Canada Vs Us Corporate Tax Rate WEB May 29 2019 nbsp 0183 32 In Canada the top personal income tax rate applies federally at an income level of 205 842 In contrast the U S federal top marginal rate for a single filer applies to incomes over a lofty 500 000 U S almost two and a half times the Canadian level

WEB Jun 19 2024 nbsp 0183 32 The top federal tax rate in Canada is 33 Wealthy Americans have access to many tax deductions that Canada s alternative minimum tax doesn t allow WEB Fiscal Facts October 24 2022 Fact In 2020 compared to Canada the United States relied more on personal income taxes and payroll taxes than on corporate income taxes and consumption taxes View Data Previous Fact Next Fact

Canada Vs Us Corporate Tax Rate

Canada Vs Us Corporate Tax Rate

Canada Vs Us Corporate Tax Rate

https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/3.18.2.fig1_.png?itok=LRI03vPi

WEB Jun 22 2020 nbsp 0183 32 Fact Compared to Canada the United States relies more heavily on personal income tax and Social Security contributions 65 vs 50 and less on corporate income tax 4 vs 11 or consumption taxes such as

Templates are pre-designed documents or files that can be utilized for different purposes. They can conserve time and effort by supplying a ready-made format and layout for developing various type of material. Templates can be used for personal or expert jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Canada Vs Us Corporate Tax Rate

