Difference Between Fiscal Year And Financial Year In India WEB Mar 31 2021 nbsp 0183 32 Table of Contents What is the Financial Year and Assessment Year Difference between Financial Year and Assessment Year Financial Year and Assessment Year in Hindi Where all are Assessment Year used Download Income Tax Utilities based on Assessment Year Check Assessment Year in ITR Advance Tax Self

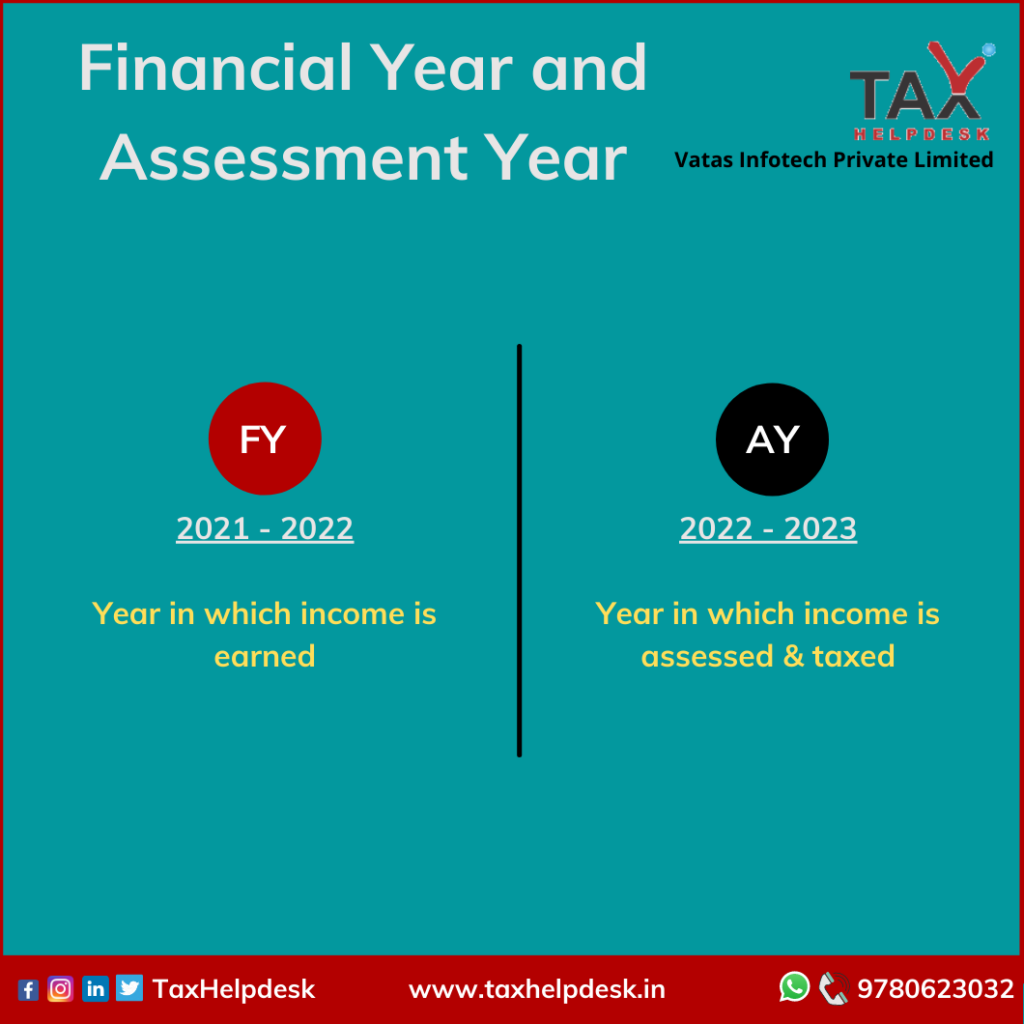

WEB Jun 8 2022 nbsp 0183 32 In India people file their ITR the following year after the financial year ends An assessment year is the name given to this time period An assessment year is the period during which your prior year s income is assessed for ITR filing reasons WEB Blog Financial Year and Assessment Year Difference Between FY and AY Understanding Financial Year and Assessment Year in India A Comprehensive Guide In the intricate landscape of India s fiscal calendar comprehending the nuances of Financial Year FY and Assessment Year AY is essential for individuals navigating the tax system

