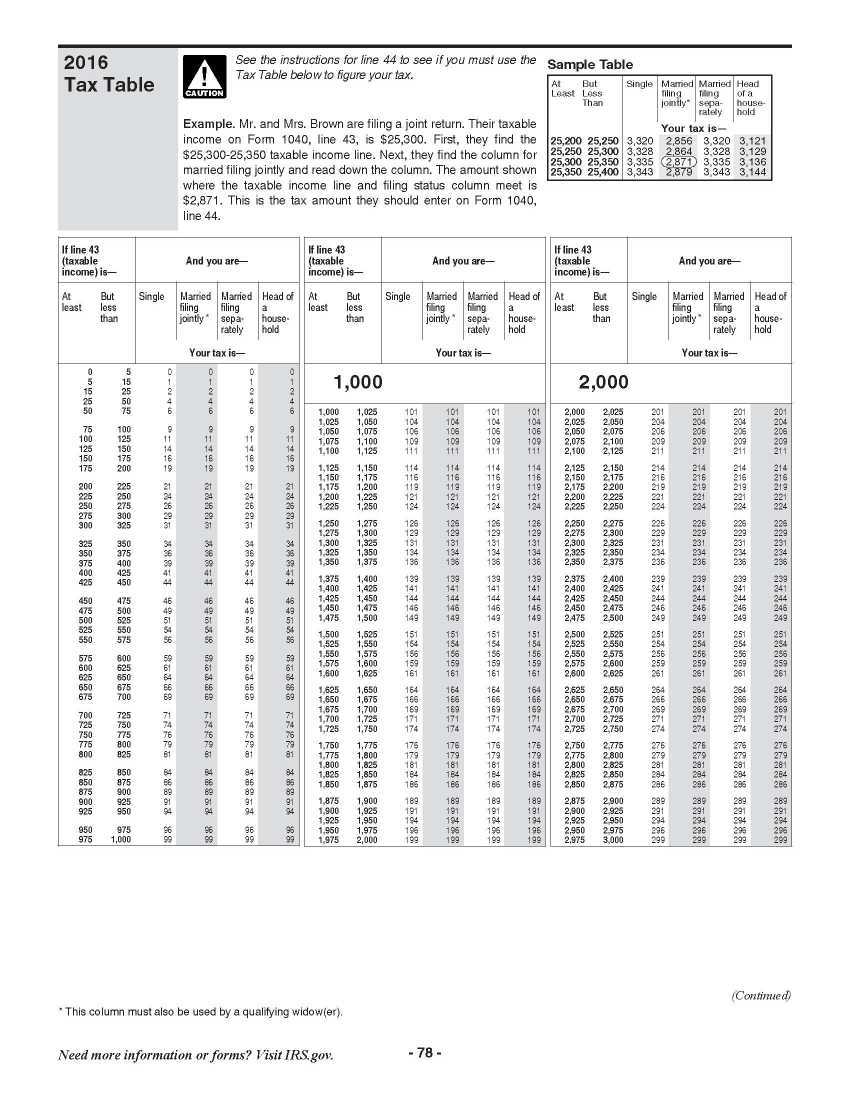

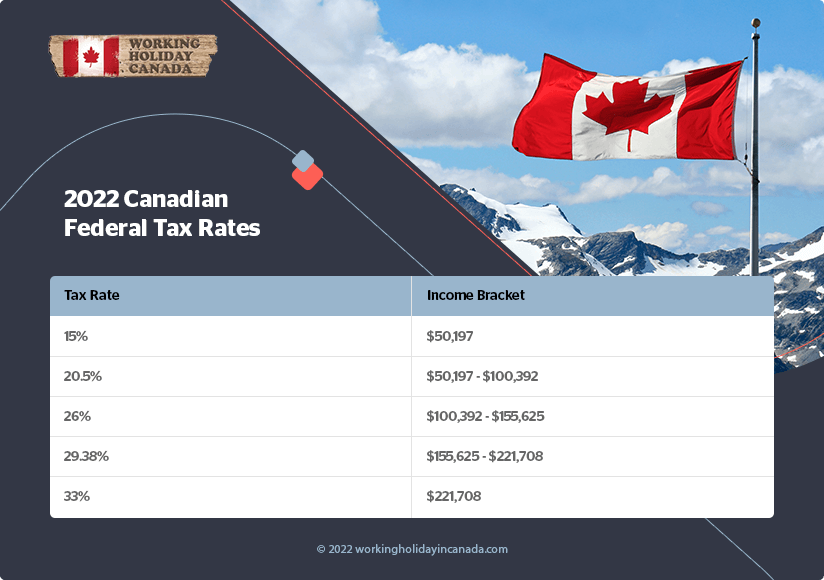

Canadian Federal Tax Tables 2022 Web Federal and Provincial Territorial Income Tax Rates and Brackets for 20221 Quebec7 15 00 20 00 24 00 25 75 Refer to notes on the following pages 10 Up to 46 295

Web The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1 024 a 2 4 increase The federal indexation factors tax brackets and tax rates have been confirmed to Web For 2022 employers can use a Federal Basic Personal Amount BPAF of 14 398 for all employees The federal income tax thresholds have been indexed for 2022 The federal

Canadian Federal Tax Tables 2022

Canadian Federal Tax Tables 2022

Canadian Federal Tax Tables 2022

https://i.etsystatic.com/32118615/r/il/05d84d/3623632607/il_fullxfull.3623632607_nknk.jpg

Web Federal and Provincial Territorial Income Tax Rates and Brackets for 20221 Tax Rates Tax Brackets Surtax Rates Surtax Thresholds Federal1 15 00 20 50 26 00 29 00 33 00 Up

Pre-crafted templates use a time-saving service for producing a varied range of documents and files. These pre-designed formats and designs can be utilized for various individual and professional jobs, consisting of resumes, invites, flyers, newsletters, reports, presentations, and more, streamlining the material production procedure.

Canadian Federal Tax Tables 2022

Irs Ez Tax Table 2022 2023 Eduvark Hot Sex Picture

Federal Tax Brackets 2021 Newyorksilope

2023 Tax Tables Fill Online Printable Fillable Blank

Tax Tables 2018 Computerfasr

2022 Tax Refund Calculator Canada Impeccable Weblogs Bildergallerie

2022 Tax Brackets PersiaKiylah

