal filing statuses e g whether you are single a head of household married etc The federal income tax rates for 2022 are 10 12 22 24 32

https://www.irs.gov/newsroom/irs-provides-tax...

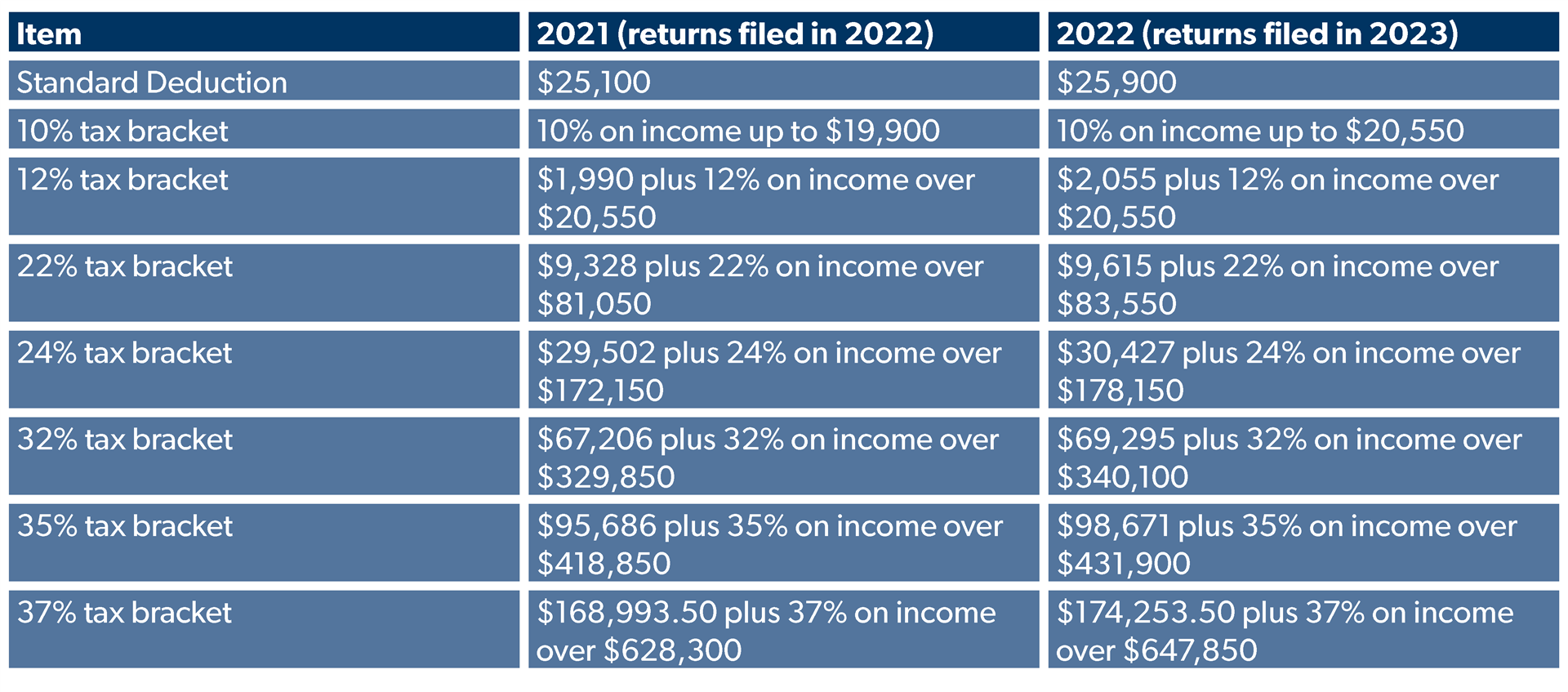

Web Result Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for married couples filing jointly The other rates are 35 for incomes over 215 950 431 900 for married couples filing jointly

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

Web Result Feb 21 2024 nbsp 0183 32 There are seven federal income tax rates and brackets in 2023 and 2024 10 12 22 24 32 35 and 37 Taxable income and filing status determine which federal tax rates apply

https://www.cnbc.com/2021/11/10/2022-income-tax...

Web Result Nov 10 2021 nbsp 0183 32 Share Twenty 20 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been

Web Result Jan 9 2024 nbsp 0183 32 And while U S income tax rates will remain the same during the next two tax years the tax brackets the buckets of income that are taxed at progressively higher rates will change To Web Result Nov 13 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2023 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your tax bracket

Web Result Jan 27 2023 nbsp 0183 32 Personal income tax rates begin at 10 for the tax year 2022 the return due in 2023 then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37 Each tax rate applies to a specific range of income referred to as a tax bracket Where each tax bracket begins and ends