Company Tax Rates Australia 2023 Oct 12 2022 nbsp 0183 32 When operating a business in Australia you must understand the australia corporate income tax rate system Read this article to get the best understanding about the Australian corporate income tax system and when

Jan 17 2024 nbsp 0183 32 This resource goes into detail about tax updates following the release of the May 2023 Federal Budget including Details of corporate and individual tax rates The Medicare Levy for resident individuals Tax offsets The statutory benchmark interest rate for the 2023 24 FBT year is 7 77 per annum 2022 23 4 52 FBT CAR STATUTORY PERCENTAGES For contracts entered into after 7 30pm

Company Tax Rates Australia 2023

Company Tax Rates Australia 2023

Company Tax Rates Australia 2023

https://i1.wp.com/thumbor.forbes.com/thumbor/711x309/specials-images.forbesimg.com/imageserve/5f5be3403690f0bc6cef8e58/HOH-rates-2021/960x0.jpg?fit=scale

Tax Rates in Australia for the previous years ATO Tax Rates 2022 2023 These tax rates apply to individuals who are Australian residents for tax purposes The following rates for FY 2022 23

Templates are pre-designed files or files that can be used for various purposes. They can conserve time and effort by offering a ready-made format and layout for developing various kinds of material. Templates can be used for individual or professional jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Company Tax Rates Australia 2023

