Ato Tax Rates Monthly 2022 Web Jul 1 2003 nbsp 0183 32 Monthly rates These rates are updated at the beginning of the following month Monthly foreign exchange rates for income years 2023 24 income year 2022 23 income year 2021 22 income year 2020 21 income year

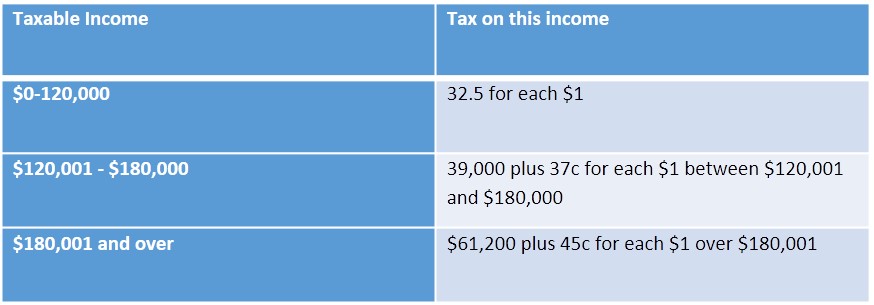

Web ATO Tax Rates 2022 2023 These tax rates apply to individuals who are Australian residents for tax purposes The following rates for FY 2022 23 apply from 1 July 2022 Web Jul 1 2018 nbsp 0183 32 The 2022 23 Tax Scale The basic tax scales are the same as the previous year but the Low amp Middle Income Tax Offset drops out which would effectively increase tax for lower income earners jump to free tax calculator

Ato Tax Rates Monthly 2022

Ato Tax Rates Monthly 2022

Ato Tax Rates Monthly 2022

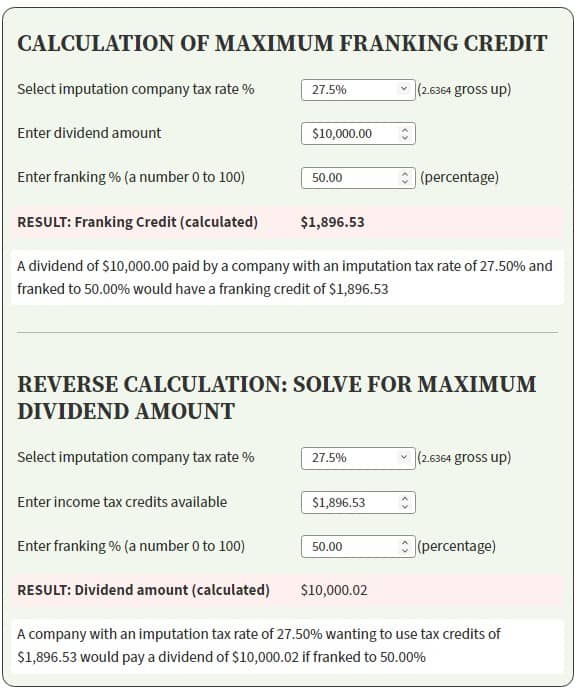

https://atotaxrates.info/wp-content/uploads/2021/11/franking-credit-calculators.jpg

Web Jun 23 2022 nbsp 0183 32 Use this tax table for payments made from 1 July 2022 to 30 June 2023 You can use the Study and training support loans component lookup tool XLSX 24KB This link will download a file to quickly work out the monthly PAYG withholding component

Templates are pre-designed documents or files that can be utilized for numerous purposes. They can save effort and time by offering a ready-made format and layout for producing different kinds of content. Templates can be utilized for personal or professional jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Ato Tax Rates Monthly 2022

Tax Brackets Australia Beyondearheadphonescenter

Ato Income Tax Rates Prior Years Spot Walls

The Difference Between An ATO Tax Account And Integrated Tax Ac

Tax Tables Weekly Ato Review Home Decor

Australian Withholding Tax Artist Escrow Services Pty Ltd

Q2 Use The 2021 Tax Rates From Course Hero

https://www.ato.gov.au/tax-rates-and-codes/tax-rates-australian-residents

Web Sep 28 2023 nbsp 0183 32 Resident tax rates 2022 23 Taxable income Tax on this income 0 18 200 Nil 18 201 45 000 19c for each 1 over 18 200 45 001 120 000 5 092 plus 32 5c for each 1 over 45 000 120 001 180 000 29 467 plus 37c for each 1 over 120 000 180 001 and over 51 667 plus 45c for each 1 over 180 000

https://www.ato.gov.au/tax-rates-and-codes/tax-tables-overview

Web Jul 1 2023 nbsp 0183 32 Last updated 22 November 2023 Print or Download About tax tables We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other payees A tax withheld calculator that calculates the correct amount of tax to withhold is also available

https://www.ato.gov.au/tax-rates-and-codes

Web Find our most popular tax rates and codes listed below or use search and then refine your results using the filters Individual income tax rates Tax tables Weekly tax table Fortnightly tax table Monthly tax table Estimated tax savings Help TSL and SFSS repayment thresholds and rates

https://www.ato.gov.au/tax-rates-and-codes/foreign...

Web Jul 1 2022 nbsp 0183 32 Monthly foreign exchange rates for financial year ending 2023 Updated to include monthly rates for June 2023 Last updated 6 July 2023 Print or Download 2023 April May June 2023 January February March 2022 October November December 2022 July August September

https://atotaxrates.info/individual-tax-rates-resident/ato-tax-rates-2022

Web Jun 30 2022 nbsp 0183 32 ATO Tax Rates 2022 Tax Rates 2021 2022 Year Residents Tax Scale For Year Ended 30 June 2022 free tax calculator The 2022 financial year in Australia starts on 1 July 2021 and ends on 30 June 2022 The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year

Web 25 Votes This page contains the tax table information used for the calculation of tax and payroll deductions in Australia in 2022 These tax tables are used for the tax and payroll calculators published on iCalculator AU Web Jul 1 2021 nbsp 0183 32 Monthly foreign exchange rates for financial year ending 2022 Updated to include monthly rates for June 2022 Monthly exchange rates for 1 July 2021 to 30 June 2022 Australian Taxation Office

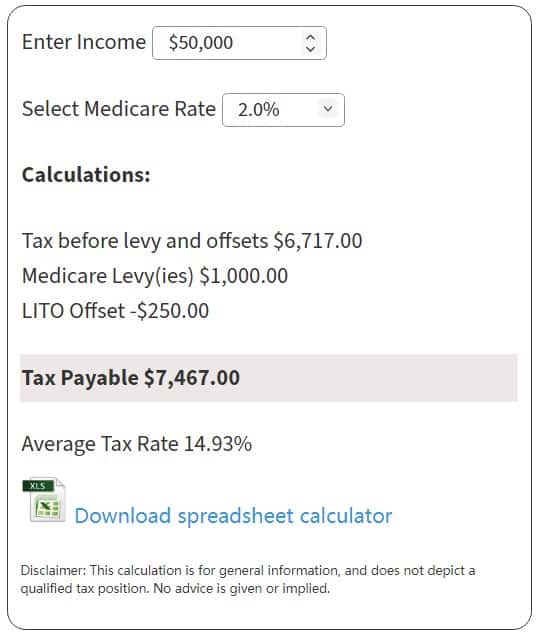

Web This simplified ATO Tax Calculator will calculate your annual monthly fortnightly and weekly salary after PAYG tax deductions Please enter your salary into the quot Annual Salary quot field and click quot Calculate quot Updated with 2023 2024 ATO Tax rates