Why The United States Needs A 21 Minimum Tax On Corporate Foreign

Here Are The Corporate Tax Rate Bills You Should Pay Attention To This

Corporation Tax Ambiance Accountants Sheffield Accountants

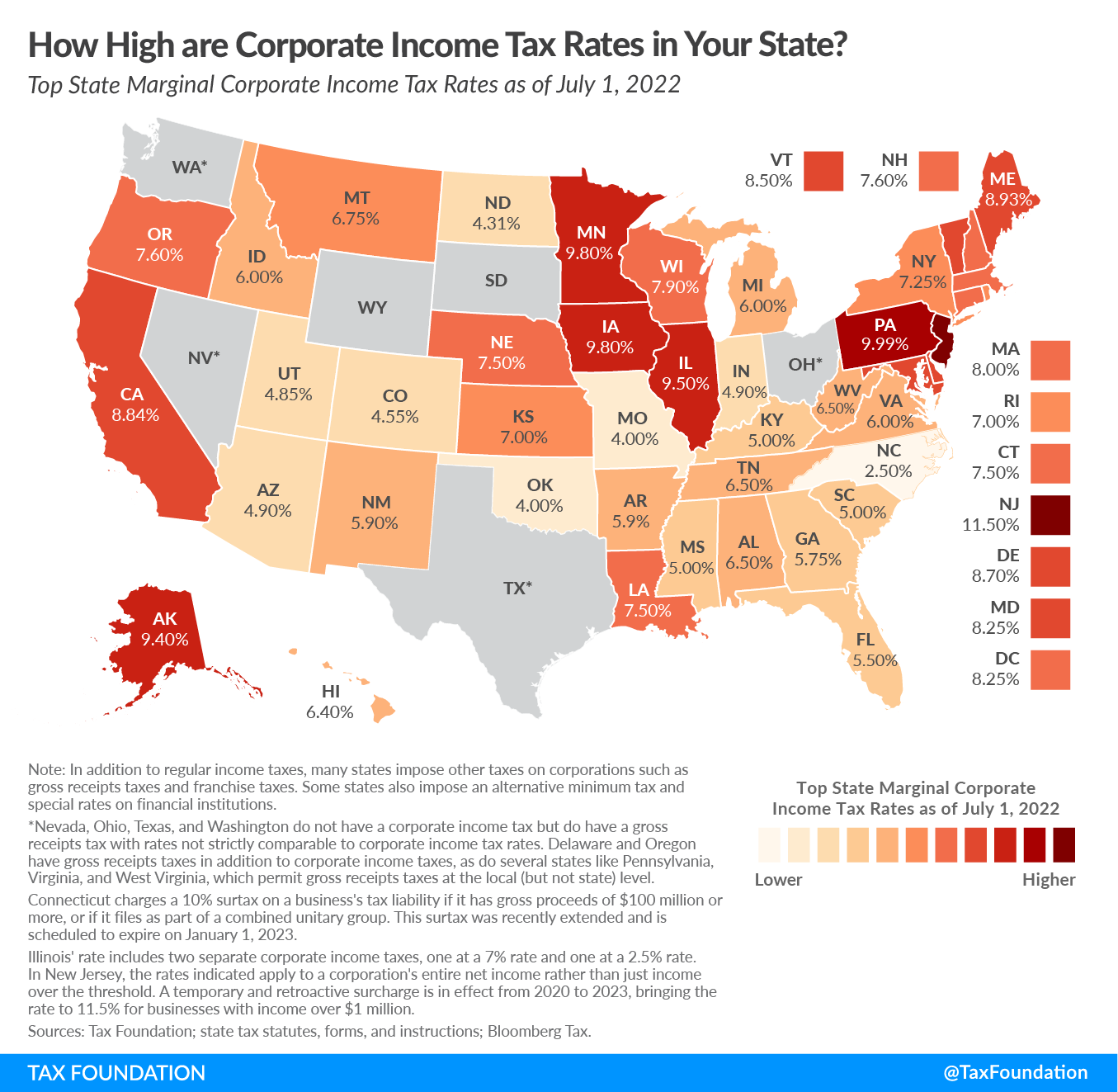

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

US Corporate Tax Hike After The Election Most Negatively Impacted

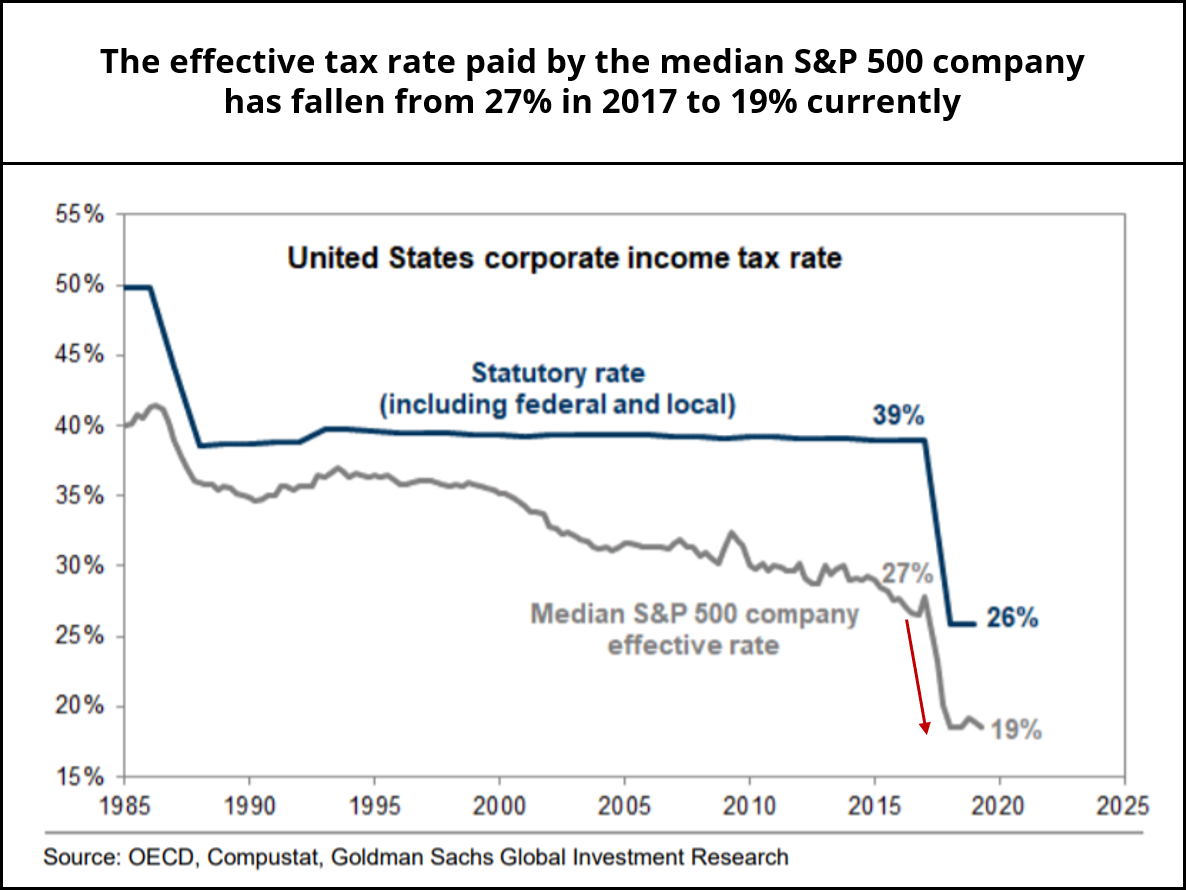

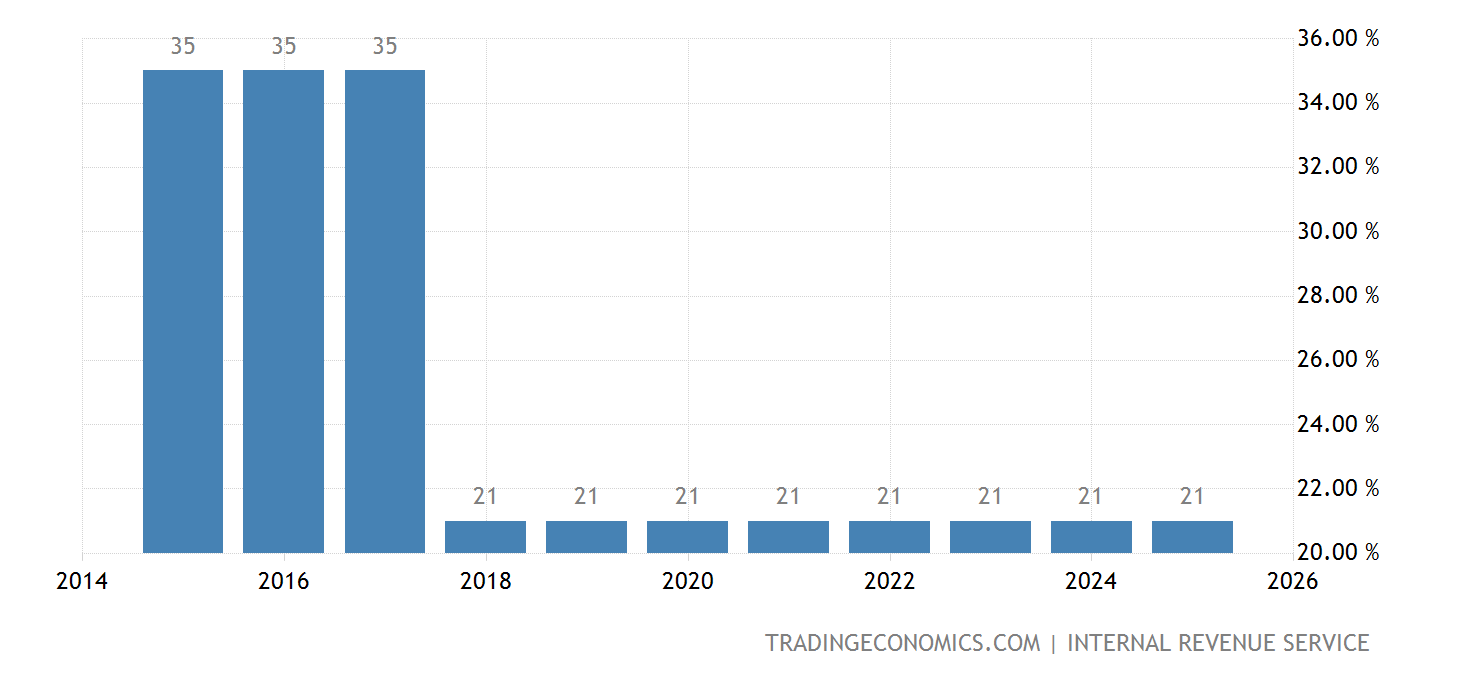

United States Federal Corporate Tax Rate 2022 Data 2023 Forecast

https://taxfoundation.org/data/all/global/...

WEB Dec 13 2022 nbsp 0183 32 The following chart shows a distribution of corporate income tax rates among 225 jurisdictions in 2022 A plurality of countries 118 total impose a rate above 20 percent and below or at 30 percent Eighteen jurisdictions have a statutory corporate tax rate above 30 percent and below or at 35 percent

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/PBPVFCYSMVH6ZPCPEW3EHJGRYE.jpg?w=186)

