Australia Income Tax Rates 2022 23 WEB Australian income tax rates 2022 2023 Source ATO April 2023 Note The rates in the above tables do not include the Medicare levy of 2 What is taxable income The ATO

WEB The following rates for FY 2022 23 apply from 1 July 2022 Please note the above ATO tax rates do not include the Medicare levy which increased from 1 5 to 2 from July 1 WEB By April 26 2023 Income Tax Brackets 2023 are published start of each financial year by the ATO These brackets are effective rates at which an individual taxpayer must file

Australia Income Tax Rates 2022 23

Australia Income Tax Rates 2022 23

Australia Income Tax Rates 2022 23

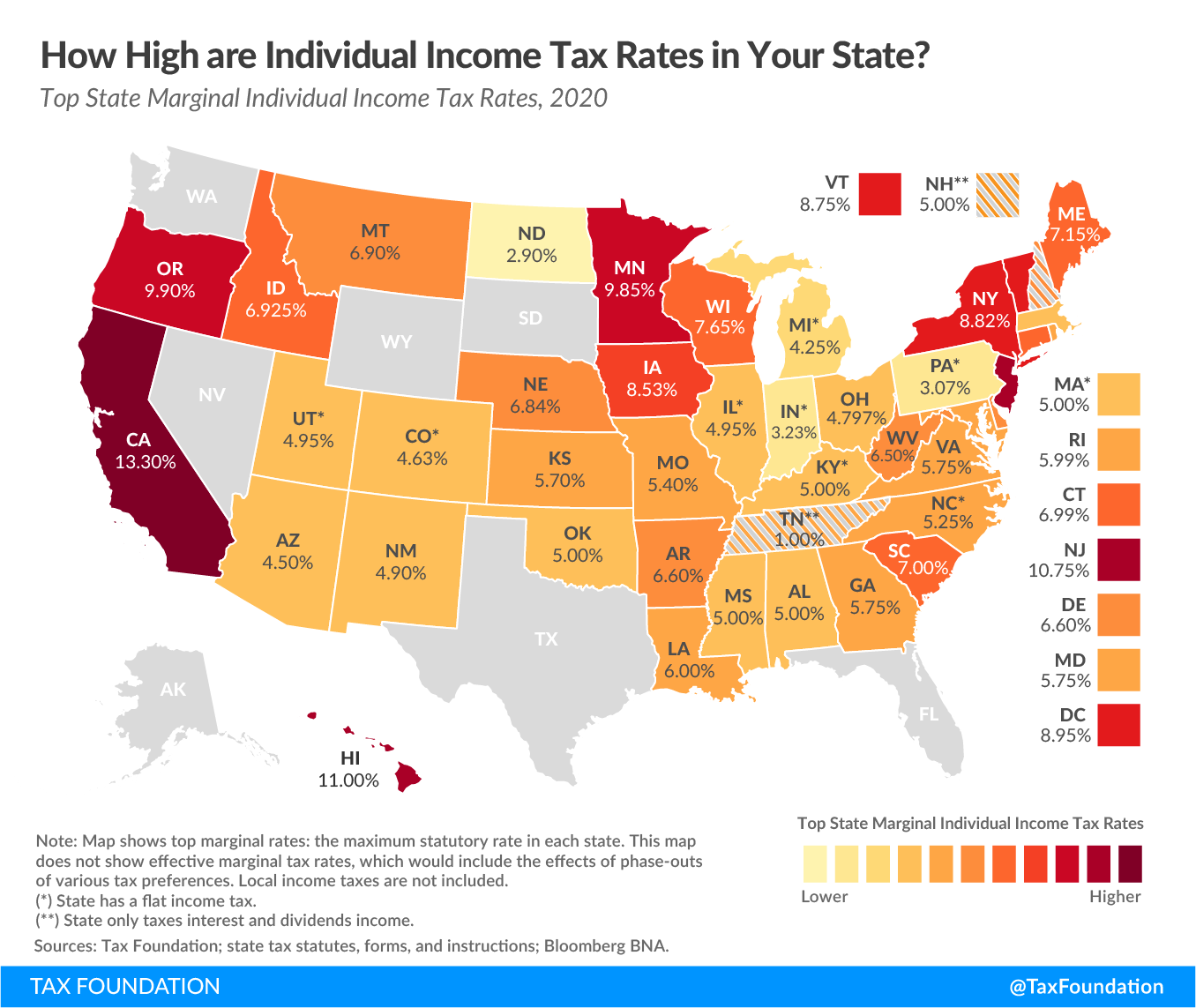

https://standard-deduction.com/wp-content/uploads/2020/10/2020-state-individual-income-tax-rates-and-brackets-tax.png

WEB 1 minutes On this page Helps you work out how much Australian income tax you should be paying what your take home salary will be when tax and the Medicare levy are

Pre-crafted templates provide a time-saving solution for developing a varied series of documents and files. These pre-designed formats and layouts can be used for various individual and professional projects, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, streamlining the material production process.

