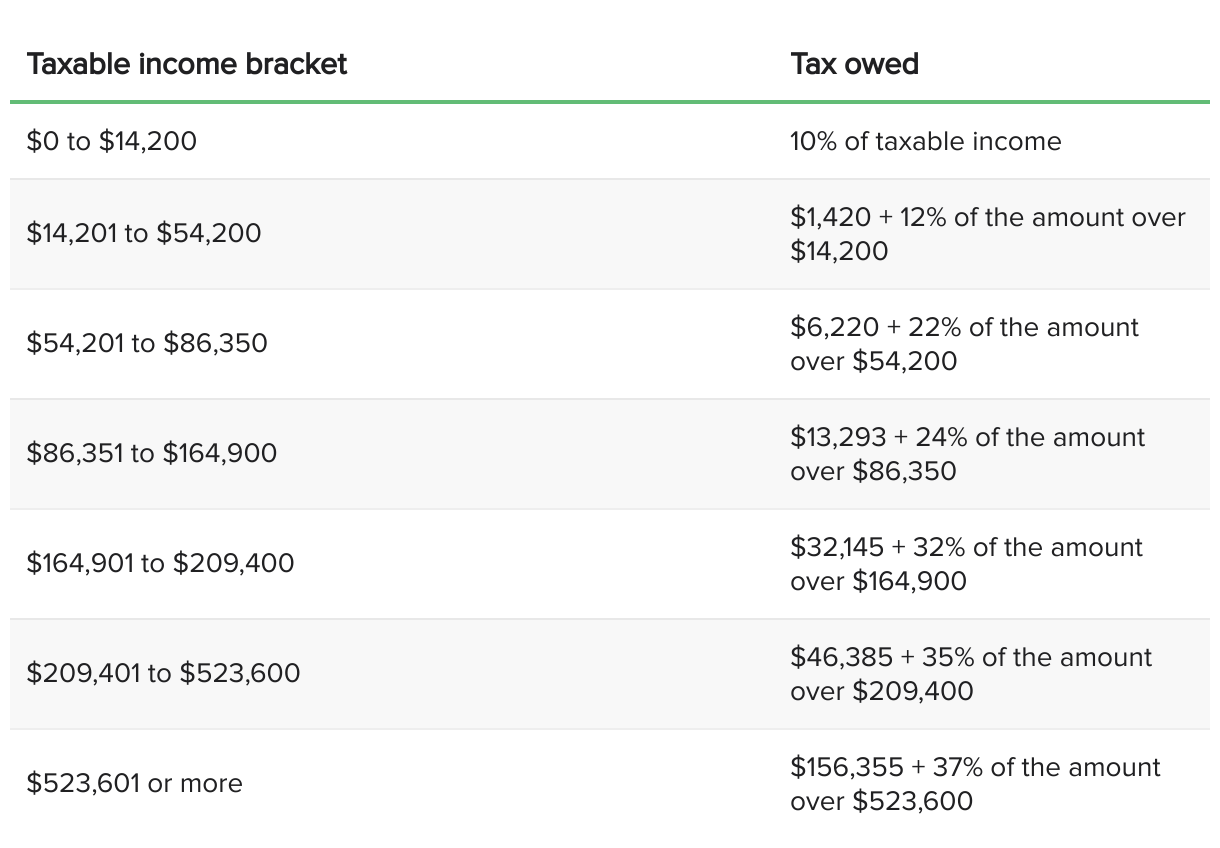

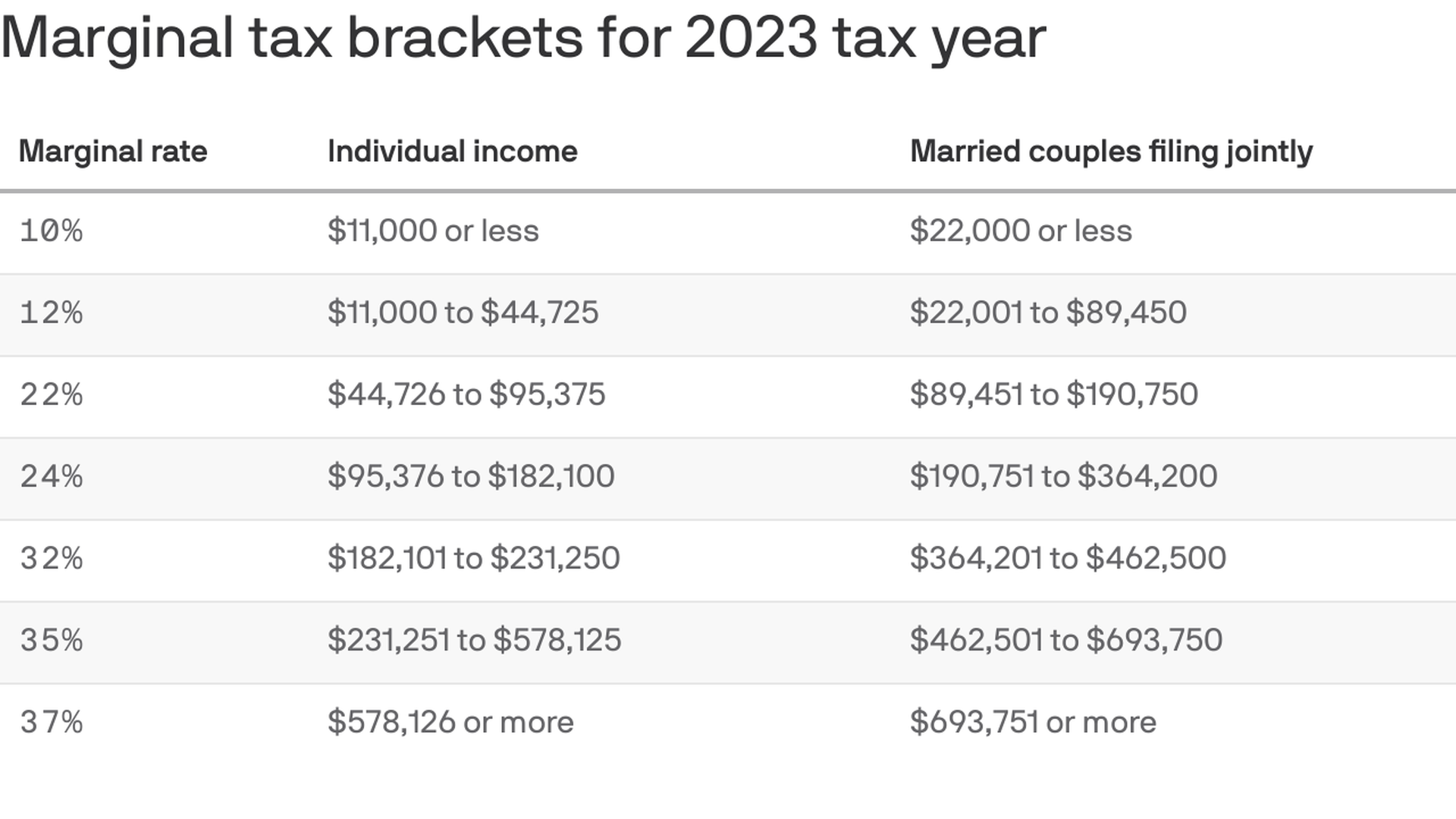

California Tax Brackets For 2023 Married Filing Jointly Web Mar 3 2023 nbsp 0183 32 Tax Rate Federal Income Tax Married Filing Jointly Tax Owed 10 Up to 22 000 10 of taxable income 12 22 001 to 89 450 2 200 12 of the total gt 22 000 22 89 450 to 190 750 10 734 22 of the total gt 89 450 24 190 751 to 364 200 41 965 24 of the total gt 190 750 32 364 201 to 462 500 87 408

