Compare 2021 To 2022 Tax Brackets Web Mar 9 2022 nbsp 0183 32 Wolters Kluwer looks at the 2021 and 2022 tax brackets and standard deduction amounts Only limited material is available in the selected language All

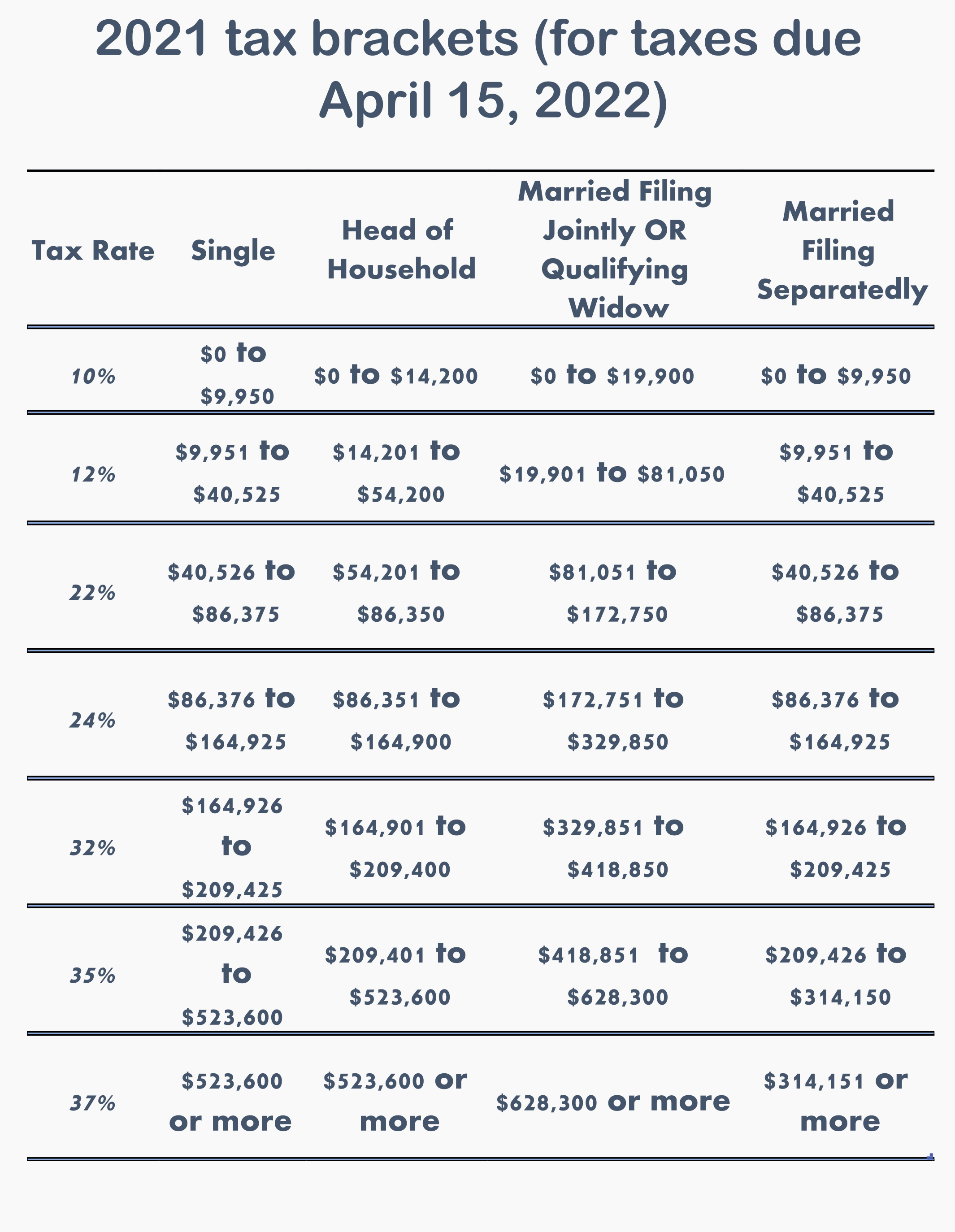

Web Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022 Web Nov 10 2021 nbsp 0183 32 These are the 2021 brackets Here are the new brackets for 2022 depending on your income and filing status For married individuals filing jointly 10

Compare 2021 To 2022 Tax Brackets

Compare 2021 To 2022 Tax Brackets

Compare 2021 To 2022 Tax Brackets

https://i1.wp.com/goneonfire.com/wp-content/uploads/2020/11/045_2021-2020-Tax-Brackets.jpg?resize=1024%2C576&ssl=1

