Are Irs Tax Brackets Different For 2022 And 2023 Jan 22 2023 nbsp 0183 32 For the 2023 tax year there are seven federal tax brackets 10 12 22 24 32 35 and 37 Your tax bracket is determined by your taxable income and filing status and

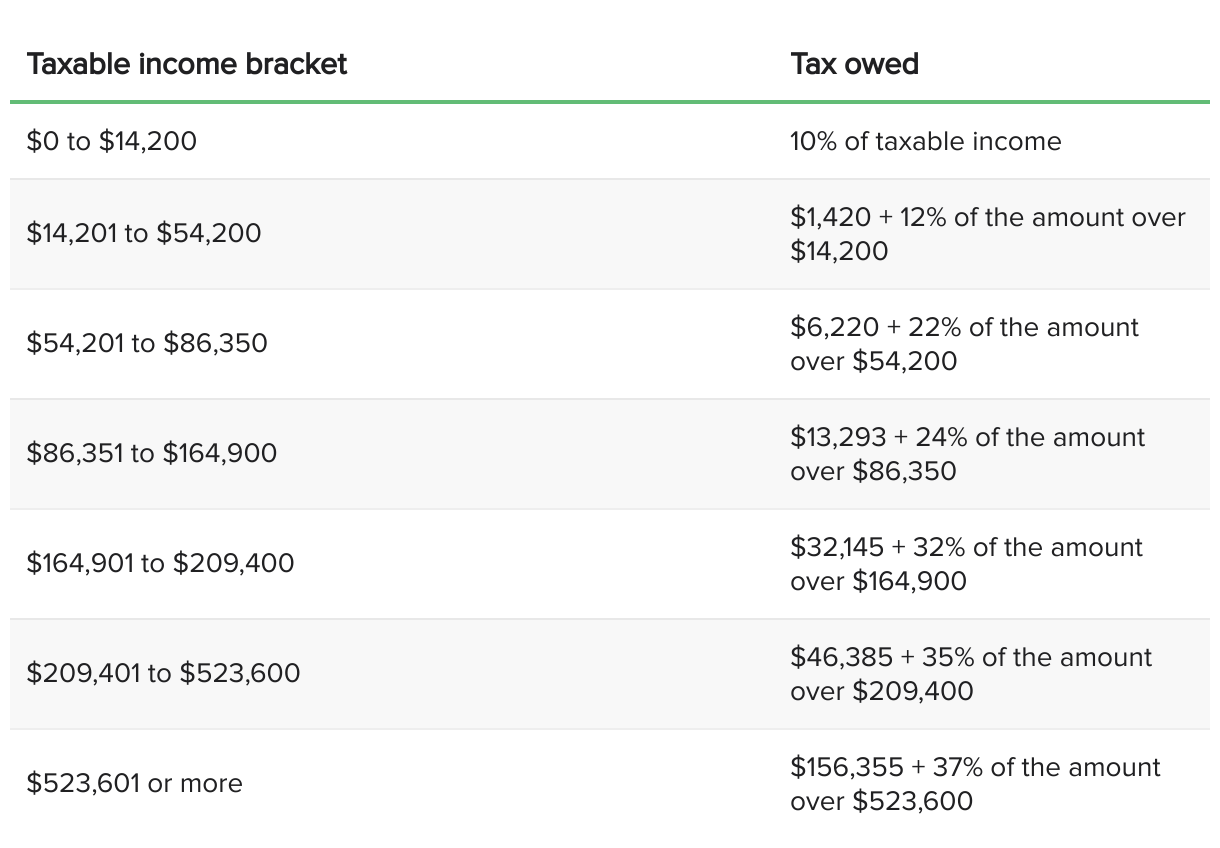

May 12 2023 nbsp 0183 32 The 7 federal income tax brackets for 2023 are the same as 2022 However there s good news Due to 2022 and 2023 inflation the IRS significantly updated the income thresholds for each of the 7 tax brackets to help prevent you from paying higher taxes because your cost of living has also increased There are seven federal tax brackets for the 2022 tax year 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status 2022 federal income tax brackets for taxes due in April 2023

Are Irs Tax Brackets Different For 2022 And 2023

Are Irs Tax Brackets Different For 2022 And 2023

Are Irs Tax Brackets Different For 2022 And 2023

https://img.money.com/2023/02/News-Federal-Income-Tax-Brackets-2022-2023.jpg?quality=85

Jul 27 2023 nbsp 0183 32 The seven federal income tax brackets for the 2022 tax year are 10 12 22 24 32 35 and 37 Capital gains tax rates are different Your tax brackets and rates are based on your filing status as well as your taxable ordinary income

Templates are pre-designed files or files that can be used for numerous functions. They can save effort and time by offering a ready-made format and layout for creating various type of content. Templates can be utilized for individual or expert jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Are Irs Tax Brackets Different For 2022 And 2023

2022 Georgia State Income Tax Brackets Latest News Update

2022 Irs Tax Table Chart

Pin On Finance

IRS Tax Brackets 2022 Married People Filing Jointly Affected By

Amid Soaring Inflation IRS Releases Higher Tax Brackets And Standard

2022 Vs 2023 IRS Tax Brackets Comparison

https://taxfoundation.org › data › all › federal

Oct 18 2022 nbsp 0183 32 The IRS recently released the new inflation adjusted 2023 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A

https://taxfoundation.org › data › all › federal

Nov 10 2021 nbsp 0183 32 The IRS recently released the new inflation adjusted 2022 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A

https://www.ntu.org › foundation › detail

Oct 18 2022 nbsp 0183 32 The Internal Revenue Service IRS has released 2023 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code These inflation adjustments will be in effect for income earned in 2023 which taxpayers will file a

https://www.irs.gov › newsroom

Oct 18 2022 nbsp 0183 32 For self only coverage the maximum out of pocket expense amount is 5 300 up 350 from 2022 For tax year 2023 for family coverage the annual deductible is not less than 5 300 up from 4 950 for 2022 however the deductible cannot be more than 7 900 up 500 from the limit for tax year 2022

https://www.quicktaxus.com

You need to know how the new IRS tax brackets will affect your income if you file your taxes in 2023 In this article you will see the difference between the 2022 and 2023 tax brackets The IRS has just adjusted the income thresholds for all seven federal income tax brackets

Feb 24 2023 nbsp 0183 32 The top bracket in which a 37 tax rate will apply is now 578 125 and above for individuals and 693 750 and above for married couples filing jointly which is about 40 000 more than the 2022 Feb 6 2025 nbsp 0183 32 Just like the previous year seven federal tax brackets have been devised for the tax year 2023 as well These are 10 12 22 24 32 35 and 37 The relevant income tax bracket you will fall into depends on your filing status and taxable income

Every year the Internal Revenue Service announces new tax brackets among other crucial credits and deductions that determine your tax rate for the upcoming year This is done to account for