Advance Tax Percentage For Ay 2022 23 Web Checking your browser before accessing incometaxindia gov in This process is automatic Your browser will redirect to requested content shortly

Web 3 days ago nbsp 0183 32 Learn what is Advance Tax Payment including its due dates calculation procedure applicability and more Last date to pay the final installment of advance tax for the FY 2023 24 is 15th March 2024 Web Jul 1 2023 nbsp 0183 32 Advance tax slab pertaining to the advance tax due dates AY 2023 24 To adhere to the advance tax regulations you must make payments promptly By 15 June or earlier at least 15 of your tax liability should be paid By 15 September this amount increased to 45 and by 15 December it reaches 75

Advance Tax Percentage For Ay 2022 23

Advance Tax Percentage For Ay 2022 23

Advance Tax Percentage For Ay 2022 23

https://i.ytimg.com/vi/_z-Z3hV2SmQ/maxresdefault.jpg

Web Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Resident Senior Citizen who is 60 years or more but less than 80 years at any time during the previous year Net Income Range Rate of Income

Templates are pre-designed files or files that can be used for different functions. They can save time and effort by providing a ready-made format and layout for creating different type of material. Templates can be used for individual or professional jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Advance Tax Percentage For Ay 2022 23

INCOME TAX RETURN E FILING AY 2022 23 FY 2021 22 LATEST VERSON 2 0

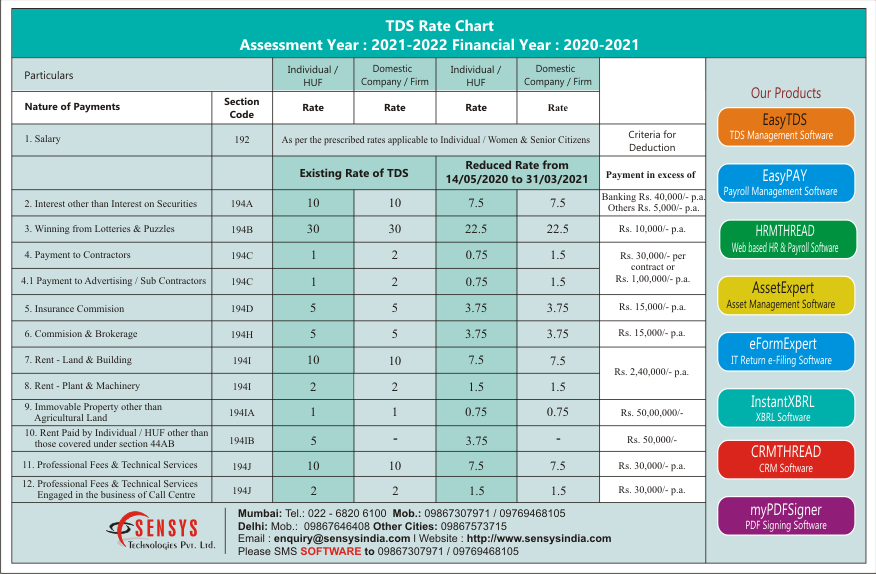

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

Income Tax Calculator FY 2023 24 2022 23 FinCalC Blog

Income Tax Filing AY 2022 2023

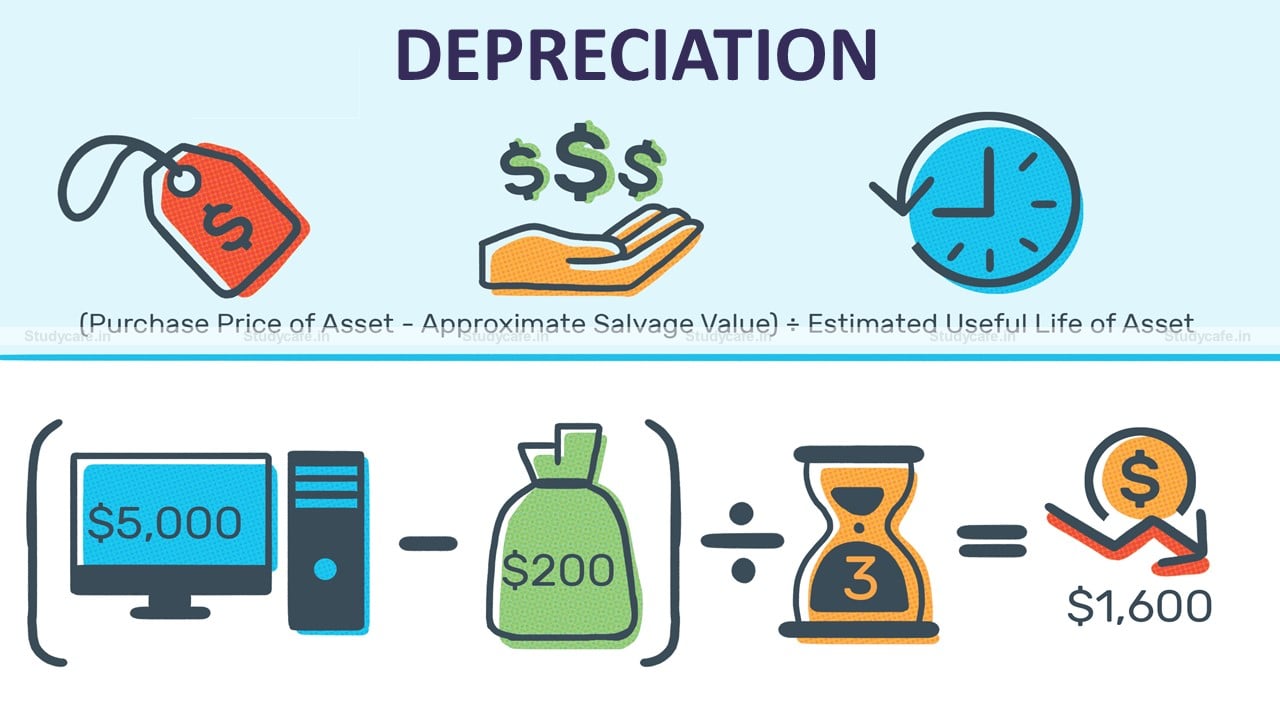

Rates Of Depreciation For Income Tax For AY 2022 23

https://karvitt.com/income-tax/advance-tax-calculator

Web Apr 1 2021 nbsp 0183 32 15th March 100 of Tax on total income for the year less advance tax already paid Updated Apr 01 2021 Comprehensive Advance Tax Calculator to calculate amp compare Advance Tax for New amp Old Tax Regimes

