Federal Corporate Income Tax Rate For 2022 Jan 15 2022 nbsp 0183 32 The tax rate on personal services business income earned by a corporation is 33 00 The federal rate applicable to investment income earned by Canadian controlled private corporations CCPCs is 38 67 due to the additional 10 67 refundable federal income tax As part of the 2021 22 federal budget the federal government has

Jan 29 2024 nbsp 0183 32 Corporate Tax Rate Schedule 2001 to 2024 Corporate income tax rate schedule Download corporate rate schedule pdf Download corporate rate schedule xlsx January 29 2024 Business Taxes Donate Today Topics The Corporate Tax Rate in the United States stands at 21 percent This page provides United States Corporate Tax Rate actual values historical data forecast chart statistics economic calendar and news

Federal Corporate Income Tax Rate For 2022

Federal Corporate Income Tax Rate For 2022

Federal Corporate Income Tax Rate For 2022

https://files.taxfoundation.org/20210303101855/2021-combined-federal-and-state-corporate-income-tax-rates.-Do-corporataions-pay-state-and-federal-taxes.png

Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539 900 for single filers and above 647 850 for married couples filing jointly

Templates are pre-designed files or files that can be used for various purposes. They can save time and effort by supplying a ready-made format and layout for producing different type of content. Templates can be utilized for personal or professional tasks, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Federal Corporate Income Tax Rate For 2022

2022 Federal Effective Tax Rate Calculator Printable Form Templates

Capital Gains Tax Rate 2021 And 2022 Latest News Update

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax

Federal Corporate Income Tax Rate For 2023 Infoupdate

Federal Corporate Income Tax Rate For 2023 Infoupdate

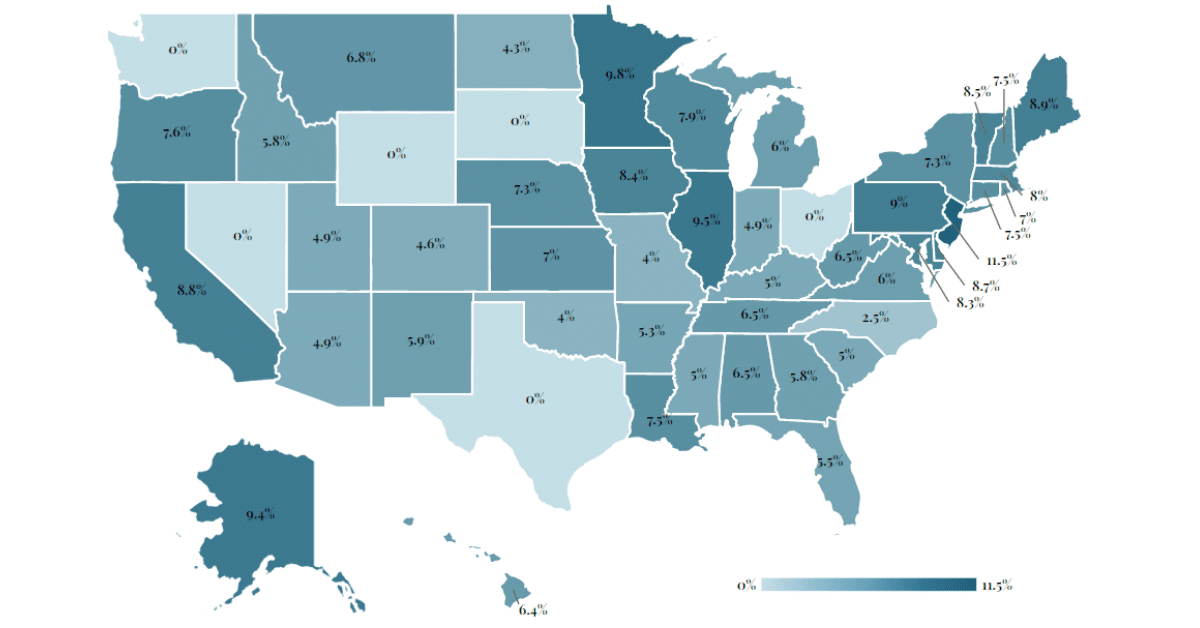

States With The Lowest Corporate Income Tax Rates Infographic

https://www.irs.gov/publications/p542

For tax years beginning after 2022 the Inflation Reduction Act of 2022 amended section 55 of the Internal Revenue Code to impose a new corporate alternative minimum tax CAMT based on the adjusted financial statement income AFSI of an applicable corporation

https://taxsummaries.pwc.com/united-states/...

Sep 12 2023 nbsp 0183 32 The Inflation Reduction Act P L 117 169 IRA enacted a new corporate AMT effective for tax years beginning after 2022 based on financial statement income corporate alternative minimum tax or CAMT The CAMT is a 15 minimum tax on adjusted financial statement income AFSI of C corporations

https://taxfoundation.org/research/all/federal/...

Feb 24 2021 nbsp 0183 32 An increase in the federal corporate tax rate to 28 percent would raise the U S federal state combined tax rate to 32 34 percent giving the U S the highest combined corporate income tax rate in the OECD ahead of France at 32 02 percent

https://www.taxpolicycenter.org/statistics/...

Jan 29 2024 nbsp 0183 32 Top marginal tax rate and income bracket for corporations Download corporate top rate bracket pdf 63 68 KB Download corporate top rate bracket xlsx 13 89 KB

https://crsreports.congress.gov/product/pdf/R/R45145/12

In 2022 66 of total income reported on individual income tax returns will be from salaries and wages 7 A substantial portion of business income in the United States is taxed in the individual income tax system

The Federal government s 2023 fiscal year that begins on October 1 2022 includes a proposal to increase C Corporations tax rate from 21 to 28 The 28 tax rate would be effective for taxable years beginning after December 31 2022 The corporate income tax is the third largest source of federal revenue although substantially smaller than the individual income tax and payroll taxes It raised 424 7 billion in fiscal year 2022 8 7 percent of all federal revenue and 1 7 percent of gross domestic product GDP

Jul 1 2024 nbsp 0183 32 See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher