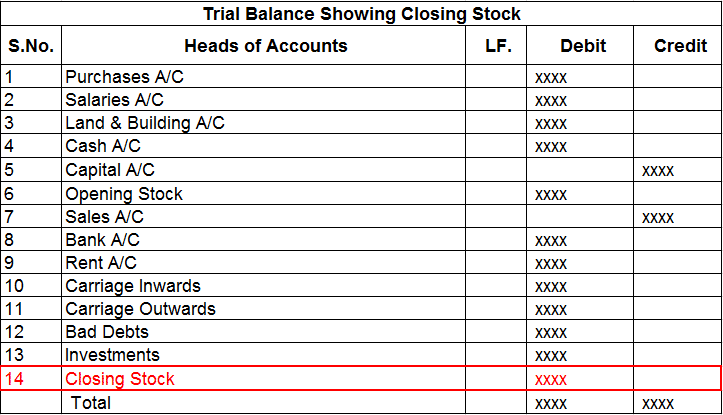

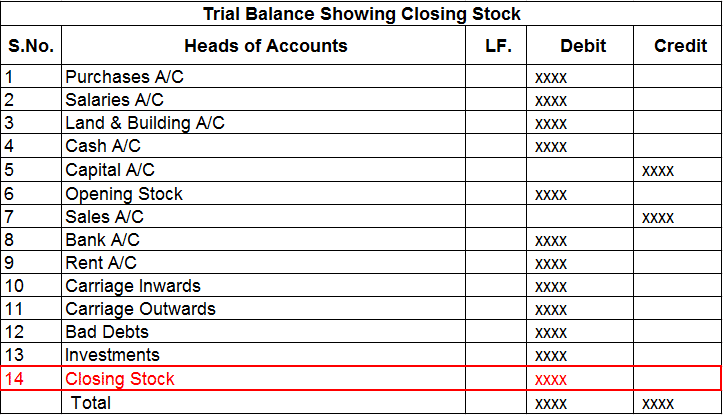

Closing Stock In Trial Balance Mar 1 2015 nbsp 0183 32 Closing stock will appear as in Trail balance stock will appear with year end close balance amount P amp L it depend on the inventory valuation method you adhere to if it periodic methoed so the difference between opening balance and closing balance appears in Balance sheet will appear as trail balance amount

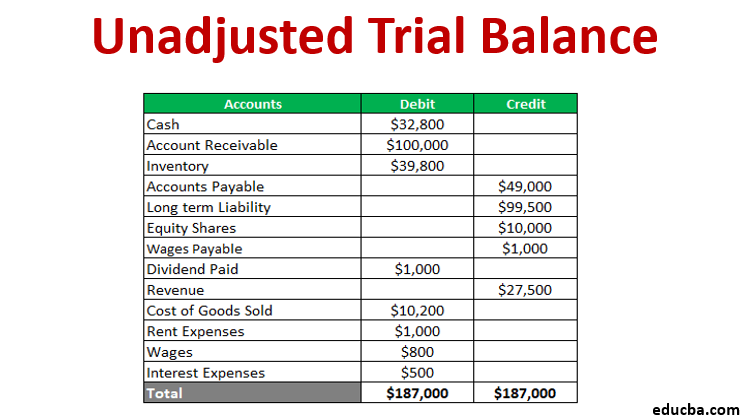

Trial balance of a trader shows the following balances Opening Stock Rs 9 600 Purchases Rs 11 850 Wages and Salaries Rs 3 200 Carriage on Purchases Rs 200 Carriage Outwards Rs 300 Sales A cs Rs 24 900 Closing Stock is Rs 3 500 Gross Profit will be Closing stock in the Trial Balance implies that it is adjusted in the Purchase A c it is already adjusted in the opening stock it is adjusted in the Cost of Sale A c it is adjusted in the Profit and Loss A c

Closing Stock In Trial Balance

Closing Stock In Trial Balance

Closing Stock In Trial Balance

https://www.accountingcapital.com/wp-content/uploads/2018/04/Closing-stock-shown-in-trial-balance.png

