2022 Irs Tax Tables Tax Table below to figure your tax Example A married couple are filing a joint return Their taxable income on Form 1040 line 15 is 25 300 First they find the 25 300 25 350 taxable

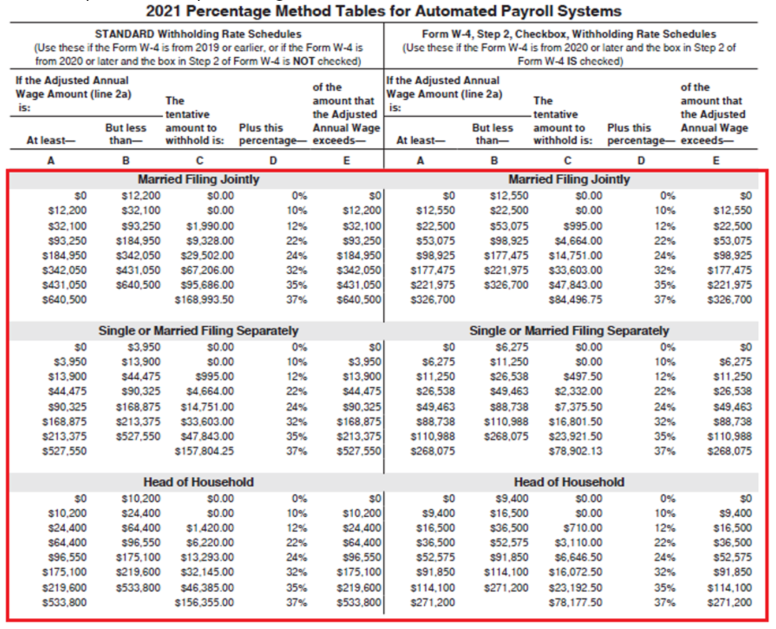

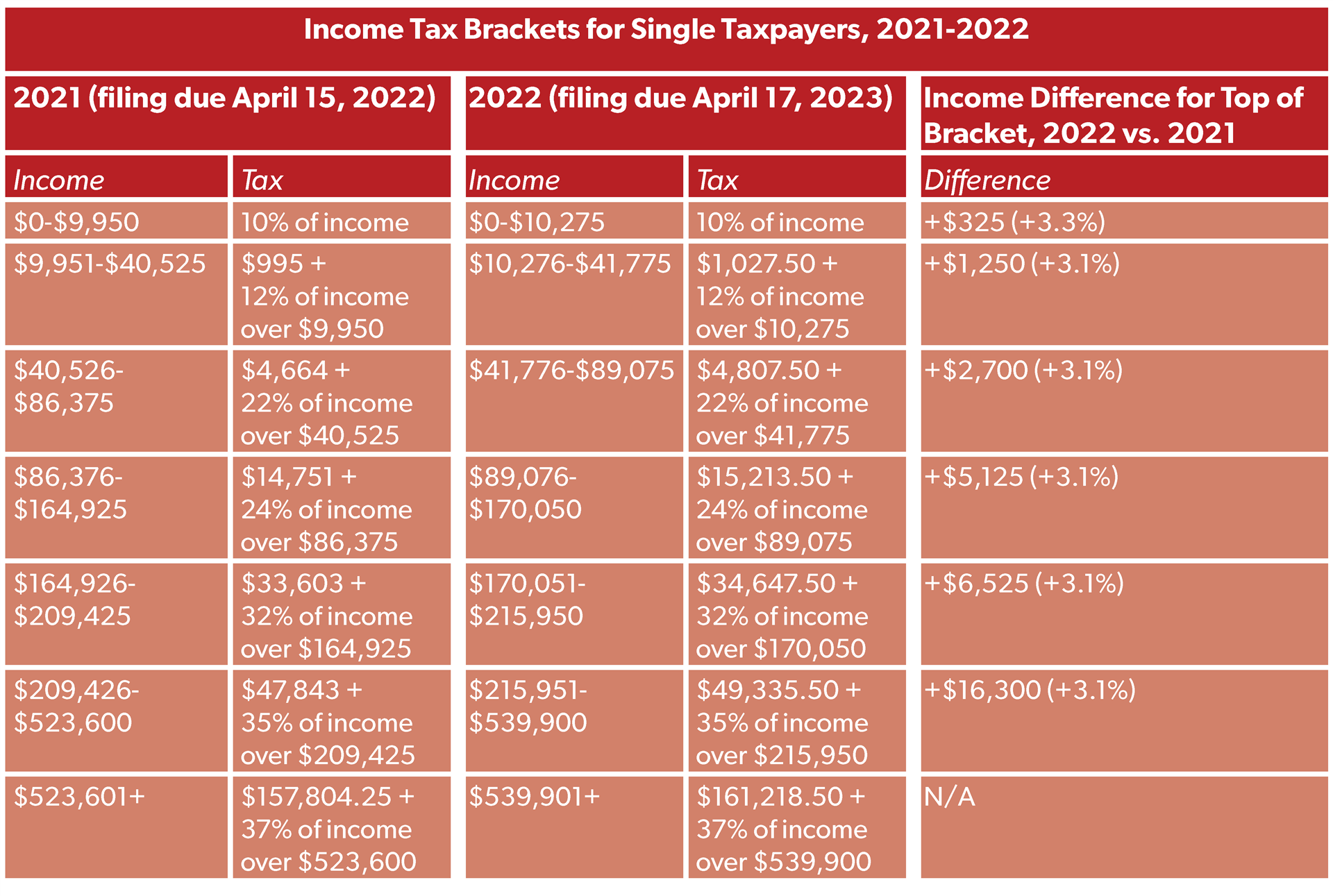

Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals Dec 2 2021 nbsp 0183 32 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This includes the tax rate tables many deduction limits and exemption amounts The following are the tax numbers impacting

2022 Irs Tax Tables

2022 Irs Tax Tables

2022 Irs Tax Tables

https://federal-withholding-tables.net/wp-content/uploads/2021/07/what-s-coming-2.png

2022 Tax Tables Individual Married Joint Head of Household Widower tax tables with annual deductions exemptions and tax credit amounts

Templates are pre-designed documents or files that can be utilized for different functions. They can save time and effort by providing a ready-made format and design for producing different kinds of content. Templates can be utilized for personal or professional projects, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

2022 Irs Tax Tables

Tax Tables 2018 Computerfasr

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

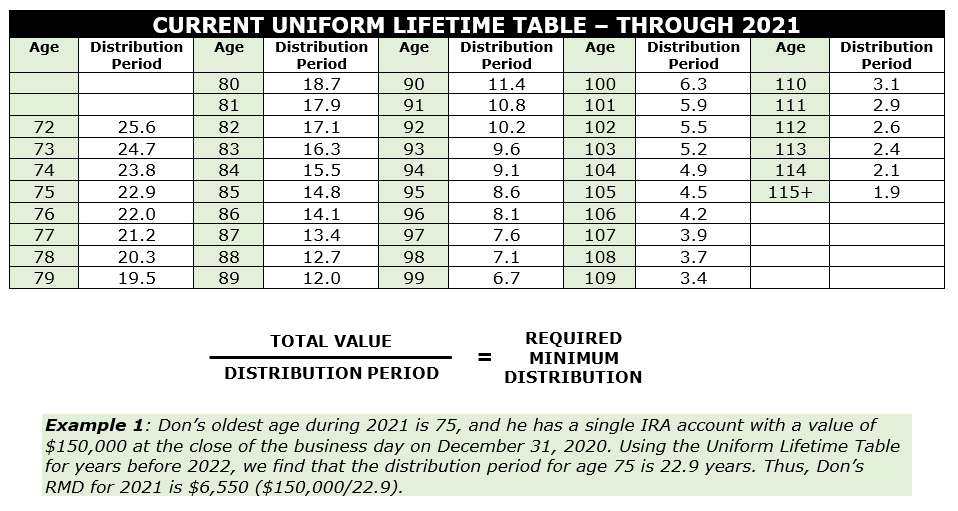

IRA Withdrawal Planning Can Save On Taxes The Wealth Guardians

96 Best Ideas For Coloring Printable Irs Form 1040 For 2022

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

New IRS Withholding Tax Tables Tax Table Budgeting Finances Wealth

https://www.irs.gov › filing › federal-inco…

Feb 13 2025 nbsp 0183 32 Find the current and future tax rates and brackets for different filing statuses The web page shows the 2024 tax rates for a single taxpayer and links to other filers rates and tables

https://www.morganstanley.com › content › dam › msdo…

Find the tax rate schedule standard deductions personal exemptions alternative minimum tax and more for 2022 Download the PDF document with tables and charts for different filing

https://www.morganstanley.com › content › dam › msdo…

Find the tax rate schedules brackets and rates for 2022 income tax returns See the tables for single married head of household and other filing statuses as well as long term capital gains

https://www.forbes.com › sites › ashleaebe…

Nov 10 2021 nbsp 0183 32 There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status 2022 Standard Deduction Amounts

https://www.irs.com › en

Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket Only the money you earn within a particular bracket is

Jan 23 2023 nbsp 0183 32 Tax tables are used to calculate the tax you owe based on your filing status and taxable income Tax tables are adjusted each year for inflation You can find the latest tax Mar 28 2024 nbsp 0183 32 IRS Tax Tables and Tax Rate Schedules and Forms Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your

The IRS has released the annual inflation adjustments for 2022 for the income tax rate tables plus more than 56 other tax provisions The IRS makes these cost of living adjustments