https://www.taxmani.in/income-tax/advance-tax-due-date.html

Web Oct 11 2023 nbsp 0183 32 First installment Calculate 15 of your total tax liability and pay online using challan 280 within advance tax due date of 15th June 2023 Second installment Calculate 45 of your total tax liability and pay online within

https://taxguru.in/income-tax/income-tax-rates-fy...

Web Feb 4 2022 nbsp 0183 32 1 Tax Rates applicable to Individuals Resident Non Resident for FY 2021 22 amp FY 2022 23 2 Income Tax Rates for HUF AOP BOI Other Artificial Juridical Person for FY 2021 22 amp FY 2022 23 3 Special Rates for Individual amp HUF u s 115BAC for FY 2021 22 amp FY 2022 23 4 Tax Rates applicable to Company for FY 2021 22 amp FY 2022

https://incometaxindia.gov.in/Pages/tools/tax-calculator.aspx?ID=442

Web Disclaimer The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances It is advised that for filing of returns the exact calculation may be made as per the provisions contained in the relevant Acts Rules etc

https://cleartax.in/s/income-tax-slabs

Web New Tax Regime FY 2022 23 AY 2023 24 New Tax Regime FY 2023 24 AY 2024 25 0 2 50 000 2 50 000 3 00 000 5 3 00 000 5 00 000 5 5 5 00 000 6 00 000 10 5 6 00 000 7 50 000 10 10 7 50 000 9 00 000 15 10 9 00 000 10 00 000 15 15 10 00 000 12 00 000

Web Sep 9 2023 nbsp 0183 32 Rate of Income tax Assessment Year 2024 25 Financial Year 2023 24 Assessment Year 2023 24 Financial Year 2022 23 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Resident Senior Citizen who is 60 years or more but less than 80 years at Web Dec 13 2023 nbsp 0183 32 Advance tax is the income tax amount a taxpayer pays in advance for a particular financial year Check Advance tax payment due date AY 2023 24

Web Nov 22 2023 nbsp 0183 32 INDEX What is Advance Tax Who is liable to Pay Advance Tax Tax on different Income Heads How to Calculate Advance Tax Advance Tax Due Dates FAQs What is Advance Tax As the name suggests Advance tax means payment of