Ato Weekly Tax Tables 2019 Jul 1 2019 nbsp 0183 32 Tax Rates 2019 2020 Year Residents The 2019 20 tax rates remain unchanged from the preceding year and for the following two years The current tax scale is the result of a number of tax scale adjustments set forth in

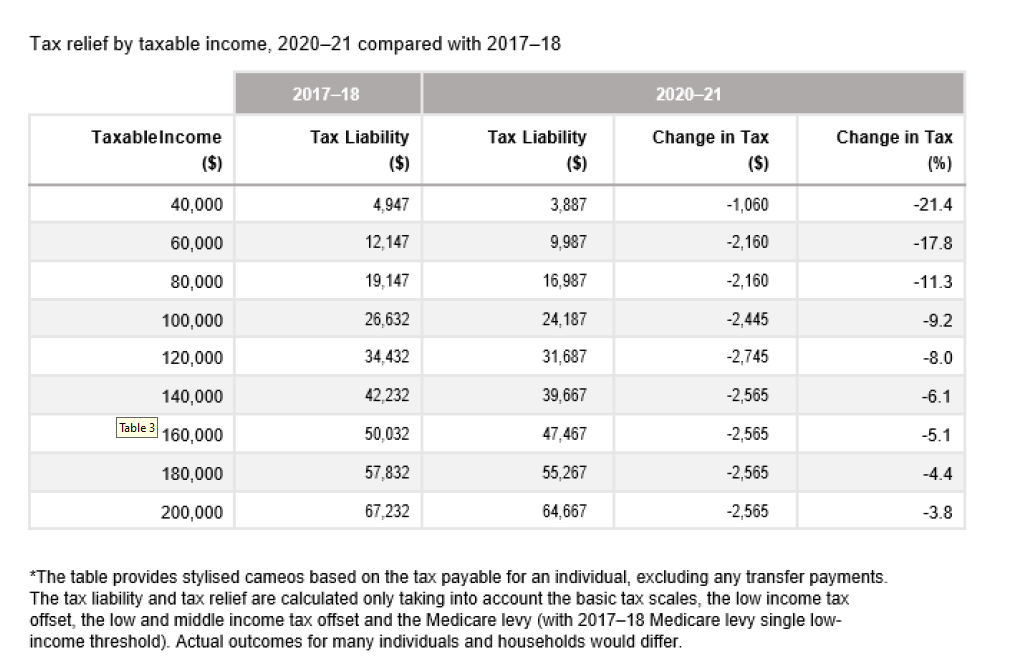

The low and middle income tax offset is available to individuals who are Australian residents during the 2018 19 2019 20 2020 21 or 2021 22 income years and have taxable income for Tax and salary calculator for the 2019 2020 financial year Also calculates your low income tax offset HELP SAPTO and medicare levy