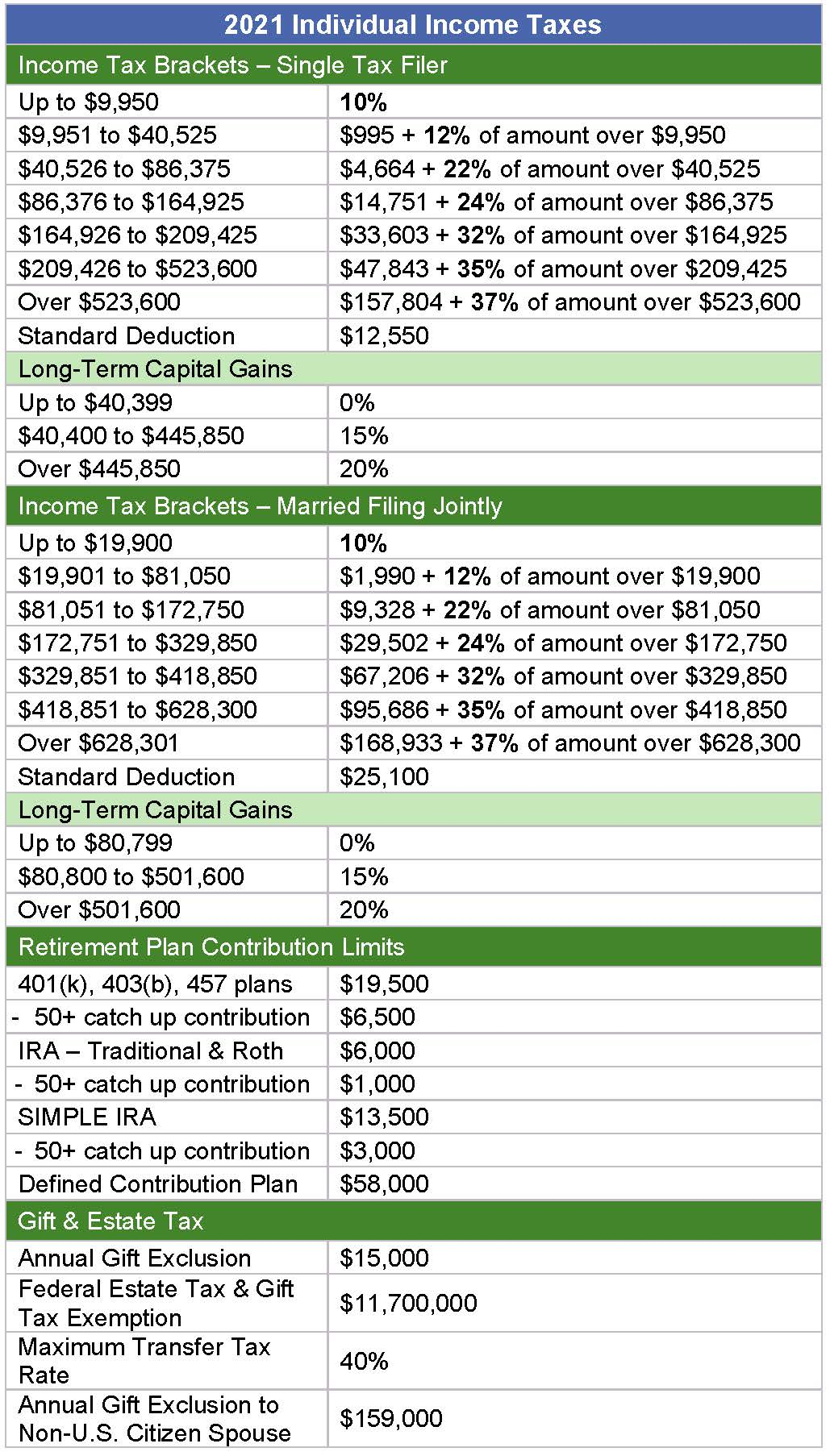

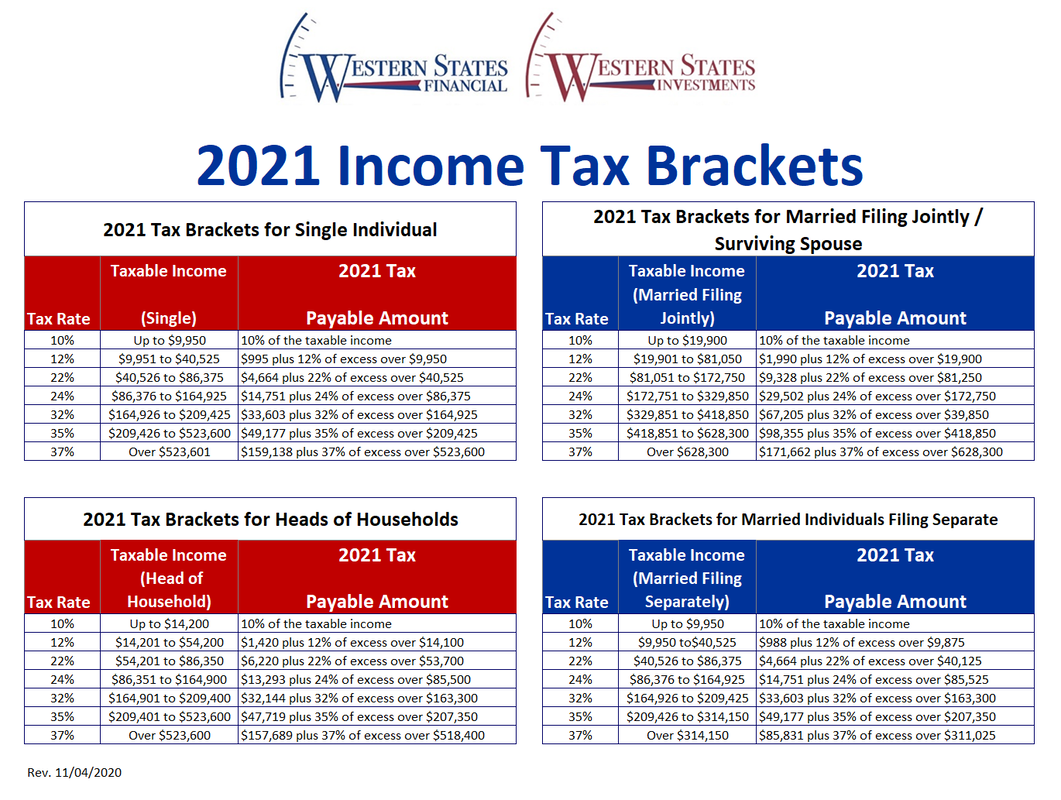

Web Jan 17 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2021 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your tax bracket

Pre-crafted templates use a time-saving service for producing a diverse series of documents and files. These pre-designed formats and layouts can be used for different individual and expert projects, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the material development process.

Compare 2021 To 2022 Tax Brackets

Federal Income Tax Brackets 2021 Vs 2022 Orangerilo

These Are The US Federal Tax Brackets For 2021 and 2020 Vs 2021

Standard Deduction For 2021 Taxes Standard Deduction 2021

What Are The Federal Tax Tables For 2021 Federal Withholding Tables 2021

Federal Tax Brackets 2021 Newyorksilope Free Nude Porn Photos

2022 Tax Brackets MeghanBrannan

https://www.fidelity.com/insights/personal-finance/2022-tax-brackets

Web What Fidelity Offers Depending on your taxable income you can end up in one of seven different federal income tax brackets each with its own marginal tax rate

https://molentax.com/2022-vs-2021-tax …

Web Aug 15 2022 nbsp 0183 32 For example for single filers the 22 tax bracket for the 2022 tax year starts at 41 776 and ends at 89 075 However for head of household filers it goes from 55 901 to 89 050 For 2021 the 22 tax

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1

https://taxfoundation.org/data/all/federal/2021-tax-brackets

Web Feb 22 2024 nbsp 0183 32 The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web 5 days ago nbsp 0183 32 Head of household See the tax rates for the 2024 tax year Page Last Reviewed or Updated 31 Jan 2024 See current federal tax brackets and rates based on

Web Jun 5 2023 nbsp 0183 32 There are currently seven brackets for 2022 and 2023 10 12 22 24 32 35 and 37 The income ranges these brackets apply to could change in the Web Mar 1 2024 nbsp 0183 32 The seven tax brackets 10 12 22 24 32 35 and 37 will be the same in 2024 as they are for 2023 In a nutshell the top income limit for each

Web Mar 8 2022 nbsp 0183 32 2021 2022 Federal Income Tax Brackets and Rates Proposals in Congress to raise top income tax rates have failed to gain traction By Laura Saunders and