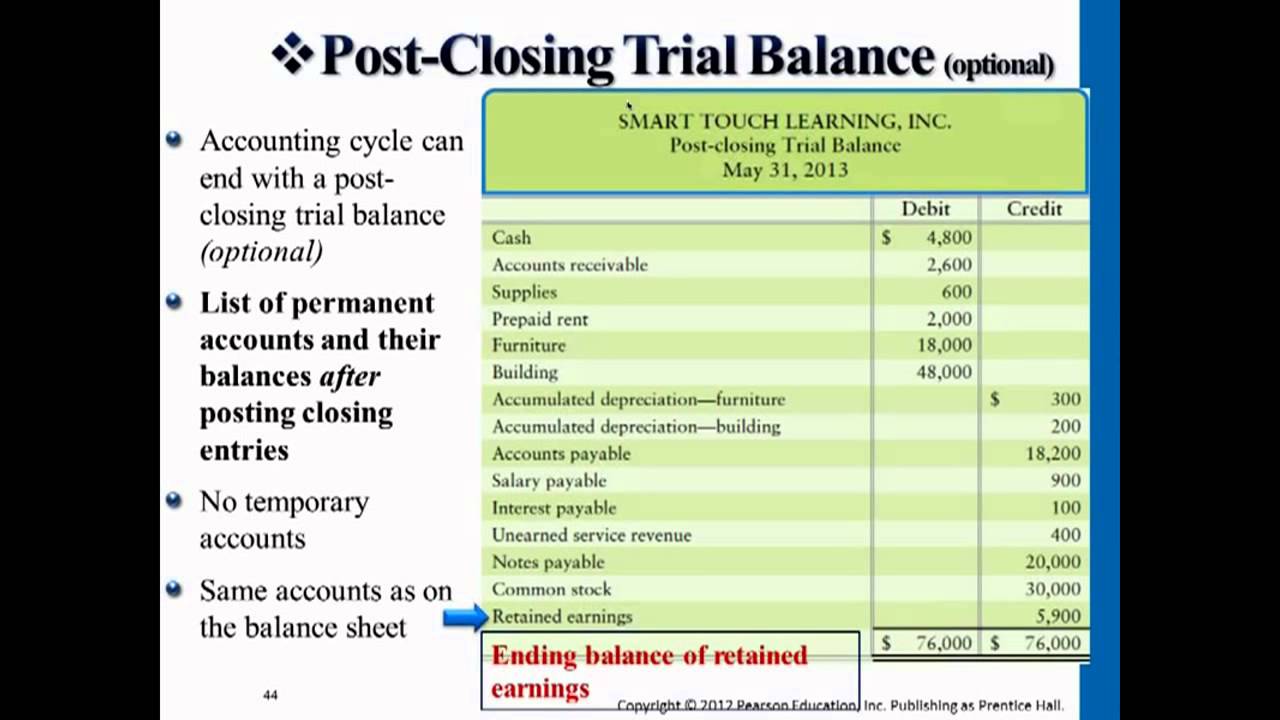

5 In Trial balance opening stock is recorded in credit balance column 6 Both sides total of an account are taken in Gross Trial Balance 7 Purchase account always shows debit balance 8 A Trial balance is a List of Ledger balances 9 A Trial balance does not ensure accounting accuracy 10 A Trial balance shows only arithmetical accuracy

Templates are pre-designed files or files that can be utilized for numerous purposes. They can save time and effort by supplying a ready-made format and layout for producing different kinds of content. Templates can be utilized for individual or professional projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Closing Stock In Trial Balance

