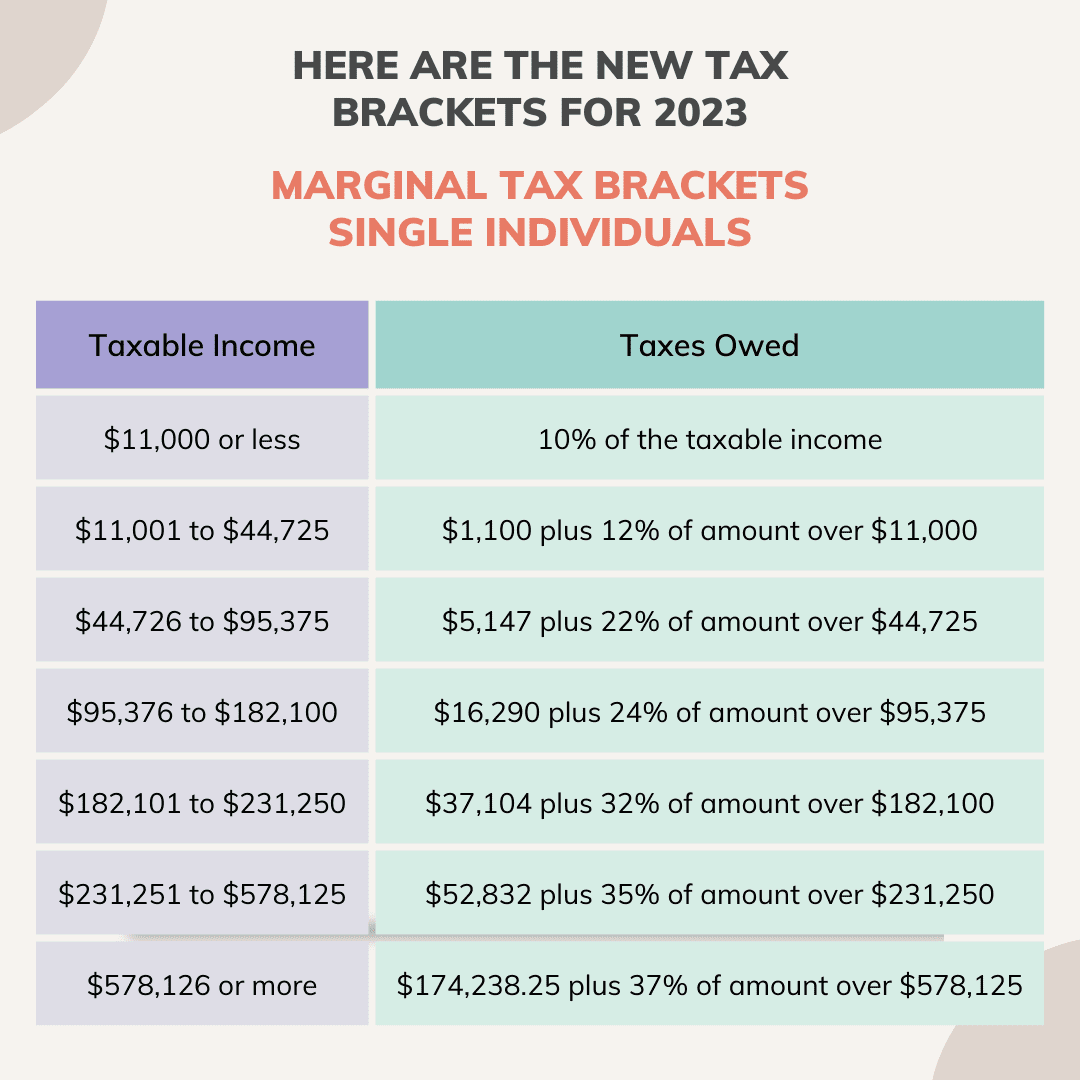

2023 Tax Rates Single Oct 21 2024 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2023 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

Jan 17 2023 nbsp 0183 32 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing jointly and 125 000 for married couples filing separately One common deduction taken by most taxpayers is the standard deduction which in 2023 is 13 850 for single filers and married filing separately 27 700 for married filing jointly and 20 800 for heads of household filers

2023 Tax Rates Single

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA16efiq.img

Dec 21 2023 nbsp 0183 32 Indexed brackets and other provisions to the Chained Consumer Price Index C CPI measure of inflation including the standard deduction which for 2023 filing in 2024 stands at 13 850 for single filers 20 800 for heads of household and 27 700 for joint filers and some surviving spouses

Templates are pre-designed documents or files that can be used for numerous functions. They can save time and effort by supplying a ready-made format and layout for producing various kinds of content. Templates can be used for individual or professional projects, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

2023 Tax Rates Single

10 2023 California Tax Brackets References 2023 BGH

2022 Tax Brackets Married Filing Jointly Irs Printable Form

IRS Tax Brackets For 2023 Taxed Right

2023 Tax Bracket 2023

2022 Tax Brackets KatherynYahya

Here Are The Federal Tax Brackets For 2023 Vs 2022 Narrative News

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Oct 16 2024 nbsp 0183 32 Here s how that works for a single person with taxable income of 58 000 per year Find the current tax rates for other filing statuses See the 2023 Find the 2024 See current federal tax brackets and rates based on your income and filing status

https://fi.icalculator.com/income-tax-rates/2023.html

The Income tax rates and personal allowances in Finland are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Finland Tax Calculator 2023

https://us.icalculator.com/terminology/us-tax-tables/2023.html

2023 US Tax Tables with 2025 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator Compare your take home after tax an

https://www.fidelity.com/learning-center/personal-finance/tax-brackets

Oct 25 2024 nbsp 0183 32 To figure out your tax bracket first look at the rates for the filing status you plan to use single married filing jointly married filing separately or head of household Next determine your taxable income

https://www.irs.gov/newsroom/irs-provides-tax...