Difference Between Fiscal Year And Financial Year In India

Difference Between Fiscal Year And Financial Year In India

Difference Between Fiscal Year And Financial Year In India

https://cdn.educba.com/academy/wp-content/uploads/2019/11/Calendar-Year-vs-Fiscal-Year-info.jpg

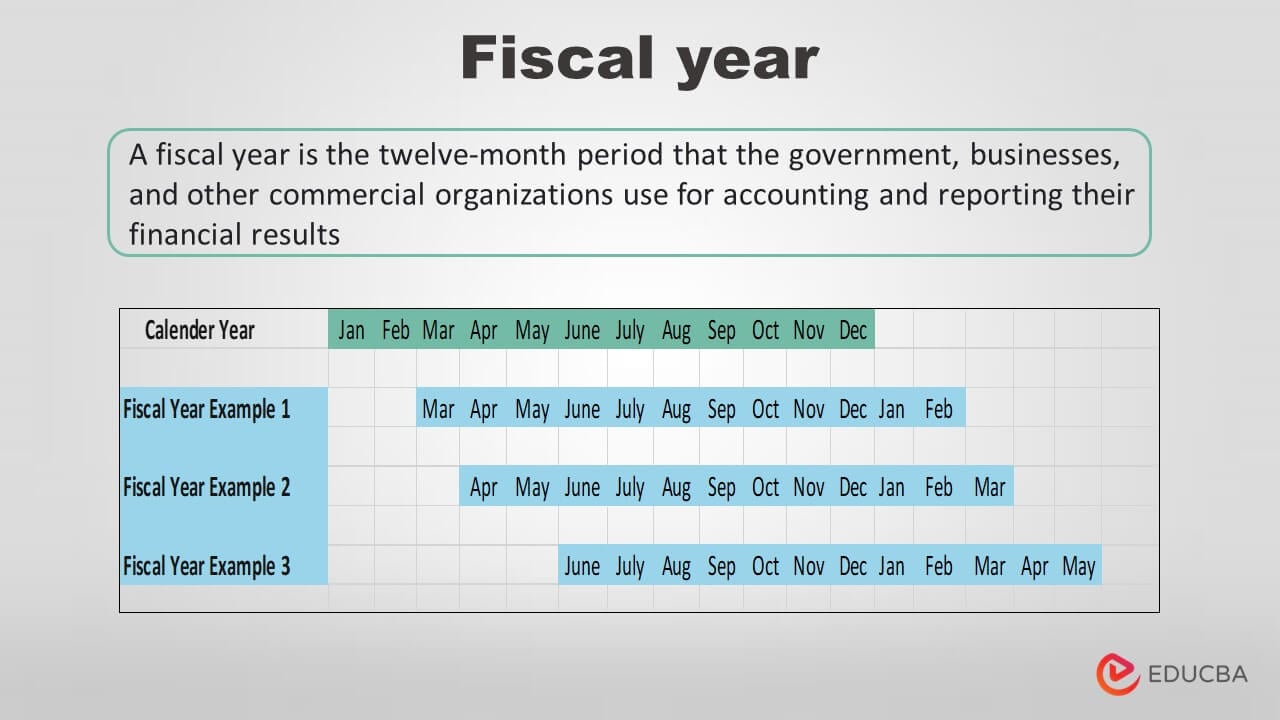

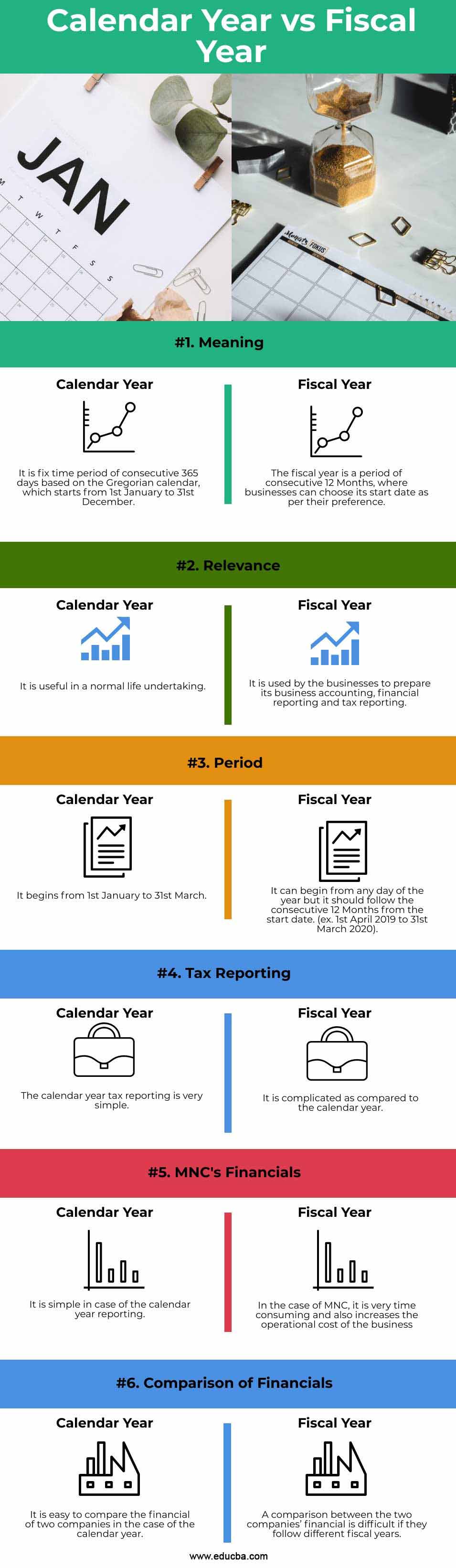

WEB A Financial Year FY also known as the fiscal year or accounting year is a fixed period of 12 months during which businesses organisations and governments manage their financial activities i e track their financial performance and report their results

Pre-crafted templates provide a time-saving option for creating a varied variety of files and files. These pre-designed formats and layouts can be used for numerous personal and professional tasks, including resumes, invites, leaflets, newsletters, reports, discussions, and more, improving the material production process.

Difference Between Fiscal Year And Financial Year In India

Calendar Year Reporting Period Month Calendar Printable

What Is Financial Year Should India Change Its Financial Year Current

What Is Financial Year And Assessment Year

Fiscal Year Meaning Difference With Assessment Year Benefits And

25 Table Definition Government KachisideMj

Financial Year What Is The Financial Year In India GST PORTAL INDIA

https://groww.in/p/tax/financial-year-and-assessment-year

WEB The assessment year is the year after the financial year in which the prior year s revenue is assessed tax is collected and the ITR is filed For example the financial year beginning on April 1 2022 and ending on March 31

https://tax2win.in/guide/what-is-financial-year-assessment-year

WEB Apr 30 2024 nbsp 0183 32 From the tax perspective a Financial year is a year in which a person earns an income On the other hand The assessment year is the year followed by the financial year in which the previous year s income is evaluated tax is paid on the same and an Income tax Return ITR is filed