Web Advertiser Disclosure California Income Tax Calculator 2023 2024 Learn More On TurboTax s Website If you make 70 000 a year living in California you will be taxed 10 448 Your average Web TY 2023 2024 eFile your California tax return now eFiling is easier faster and safer than filling out paper tax forms File your California and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for Tax Brackets users File Now with TurboTax

California Tax Brackets For 2023 Married Filing Jointly

California Tax Brackets For 2023 Married Filing Jointly

California Tax Brackets For 2023 Married Filing Jointly

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

Web Oct 26 2023 nbsp 0183 32 For the 2022 2023 tax year California estimated it would collect more than 130 billion in personal income tax comprising about two thirds of the state s revenue Married filing jointly or

Templates are pre-designed documents or files that can be used for various functions. They can conserve time and effort by offering a ready-made format and layout for creating various sort of content. Templates can be used for individual or expert projects, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

California Tax Brackets For 2023 Married Filing Jointly

Federal Income Tax Brackets 2021 Vs 2022 Orangerilo

Ca Tax Brackets 2023 2023

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

2022 Tax Brackets KatherynYahya

California Income Tax Withholding Tables Gettrip24

2022 Federal Tax Brackets And Standard Deduction Printable Form

https://www.ftb.ca.gov/forms/2023/2023-540-taxtable.pdf

Web Filing status 1 or 3 Single Married RDP Filing Separately 2 or 5 Married RDP Filing Jointly Qualifying Surviving Spouse RDP 4 Head of Household Personal Income Tax Booklet 2023 If Your Taxable Income Is The Tax For Filing Status

https://www.caltax.com/.../cat/1023-tax-rates-2023.pdf

Web Single and married RDP filing separate 5 363 Married RDP filing joint head of household and surviving spouse 10 726 Minimum standard deduction for dependents 1 250 Miscellaneous credits Qualified Senior Head of Household Credit is 2 of California taxable income with a maximum California

https://www.nerdwallet.com/article/taxes/california-state-tax

Web Jan 17 2024 nbsp 0183 32 The California standard deduction for tax returns filed in 2024 is 5 363 single or married filing separately and 10 726 married filing jointly qualifying widow er or head of

https://www.ftb.ca.gov/file/personal/tax-calculator-tables-rates.asp

Web Tax tables 2023 Form 540 and 540 NR Form 540 2EZ Single Joint Head of household 2022 Form 540 and 540 NR Form 540 2EZ Single Joint Head of household 2021 Form 540 and 540 NR Form 540 2EZ Single Joint Head of household Prior years Find prior year tax tables using the Forms and Publications Search Select tax year In

https://ca-us.icalculator.com/income-tax-rates/2023.html

Web EITC Tables for Married taxpayers married filing jointly Qualifying Widow er in 2023 Element Number of Children 0 1 2 3 Credit rate 7 65 34 40 45 Earned income amount 7 840 00 11 750 00 16 510 00 16 510 00 Maximum credit amount 600 00 3 995 00 6 604 00 7 430 00 Phaseout amount threshold 16 370 00

Web Married RDP filing separately Head of household Qualifying surviving spouse RDP with dependent child California taxable income Enter line 19 of 2023 Form 540 or Form 540NR Caution This calculator does not figure tax for Form 540 2EZ Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page Web Married Filing Jointly Qualifying Widow er Head of Household Married Filing Separately Calculate tax liability California tax brackets are adjusted for the 2023 2024 taxes The same as the federal income tax brackets California has a progressive tax system meaning the more you earn the more you pay in taxes

Web Dec 15 2023 nbsp 0183 32 California Married Filing Jointly Tax Brackets Tax Year 2023 Due Date April 15 2024 The California Married Filing Jointly filing status tax brackets are shown in the table below These income tax brackets and rates apply to California taxable income earned January 1 2023 through December 31 2023