Do You Get Taxed More If You Get Paid Weekly WEB A biweekly paid employee might appear to pay more income taxes than if she were paid weekly That s only because a biweekly payroll happens less frequently than a weekly

WEB If you are paid semi monthly you will be paid 1 750 per paycheck before taxes your salary divided by 24 checks per year If you re paid bi weekly you will receive 1 615 38 per paycheck before taxes same salary WEB Do you get taxed more if paid monthly versus biweekly Whether you re paid monthly or biweekly doesn t affect the amount of your taxes

Do You Get Taxed More If You Get Paid Weekly

Do You Get Taxed More If You Get Paid Weekly

Do You Get Taxed More If You Get Paid Weekly

https://i.ytimg.com/vi/HNTTa3MKAjU/maxresdefault.jpg

WEB You pay the same amount of tax whether you earn 1000 a week through having a single job or multiple jobs However it can look like you re being taxed more because of the

Pre-crafted templates offer a time-saving option for producing a diverse series of files and files. These pre-designed formats and layouts can be used for numerous individual and expert projects, including resumes, invites, flyers, newsletters, reports, presentations, and more, enhancing the content production procedure.

Do You Get Taxed More If You Get Paid Weekly

Do You Get Taxed On Rental Properties Benefit Title Services

Do You Get Taxed When You Sell Your Home Tax Walls

Do You Get Taxed On Cd Interest Tax Walls

Yo Dawg We Herd U Like Taxes So We Put Taxes On Your Taxed Income So

YOU KNOW YOU ARE GERMAN WHEN YOU GET TAXED FOR YouTube

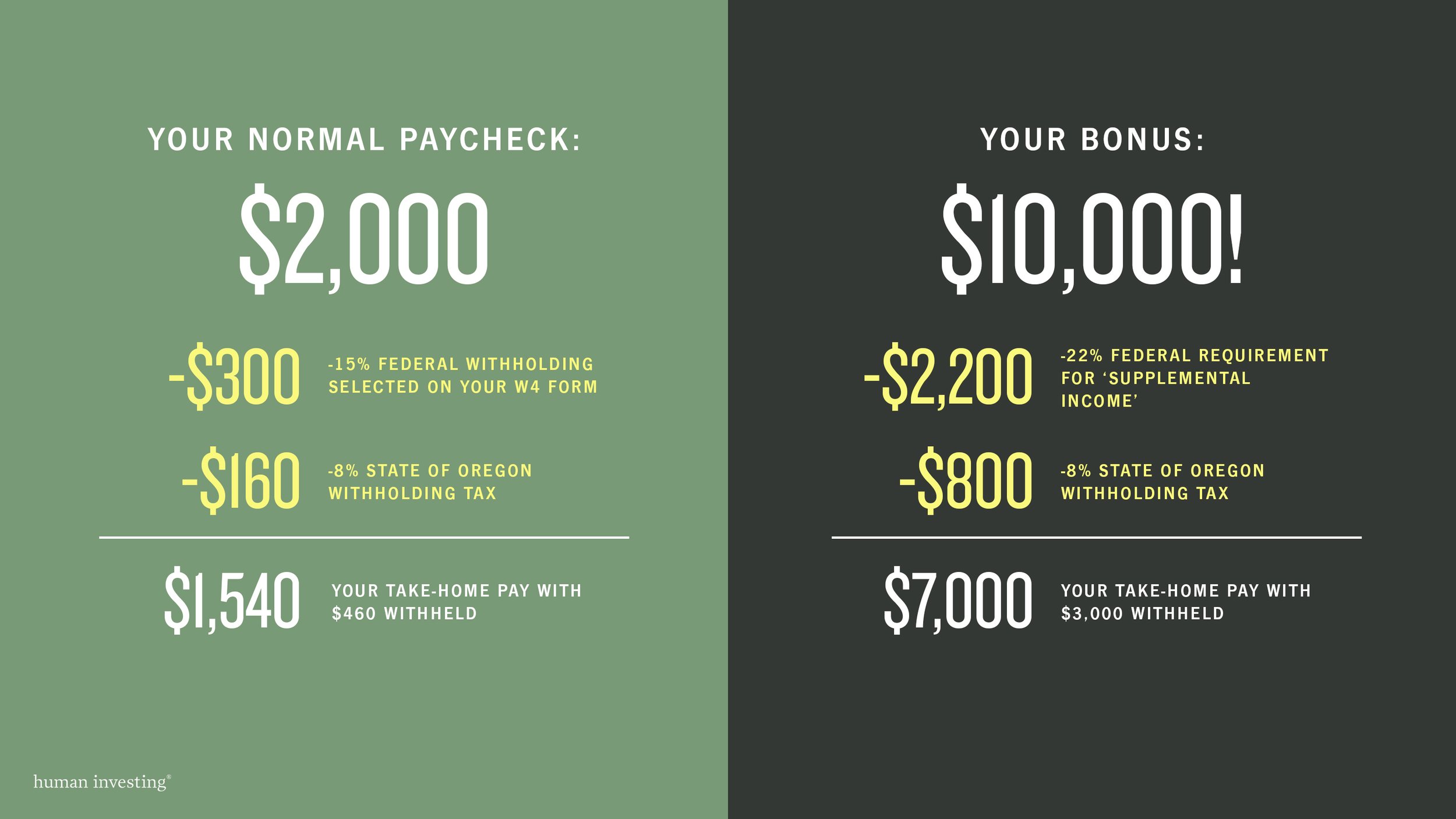

Really My Bonus Is Taxed The Same As My Paycheck Human Investing

https://smallbusiness.chron.com/monthly-vs...

WEB Employee tax liabilities aren t affected by the length of your pay period although the amounts you take out of each employee s paycheck are different if you pay monthly or

https://smallbusiness.chron.com/taxes-wee…

WEB Social Security tax is 0 062 times the gross income on a paycheck whether that check covers a weekly or biweekly period If you pay an employee

https://www.dailypay.com/resource-center/blog/weekly-vs-bi-weekly-pay

WEB Saves money If you use a payroll vendor it s likely they charge for each payroll run If you have dozens of employees on weekly schedules these fees can add up Depending on

https://money.stackexchange.com/questions/84102

WEB They under withheld your first check you wouldn t get more money by getting paid weekly Ostensibly if paid weekly you could be earning a small amount of interest that

https://www.sapling.com/7755185/do-withhold-taxes-paid-weekly

WEB Your employer does not withhold a greater amount of your paycheck when you get paid weekly although he does withhold payroll taxes more frequently than if you were paid

WEB Getting paid once a month makes no difference to your taxes You pay federal income tax at exactly the same rate regardless of the pay period Your employer will calculate your WEB Yes some U S Olympic medalists have to pay federal taxes on their winnings Federal law exempts Olympic medalists from being taxed on their winnings if their annual incomes

WEB Your overtime wages are taxed at the same rate as your regular wage bracket 10 for the lowest income and 37 for the highest income no matter how many hours each week