https://www.canada.ca/en/revenue-agency/services/tax/rates.html

Web Fuel charge rates FCRATES Date modified 2024 01 23 Information for individuals and businesses on rates such as federal and provincial territorial tax rates prescribed interest

https://www.canada.ca/en/revenue-agency/services/...

Web Jan 1 2024 nbsp 0183 32 For 2024 the federal income thresholds the personal amounts and the Canada employment amount have been changed based on changes in the consumer

https://www.taxtips.ca/priortaxrates/tax-rates-2022-2023/canada.htm

Web for 2022 from 12 719 to 14 398 for taxpayers with net income line 23600 of 155 625 or less For incomes above this threshold the additional amount of 1 679 is reduced until it

https://www.canada.ca/en/revenue-agency/programs/...

Web The 2022 edition of Individual Tax Statistics by Tax Bracket presents basic counts and amounts of individual tax filer information by tax bracket These statistics are based on

https://www.canada.ca/en/revenue-agency/services/...

Web Step 1 Identification and other information Step 2 Total income Step 3 Net income Step 4 Taxable income Step 5 Federal tax Part A Federal tax on taxable income

Web Refer to the following tables for Canadian filing and payment deadlines in the 2020 calendar year that were extended for COVID 19 Personal Tax Returns Web Jan 1 2024 nbsp 0183 32 Indexing for 2024 Tax rates and income thresholds Chart 1 2024 federal tax rates and income thresholds Additional federal tax for income earned outside

Web 2022 Personal tax calculator EY Canada Calculate your combined federal and provincial tax bill in each province and territory The calculator reflects known rates as of December