https://accountor.ca/blog/taxation/corporate-tax-rate.html

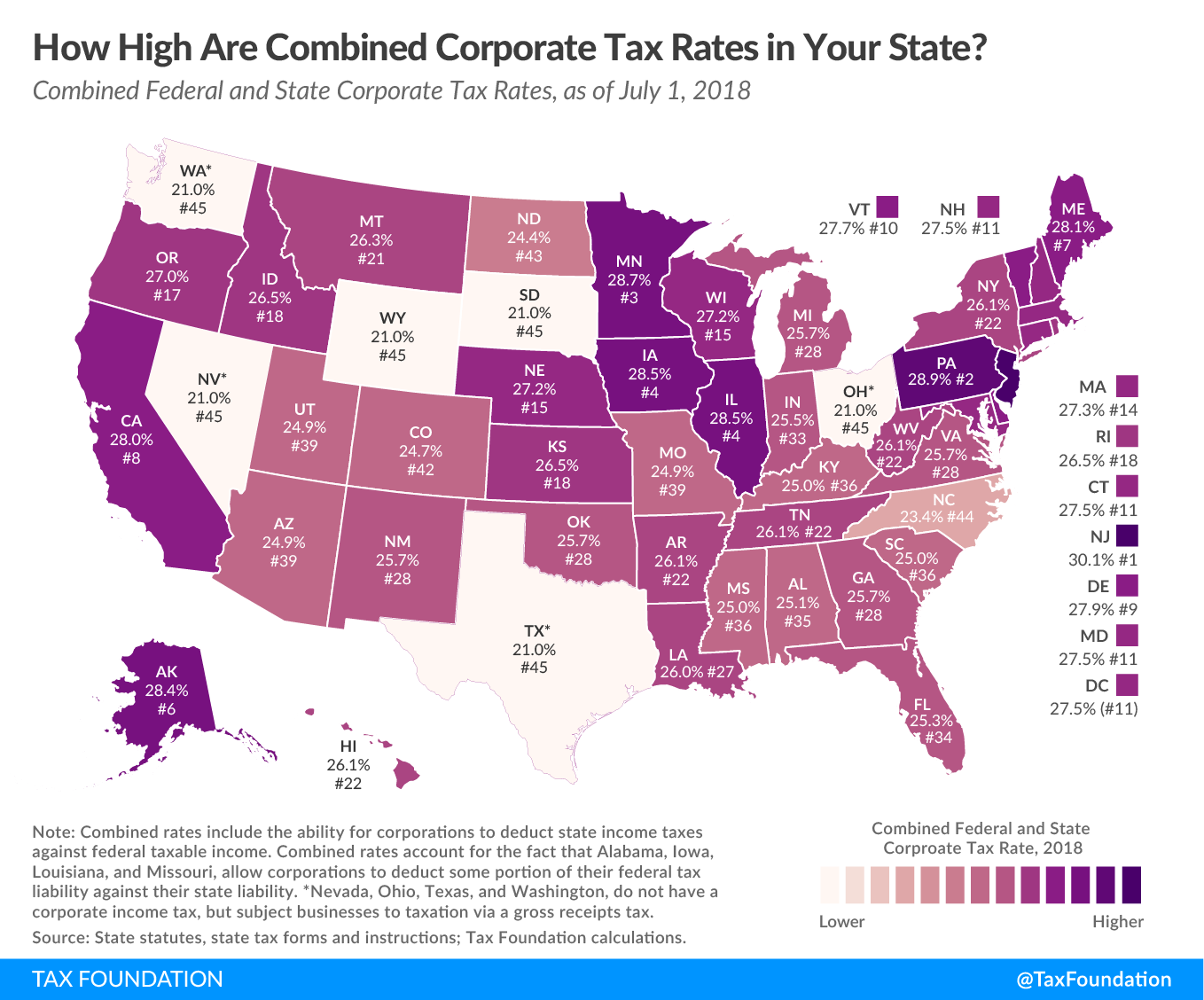

WEB How does the corporate tax rate in Canada compare to the USA Canadian corporate tax rates range from 26 5 to 31 similar to the USA s combined federal and state rates which average around 27 What factors determine a corporation s tax rate

https://www.canada.ca/en/revenue-agency/services...

WEB The basic rate of Part I tax is 38 of your taxable income 28 after federal tax abatement After the general tax reduction the net tax rate is 15 For Canadian controlled private corporations claiming the small business deduction the net tax rate is 9

https://kpmg.com/ca/en/home/services/tax/tax-facts/...

WEB Jun 30 2024 nbsp 0183 32 Federal and Provincial Territorial Tax Rates for Income Earned by a General Corporation 2024 and 2025 Current as of June 30 2024

https://taxsummaries.pwc.com/canada/corporate/...

WEB Jun 21 2024 nbsp 0183 32 As a general rule corporations resident in Canada are subject to Canadian corporate income tax CIT on worldwide income Non resident corporations are subject to CIT on income derived from carrying on a business in Canada and on capital gains arising upon the disposition of taxable Canadian property see Capital gains in the

WEB Dec 9 2021 nbsp 0183 32 Twenty countries made changes to their statutory corporate income tax rates in 2021 Bangladesh Argentina and Gibraltar increased their top corporate tax rates from 25 percent 30 percent and 10 percent to 32 5 percent 35 WEB Sep 30 2022 nbsp 0183 32 The tax rates on zero emission technology manufacturing profits would be 4 5 where that income would otherwise be taxed at the 9 small business tax rate and 7 5 where that income would otherwise be taxed at the 15 general corporate tax rate

WEB Jan 15 2022 nbsp 0183 32 The tax rate on personal services business income earned by a corporation is 33 00 The federal rate applicable to investment income earned by Canadian controlled private corporations CCPCs is 38 67 due to the