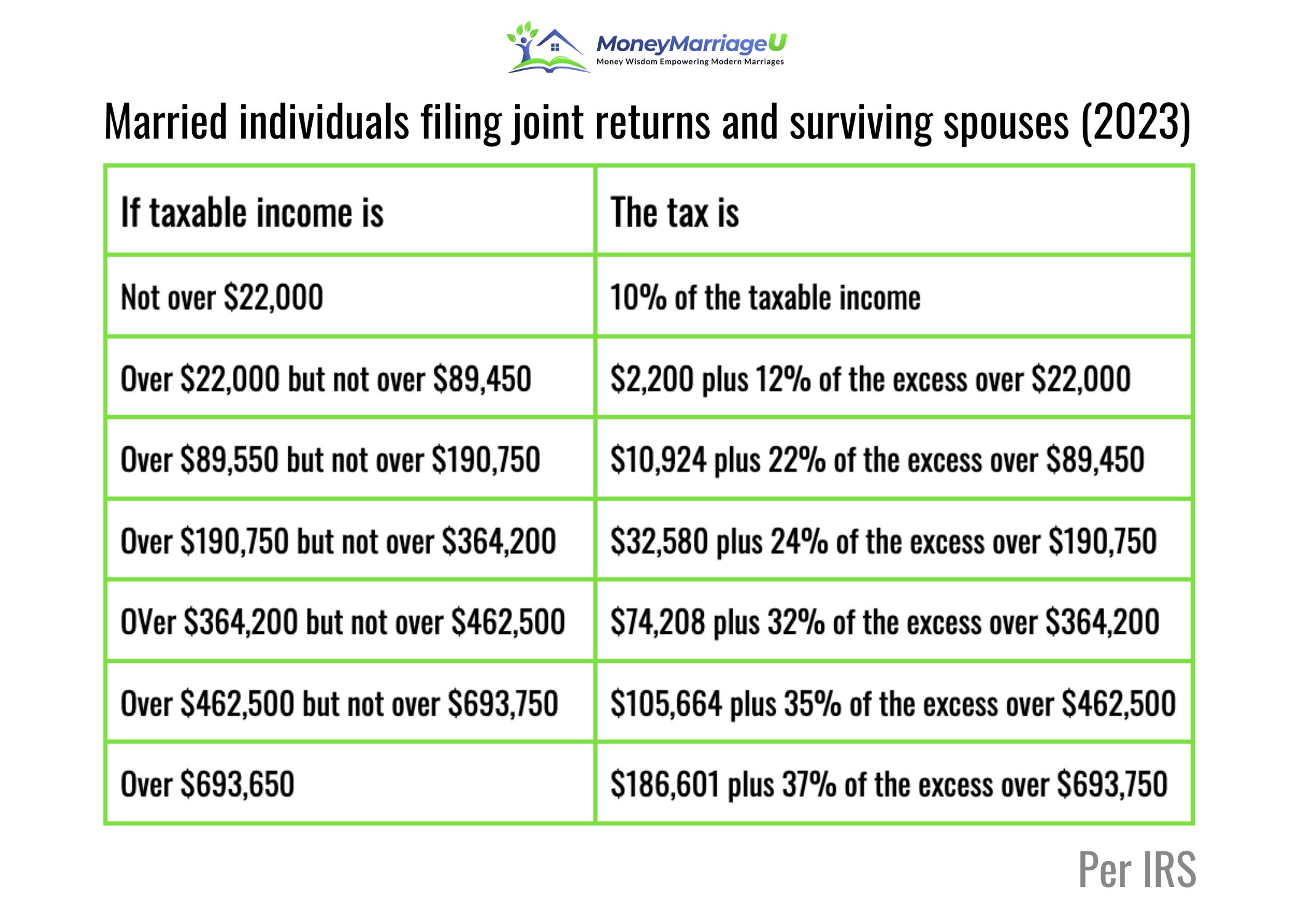

Oct 18 2022 nbsp 0183 32 Marginal Rates For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578 125 693 750 for married couples filing jointly 12 for incomes over 11 000 22 000 for married couples filing jointly

Here we outline the 2023 tax brackets and corresponding 2023 tax rates For each bracket the second number is the maximum for that tax rate and the first number in the next bracket is over the highest amount for the previous rate For instance the 10 rate for a single filer is up to and including 11 000 The 12 rate starts at 11 001 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539 900 for single filers and above 693 750 for married couples filing jointly

Mar 28 2024 nbsp 0183 32 Let s say you earned 75 000 in taxable income in 2023 and you re single For the first 11 000 of that income you ll pay the lowest 2023 tax rate 10 on that tier of income For the