Ato Company Income Tax Rates 2022 The ATO is the government s principal revenue collection agency The ATO s role is to effectively manage and shape the tax excise and superannuation systems that support and fund services

How individuals and businesses can make a payment to the ATO and what happens if you don t pay your debt Income deductions offsets and records What income you need to declare 6 days ago nbsp 0183 32 A new era of thin capitalisation rules On 29 May 2025 the Australian Taxation Office ATO released Draft PCG 2025 D2 a practical compliance guideline that reshapes how

Ato Company Income Tax Rates 2022

Ato Company Income Tax Rates 2022

Ato Company Income Tax Rates 2022

https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2022.jpg

For security reasons and protection of your personal data your session has expired You will need to start again select cancel to return to the login page

Templates are pre-designed files or files that can be utilized for different functions. They can conserve time and effort by offering a ready-made format and design for developing different kinds of content. Templates can be used for individual or professional projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Ato Company Income Tax Rates 2022

Irs Tax Rates 2022 Latest News Update

Corporate Tax Revenues Are Irrelevant The Sounding Line

Australian Tax Rates 2022 2023 Year Residents Atotaxrates info

Dara Pack

HEARTLAND Chega Ao Streaming No Brasil E Am rica Latina

Tax Brackets Australia Beyondearheadphonescenter

https://www.ato.gov.au › online-services

How to access ATO online services myGov and the ATO app as an individual or sole trader Online services for foreign investors What you need to do to manage your registrations and

https://auth.ato.gov.au › ThvClient.web › index.html

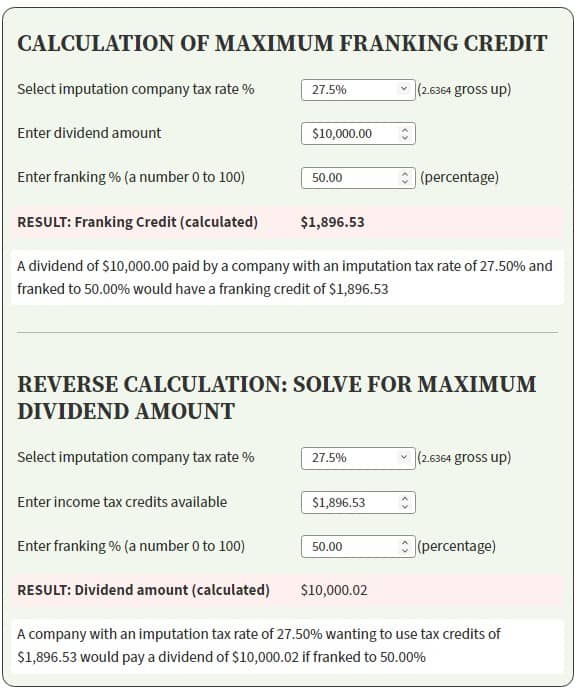

Help clients lodge their tax return Assist with a refund of franking credits claim Tell us that the customer doesn t need to lodge a tax return

https://tdv.ato.acc.ato.gov.au › about-ato › contact...

Nov 10 2024 nbsp 0183 32 To access ATO online services through the ATO app you need to create a myGov account link it to the ATO download the ATO app Self help phone service Our self help

https://onlineservices.ato.gov.au › business

Use Online services for business to interact with us online for all your tax and super needs

https://www.ato.gov.au › about-ato › contact-us

Apr 6 2025 nbsp 0183 32 You can only use this number if someone from the ATO contacted you and asked you to phone us back The ATO staff member will give you a PIN that you must enter when

[desc-11] [desc-12]

[desc-13]