Ato Weekly Tax Tables 2019

Ato Weekly Tax Tables 2019

Ato Weekly Tax Tables 2019

https://taxstore.com.au/assets/images/menu.jpg

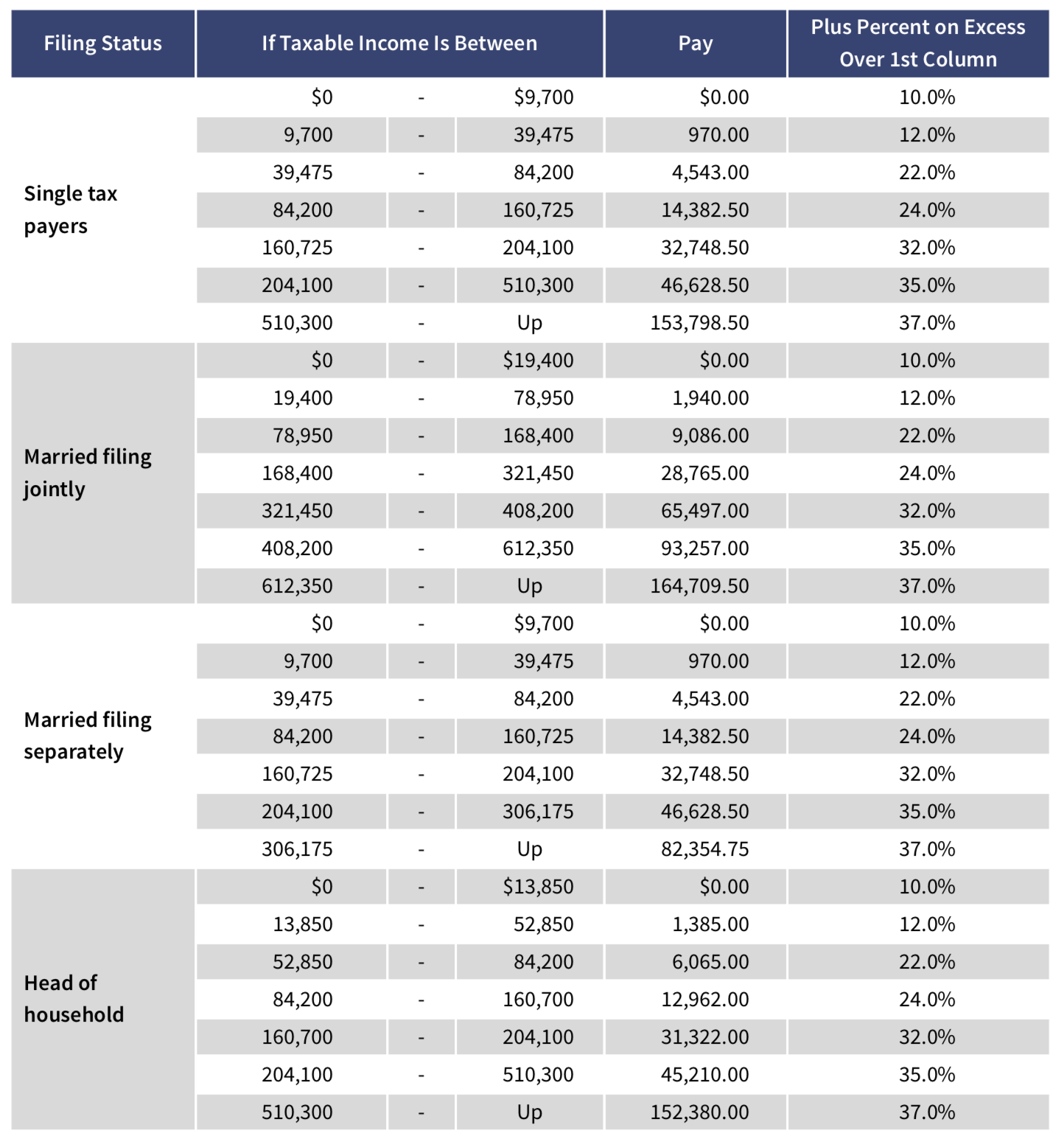

All income received by individuals is taxed at progressive tax rates in Australia That means your income is taxed in brackets and not at the marginal tax rate Below are the ATO tax rates that

Templates are pre-designed documents or files that can be used for numerous purposes. They can save time and effort by offering a ready-made format and design for creating different kinds of content. Templates can be used for personal or professional jobs, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Ato Weekly Tax Tables 2019

Tax Table 2022

Federal Income Tax Tables 2019

Federal Budget 2023 24 Personal Income Tax Pitcher Partners

Payg Withholding Weekly Tax Table 2019 Brokeasshome

Budget 2020 Individuals Tax Accounting Adelaide

2022 Monthly Tax Tables TAX

https://www.ato.gov.au/tax-rates-and-codes/previous-years-tax-tables

Nov 28 2024 nbsp 0183 32 Use these quick links to find the pay as you go PAYG withholding tax tables for previous years See tax tables for the 2023 24 financial year See tax tables for the 2022 23

