Domestic Company Tax Rate For Fy 2022 23 Feb 1 2022 nbsp 0183 32 Domestic Company Income tax rates applicable in the case of domestic companies for the assessment year 2022 23 amp 2023 24 are as follows

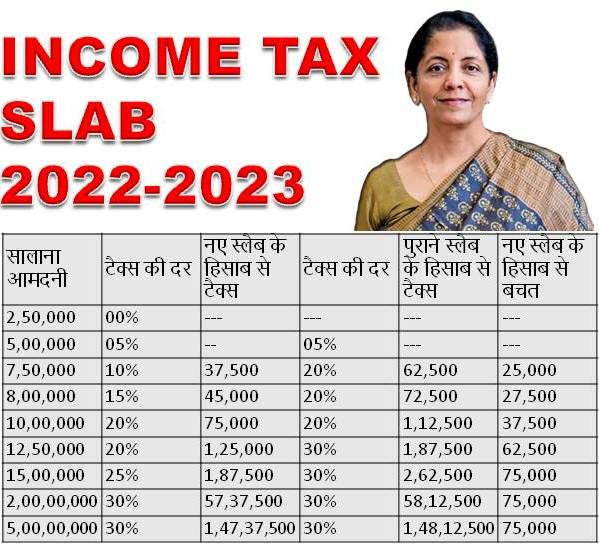

May 27 2022 nbsp 0183 32 Applicable Tax Rates for Financial Year 2022 23 are as follows No Tax on individual having taxable income up to Rs 5 00 000 as a result of rebate of Rs 12 500 u s 87A Jan 2 2023 nbsp 0183 32 In case of domestic company the rate of income tax shall be 25 of the total income if the total turnover or gross receipts of the previous year 2021 22 does not exceed

Domestic Company Tax Rate For Fy 2022 23

Domestic Company Tax Rate For Fy 2022 23

Domestic Company Tax Rate For Fy 2022 23

https://www.calendarpedia.com/images-large/fiscal/2025-fiscal-calendar.png

Dec 21 2022 nbsp 0183 32 Given below are the income tax slabs for sole proprietorships professionals partnership firms and companies for FY 2022 23 AY 2023 24 The income tax slabs under the old income tax regime for sole proprietorship

Templates are pre-designed documents or files that can be utilized for numerous functions. They can conserve effort and time by offering a ready-made format and design for producing different type of material. Templates can be used for personal or professional tasks, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Domestic Company Tax Rate For Fy 2022 23

Donna GayleenKacy SallieTrude HorPippa Ferguson Mia Yumna

Chase Cd Rates 2025 2025 Virginia Rarcher

Tds New Slab Rate For Fy 2024 25 Jane Fanechka

Income Tax Slab For A Year 2025 26 Opal Mignon

New Regime Tax Calculator Ay 2025 25 Clara Layla

Income Tax Calculator 2023 Excel

https://taxguru.in › income-tax

Jan 22 2025 nbsp 0183 32 Detailed overview of corporate tax rates surcharges and MAT for AY 2021 22 to AY 2025 26 applicable for various domestic and manufacturing companies

