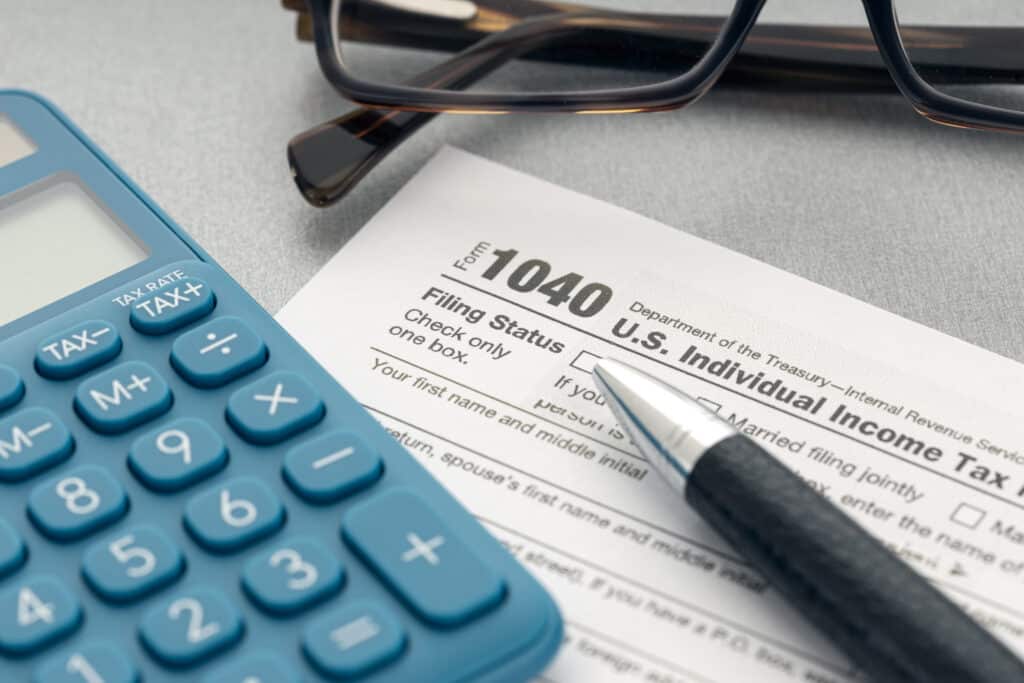

2022 Ohio Individual Income Tax Rates Nov 1 2022 nbsp 0183 32 The Ohio Department of Taxation Nov 1 published the 2022 individual income tax brackets and rates The tax brackets were adjusted per H B 110 Taxpayers with 26 050 or

Ohio has a graduated state individual income tax with rates ranging from 2 750 percent to 3 500 percent There are also jurisdictions that collect local income taxes Ohio does not have a corporate income tax but does levy a state gross The Ohio tax rate ranges from 0 to 4 797 depending on your taxable income Beginning with tax year 2019 Ohio income tax rates were adjusted so taxpayers making an income of 21 750 or less aren t subject to income tax

2022 Ohio Individual Income Tax Rates

2022 Ohio Individual Income Tax Rates

2022 Ohio Individual Income Tax Rates

https://ke.icalculator.com/img/og/KE/65.png

Ohio imposes an individual income tax on both residents and nonresidents calculated using their federal adjusted gross income with rates ranging from 2 765 to 3 99

Templates are pre-designed files or files that can be used for different purposes. They can save time and effort by supplying a ready-made format and layout for creating various sort of content. Templates can be utilized for personal or professional tasks, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

2022 Ohio Individual Income Tax Rates

20595k Salary After Tax Example JP Tax 2024

Tax Season Preparing For 2023 Income Tax Brackets SageSpring Wealth

What Are The Tax Brackets For 2022 In California Printable Form

R35k Salary After Tax Example ZA Tax 2023

33 7k Salary After Tax Example CA Tax 2023

2024 State Corporate Income Tax Rates Brackets EFILETAXONLINE COM

https://oh-us.icalculator.com › income-tax-r…

2022 Tax Calculator for Ohio The 2022 tax rates and thresholds for both the Ohio State Tax Tables and Federal Tax Tables are comprehensively integrated into the Ohio Tax Calculator for 2022 This tool is freely available and is designed to

https://tax.ohio.gov › individual › resources › ...

Below are the in statute Individual and School District Income tax instructional booklets by year 2024 2023 2022 2021 Prior Years

https://www.efile.com › ohio-tax-rates-forms-and-brackets

Jan 10 2025 nbsp 0183 32 Ohio Tax Brackets for Tax Year 2022 Ohio income is taxed at different rates within the given tax brackets below Any income over 115 300 would be taxes at the rate of 3 990

https://www.nerdwallet.com › article › taxe…

Jan 6 2025 nbsp 0183 32 Ohio state income tax brackets depend on taxable income and residency status The state has three tax rates 0 2 75 and 3 5 which apply to income earned in 2024 reported on tax

https://taxfoundation.org › data › all › state

Compare 2022 state income tax rates and brackets with a tax data report How high are income taxes in my state Which states don t have an income tax

Review the latest income tax rates thresholds and personal allowances in Ohio which are used to calculate salary after tax when factoring in social security contributions pension contributions Westerville Individual Income Tax forms are available below You can print the fill in form attach your income documents W 2 s 1099 s Federal Schedules Sch C Sch E or Sch F and any

Ohio s income tax brackets were last changed one year prior to 2022 for tax year 2021 and the tax rates were previously changed in 2020 The latest available tax rates are for 2024 and the