Company Tax Rates lead In Saddle Bags The West Australian

Changes To Company Tax Rates Less Tax REM Accounting And Advisory

2022 Tax Rates Australia Myra Bush News

TAKE ADVANTAGE OF THE NEW LOWER COMPANY TAX RATES FOR 2020 2021

2022 Income Tax Rates Australia Viking Metaverse Idea Beat

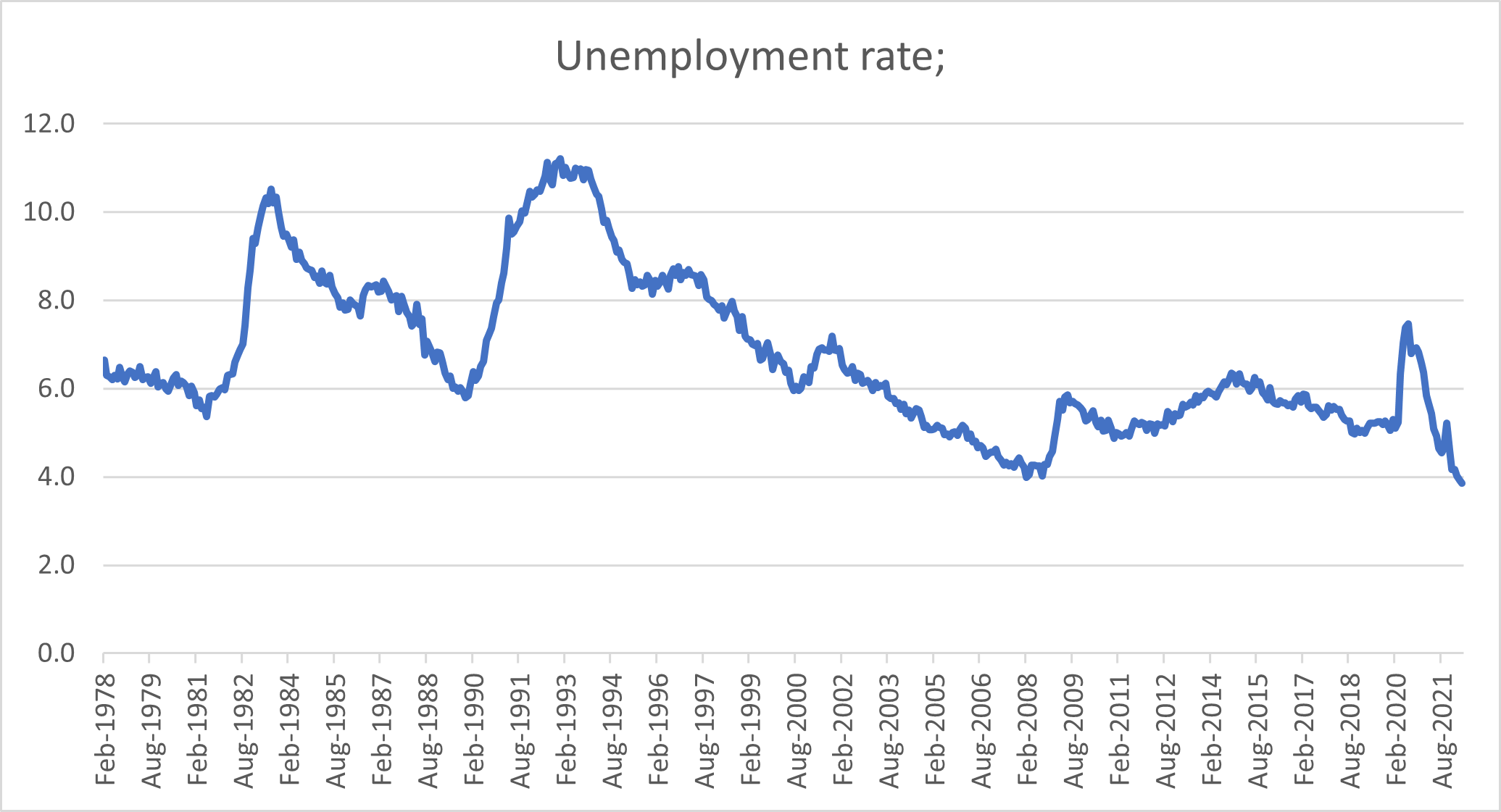

Interest Rates Australia

https://www.ato.gov.au › tax-rates-and-codes › company-tax-rates

The following rates of tax apply to companies for the 2022 23 income year Last updated 29 May 2024 Print or Download On this page Companies Life insurance companies RSA providers

https://www.ato.gov.au › tax-rates-and-codes › company...

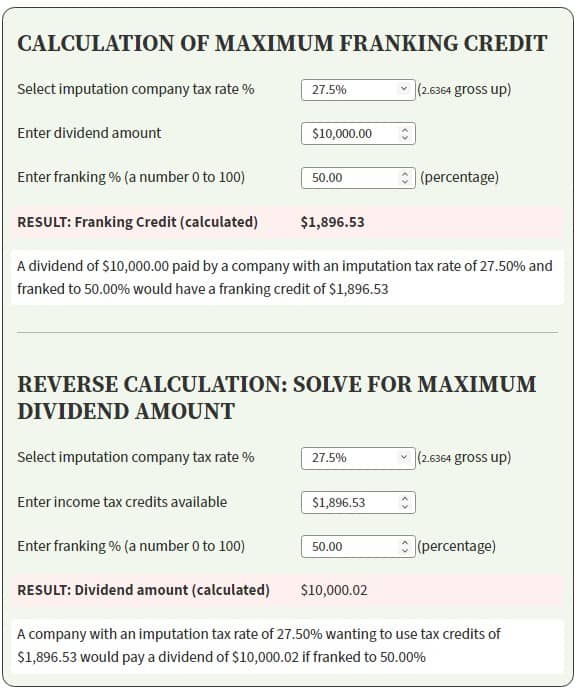

Jun 19 2024 nbsp 0183 32 When to apply the lower company tax rate and how to work out franking credits There are changes to the company tax rates The full company tax rate is 30 and lower

https://cdn.prod.website-files.com

Company Tax Rates A base rate entity is a company that both meets aggregated turnover threshold for each applicable year AND has 80 or less of their assessable income is base

https://au.taxcalculator.info › corporation-tax

May 2 2023 nbsp 0183 32 Corporation Tax in Australia is calculated on the profits made by the company in the 2023 tax year You can calculate corporation tax in Australia by following the instructions

https://www.australianbiz.com.au › small-business-tax-rates.aspx

Below is a range of useful tax rates for small and medium sized businesses that apply for the 2024 25 year including individual marginal tax rates company tax rates

Jun 27 2024 nbsp 0183 32 All companies are subject to a federal tax rate of 30 on their taxable income except for small or medium business companies which are subject to a reduced tax rate of 25 As of 2024 the company tax rate in Australia varies depending on the size and type of the business with different rates applied to small businesses and larger corporations Economic

COMPANY TAX RATES The tax rate for Base Rate Entities BREs is now set at 25 BREs are entities that have an aggregated turnover of less than 50 million and derive less than 80 of