https://taxguru.in › income-tax

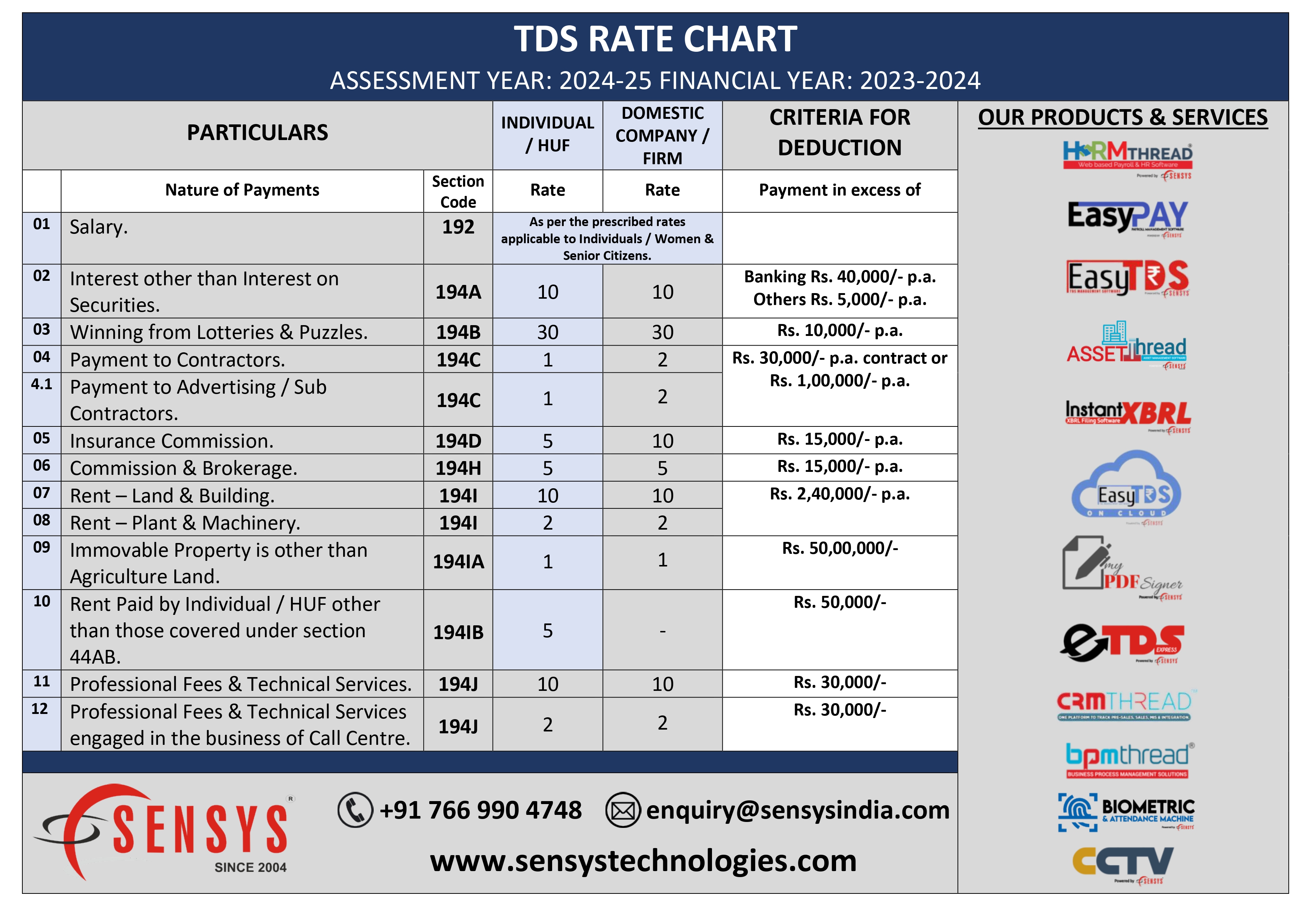

Sep 9 2023 nbsp 0183 32 4 Domestic Company Income tax rates applicable in case of domestic companies for assessment years 2023 24 and 2024 25 are as follows

https://incometaxindia.gov.in › Documents › Left Menu...

Tax Rates Domestic Company Income tax rates applicable in case of domestic companies for assessment years 2025 26 and 2024 25 are as follows

https://rtsprofessionalstudy.com › ...

Such income tax and surcharge 4 Domestic Company Income tax rates applicable in case of domestic companies for assessment year 2022 23 and 2023 24 are as follows Domestic

https://cleartax.in

Nov 7 2024 nbsp 0183 32 Section 115BAA states that domestic companies have the option to pay tax at a rate of 22 plus sc of 10 and cess of 4 The Effective Tax rate being 25 17 from the FY 2019

Apr 17 2022 nbsp 0183 32 Minimum Alternate Tax for A Y 2021 22 and A Y 2022 23 Period of carried forward of MAT credit is available for 15 AYs immediately succeeding the AY in which such Apr 1 2023 nbsp 0183 32 Income Tax Rate for Domestic Companies and Indian Companies in AY 2023 24 is 25 if the turnover is up to Rs 400 crore and 30 in other cases where turnover is above Rs

May 27 2022 nbsp 0183 32 Looking for the Income Tax slabs and rates for the financial year 2022 23 or Assessment year 2023 24 This article might help you discover the same What are Income