Closing Stock In Trial Balance Concept Accountancy Class 11th

Trial Balance

Adjustment Of CLOSING STOCK In Trial Balance Closing Stock Treatment

Journal Entry For Closing Stock with Examples Quiz

34 pdf WORKSHEET IN ACCOUNTING CYCLE PRINTABLE HD DOCX DOWNLOAD ZIP

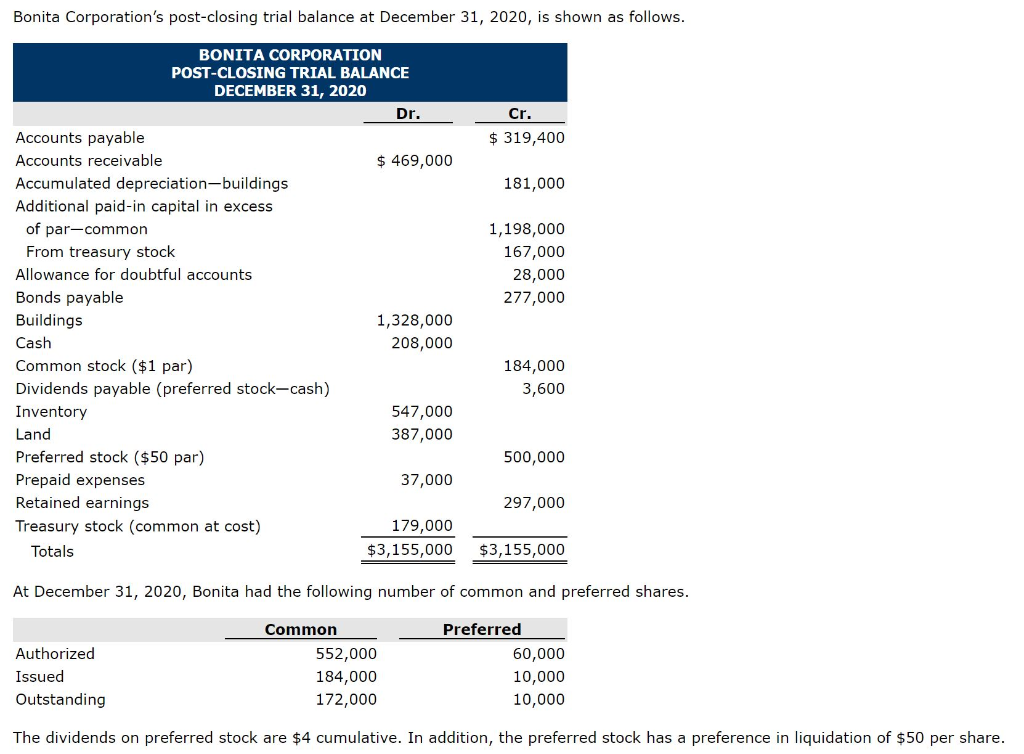

Solved Cr 319 400 181 000 BONITA CORPORATION Chegg

https://specialties.bayt.com › ... › where-will-you-include-closing-stock-i…

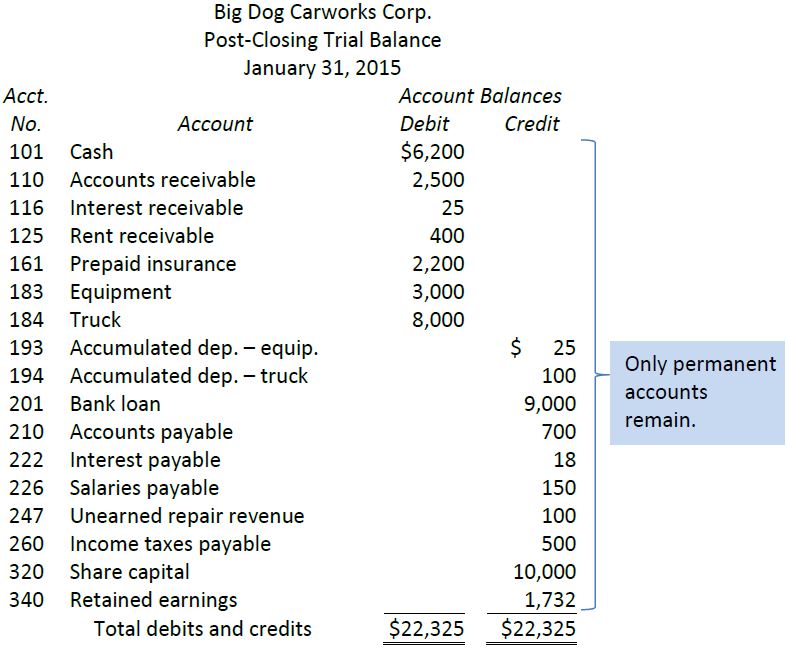

Jul 2 2013 nbsp 0183 32 The reason why closing stock is not taken into account in a trial balance is because a trial balance is a balance of all ledger account a given point in time It records only transactions which have a two way effect for EG Purchases where goods are bought against cash or credit and sales where goods are sold against cash or credit But closing stock is not a transaction having

https://www.toppr.com › ask › question › if-closing-stock-appears-in-the-t…

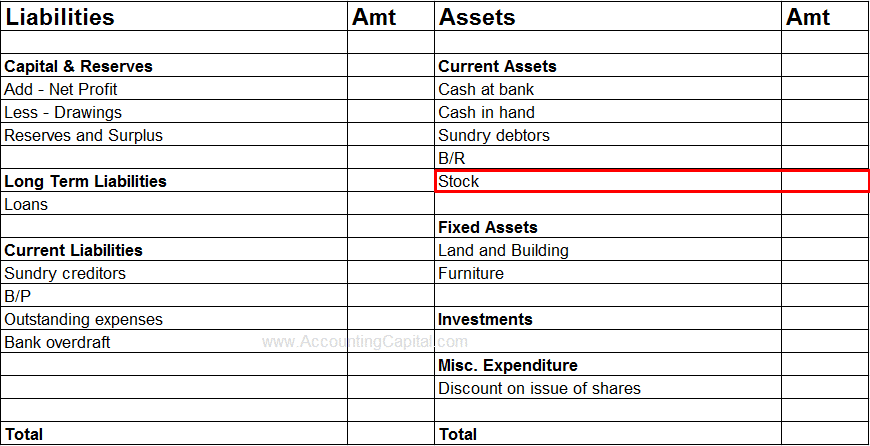

If closing stock appeared in Trial balance it means the purchases has been reduced to the extent of stock amount at the end of the period The accounting treatment will be closing stock to be shown in Balance sheet under current assets and it should not be credited to Trading a c

https://www.toppr.com › guides › fundamentals-of-accounting › special-e…

As the closing stock is an item outside the trial balance we need to treat it twice Thus it will appear in the trading account and also in the balance sheet Sometimes closing stock is recorded in the books of accounts before preparation of trial balance In such cases we need to adjust the purchases for both opening and closing stock

https://www.toppr.com › ask › question › when-the-opening-and-closing-…

The closing stock represents the cost of unsold goods lying in the stores at the end of the accounting period The closing stock of the year becomes the opening stock of the next year and is reflected in the trial balance of the next year Sometimes the opening and closing stock are adjusted through purchases account

https://www.toppr.com › ask › question

Closing stock generally does not appear in the trial balance because it is the leftover of the purchases which is already included in the trial balance An exception is when closing stock is adjusted with the purchase account balance

[desc-11] [desc-12]

[desc-13]