Australia Income Tax Rates 2022 23

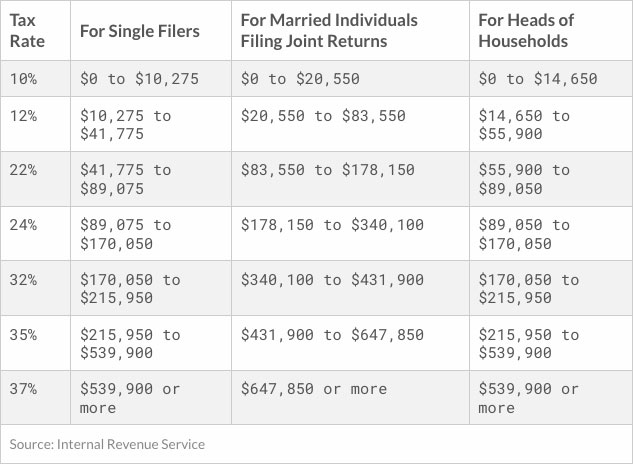

2022 Tax Brackets FatimaMarcie

2022 Us Tax Brackets Irs

2022 Tax Brackets DhugalKillen

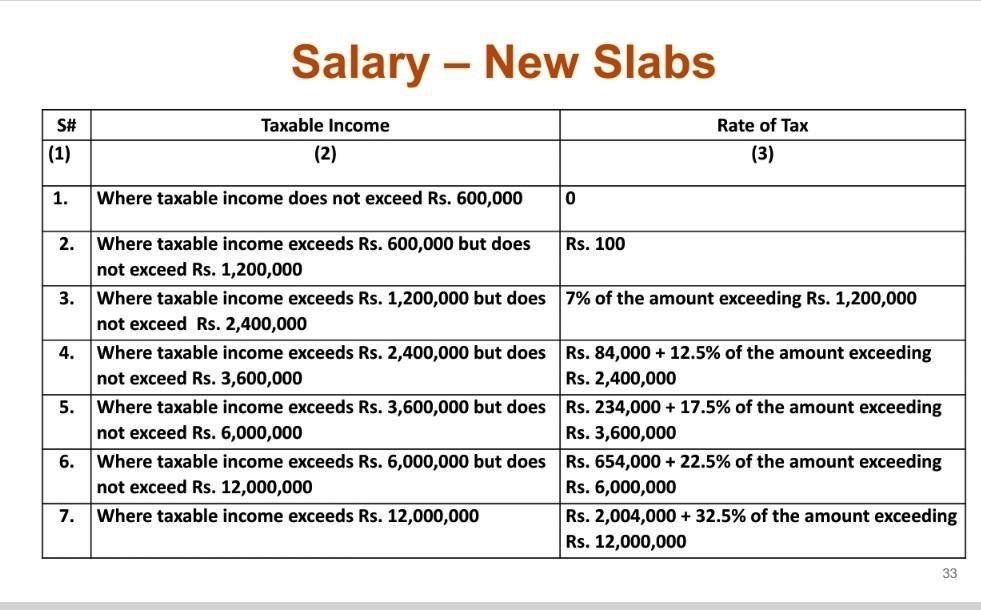

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Chantelle Bartels

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

https://www.superguide.com.au/how-sup…

WEB Mar 31 2024 nbsp 0183 32 Australian income tax rates for 2023 24 and 2022 23 residents Australian income tax rates for 2024 25 onwards residents Tax cuts from 1 July 2024 How income tax is calculated What is the tax

https://www.taxcalc.com.au/2223.html

WEB Tax Rates 2022 2023 Taxable Income Tax on this income 0 120 000 32 5c for each 1 120 001 180 000 39 000 plus 37c for each 1 over 120 000 Over 180 000

https://moneysmart.gov.au/work-and-tax/income-tax

WEB Tax rates 2022 23 There are no changes to the income tax rates for 2023 24 This means if you earned 60 000 during the 2022 23 tax year your tax would be calculated like this

https://taxsummaries.pwc.com/australia/individual/...

WEB Mar 6 2024 nbsp 0183 32 The following tables set out the PIT rates that currently apply to resident and non resident individuals for the year ending 30 June 2023 These rates and thresholds

https://www.hrblock.com.au/tax-academy/proposed...

WEB The tax rates for 2022 23 and 2023 24 excluding the 2 Medicare levy are as follows 2022 23 and 2023 24 income year Non residents foreign residents Taxpayers who are

WEB Mar 5 2024 nbsp 0183 32 These changes are now law From 1 July 2024 the proposed tax cuts will reduce the 19 per cent tax rate to 16 per cent reduce the 32 5 per cent tax rate to 30 per WEB AU Tax 2022 Australia Tax Tables 2022 Tax Rates and Thresholds in Australia Rate and Share Show you Care Your feedback and support helps us keep this resource

WEB 2022 2023 2023 2024 2024 2025 Take a Guess gt How Much Money in This Stack Our Tax Calculator uses exact ATO formulas when calculating your salary after income tax