https://www.ato.gov.au/tax-rates-and-codes/tax-tables-overview

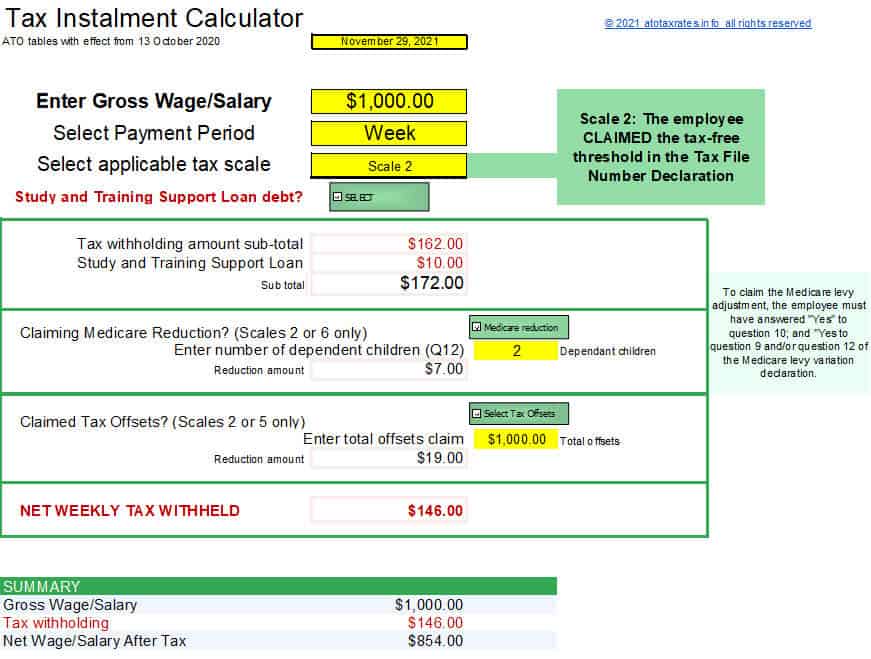

We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other payees A tax withheld calculator that calculates the correct

https://atotaxrates.info/payg-tax-tables/ato-tax...

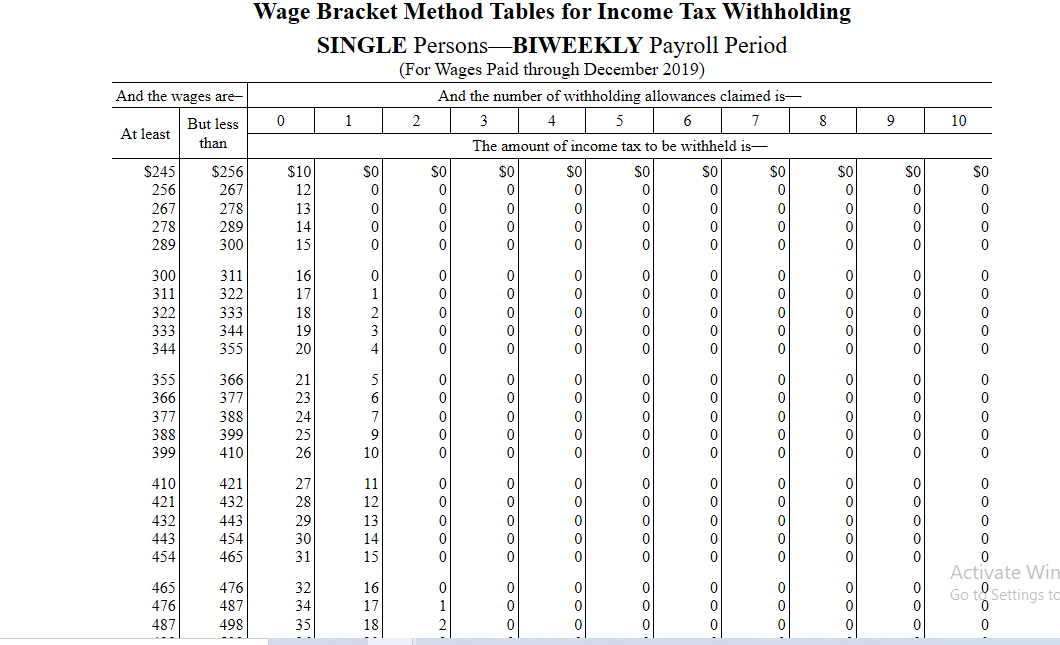

May 20 2021 nbsp 0183 32 Tax instalment tables linked below are for the 2018 19 financial year commencing on 1 July 2018 These tables are for use by employers to calculate the amount of tax to be

https://www.studocu.com/en-au/docume…

NAT 1005 Pay as you go PAYG withholding Weekly tax table For payments made on or after 1 July 2018 Includes the tax offset ready reckoner on page 9

https://atotaxrates.info/.../ato-tax-rates-…

Jul 1 2018 nbsp 0183 32 Tax Rates 2018 2019 Year Residents The 2019 financial year starts on 1 July 2018 and ends on 30 June 2019 The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year Tax

Oct 13 2020 nbsp 0183 32 Where the tax free threshold is not claimed and your employee earns more 3 275 withhold 1 141 plus 47 cents for each 1 of earnings in excess of 3 275 For all withholding ATO Tax Tables The ATO produces a range of tax tables to help you work out how much to withhold from payments to your employees or other payees Recently new tax tables have

Jun 16 2024 nbsp 0183 32 Use this tax table if you make payments to a prescribed person entitled to a full or half Medicare levy exemption Prescribed persons include members of the defence force and