https://www.timesnownews.com/business-economy/...

WEB Updated Apr 05 2020 18 22 IST The financial year in India begins on April 1 and ends on March 31 The assessment year for FY 2020 21 will be AY 2021 22 The financial year may be different from the previous year in certain cases

https://blog.taxclue.in/all-about-financial-year-fiscal-year-assessment-year

WEB Jul 5 2021 nbsp 0183 32 The Indian Financial Year In India the fiscal year starts on April 1 and ends on March 31 AY 2021 22 will be the review year for FY 2020 21 In certain circumstances the financial year may vary from the previous year Examples of Financial Year and Assessment Year

https://www.turtlemint.com/tax/assessment-year-and-financial-year

WEB The assessment year can be described as the accounting year that follows the fiscal year and is when tax returns are due Both Financial Year and Assessment Year sends on March 31st and start on April 1st

WEB Jun 8 2022 nbsp 0183 32 The term quot financial year quot or quot fiscal year quot refers to this time period the year in which you have earned the income So you will be filing ITR for 2021 22 the deadline for filing is July 31 2022 unless extended by the government Getty Images 4 5 Difference between AY and FY WEB Mar 21 2022 nbsp 0183 32 The fiscal year is the calendar year in which a taxpayer receives taxable income The following year the assessment year is when this money is taxed Even though the accounting cycle is just a few months long shareholders are often provided access to a company s annual financial report in April

WEB In India this 1 year period starts from 1 st April and ends on 31 st March This period in which the income is earned is known as the Financial Year or Fiscal Year The income tax returns are filed and taxes for a company are usually paid in the next year after the end of the Financial Year