Corporate Tax Rate For Ay 2022 23 Web Corporate Income Tax CIT Rate Your company is taxed at a flat rate of 17 of its chargeable income This applies to both local and foreign companies CIT Rebate for the Year of Assessment quot YA quot 2024 and a CIT Rebate Cash Grant UPDATED

Web Income Tax Rate excluding surcharge and cess Total Turnover or Gross Receipts during the previous year 2020 21 does not exceed 400 crores 25 If opted for Section 115BA 25 If opted for Section 115BAA 22 If opted for Section 115BAB 15 Any other Domestic Company 30 Web Jun 4 2023 nbsp 0183 32 The following rates of tax apply to companies for the 2022 23 income year Companies Note 1 This includes corporate limited partnerships strata title bodies corporate trustees of corporate unit trusts and public trading trusts Life insurance companies RSA providers other than life insurance providers Pooled development funds

Corporate Tax Rate For Ay 2022 23

Corporate Tax Rate For Ay 2022 23

Corporate Tax Rate For Ay 2022 23

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2021/02/New-Tax-Regime-Income-Tax-Slab-FY-2021-22-AY-2022-23-ArthikDisha.png

Web Nov 21 2023 nbsp 0183 32 This guide will discuss the essentials of corporate tax in India including the latest updates from the relevant laws and especially the recent Union Budget 2023 We ll explore the applicable tax rates in 2023 for domestic companies and foreign companies net income calculation dividends rebates and surcharges

Pre-crafted templates offer a time-saving option for producing a varied series of documents and files. These pre-designed formats and designs can be made use of for numerous personal and professional tasks, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, enhancing the content production process.

Corporate Tax Rate For Ay 2022 23

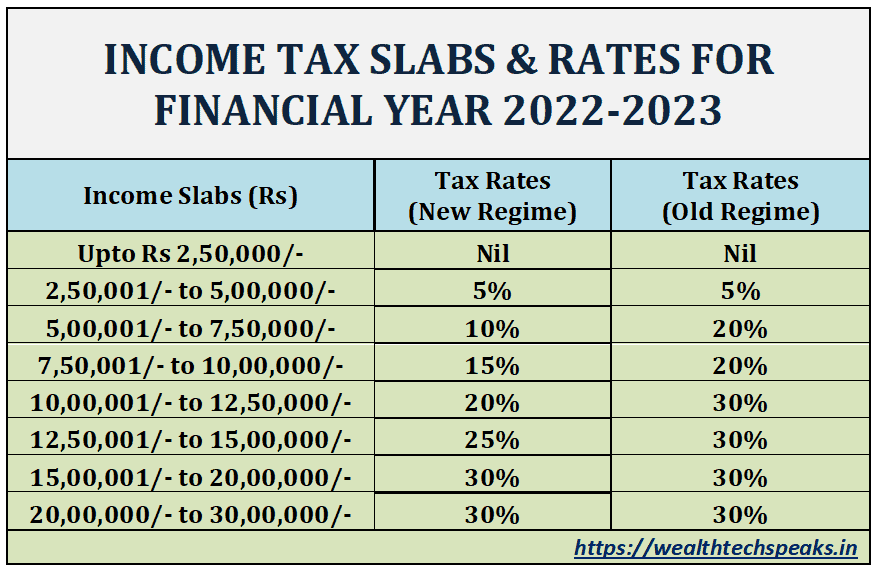

New Income Tax Slab 2022 23 Ay 2023 24 Update Income Tax Rates Rules

Latest Income Tax Slab Rates FY 2020 21 AY 2021 22 BasuNivesh

2022 Tax Brackets Irs Calculator

Old Tax Regime Vs New Tax Regime For The Assessment Year 2024 25

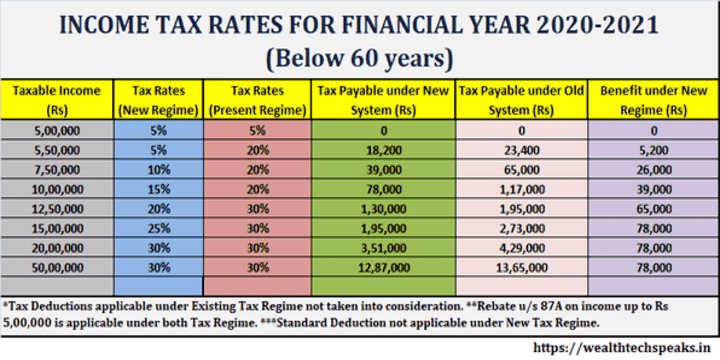

New Income Tax Slab Rate For AY 2021 22 FY 2020 21 IDeal ConsulTax

Income Tax Slab Rate Fy 2021 22 Ay 2022 23 And Fy 2020 21 Ay 2021 22

https://taxguru.in/income-tax/income-tax-rates...

Web Sep 9 2023 nbsp 0183 32 Rate of Income tax Assessment Year 2024 25 Financial Year 2023 24 Assessment Year 2023 24 Financial Year 2022 23 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Resident Senior Citizen who is 60 years or more but less than 80 years at

https://www.ato.gov.au/tax-rates-and-codes/company...

Web Jun 29 2023 nbsp 0183 32 The full company tax rate is 30 and lower company tax rates are available in some years Company tax rates apply to entities which include companies corporate unit trusts public trading trusts The full company tax rate of 30 applies to all companies that are not eligible for the lower company tax rate

https://www.ato.gov.au/tax-rates-and-codes/company-tax-rates

Web Jun 4 2023 nbsp 0183 32 Find out company tax rates from 2001 02 to 2022 23 Last updated 4 June 2023 Tax rates 2022 23 Company tax rates for the 2022 23 income year Tax rates 2021 22 Company tax rates for the 2021 22 income year Tax rates 2011 12 to 2020 21 Company tax rates for the 2011 12 to 2020 21 income years Tax rates 2001 02 to

https://www2.deloitte.com/content/dam/Deloitte/...

Web Minimum effective tax rate of 15 based on accounting profits applies Profits remitted abroad by branch of foreign company not taxed at corporate level subject to 35 withholding tax plus special rate of 20 that applies after deducting 35 tax giving effective rate of 48 Branch remittances taxed at corporate level subject only to 20 tax

https://taxguru.in/income-tax/income-tax-rates-fy...

Web Feb 4 2022 nbsp 0183 32 This article summarizes Tax Rates Surcharge Health amp Education Cess Special rates and rebate relief applicable to various categories of Persons viz Individuals Resident amp Non Resident Hindu undivided family Firms LLP Companies Co operative Society Local Authority AOP BOI artificial juridical persons for income liable to tax in

Web September 26 2022 On 17 June 2022 Central Board of Direct Taxes CBDT issued Notification No 66 2022 F No 370142 26 2022 TPL Vide this Notification the CBDT has extended the Safe Harbour Rules SHR to Assessment Year AY 2022 23 relevant to the previous year 2021 22 Web 4 From 1 April 2023 the main rate of corporation tax will increase to 25 for profits in excess of 163 250 000 From the same date a small profits rate of 19 will apply to profits up to 163 50 000

Web Mar 30 2021 nbsp 0183 32 1 Income Tax Slab Rate for Individuals opting for old tax regime 1 1 Individual resident or non resident who is of the age of fewer than 60 years on the last day of the relevant previous year