2022 Income Tax Table Married Filing Jointly Web Jan 18 2022 nbsp 0183 32 Married filing jointly and qualifying widow er s 25 900 N A Married filing separately 12 950 N A N A Dependent filing own tax return 1 150 N A N A

Web Nov 10 2021 nbsp 0183 32 The IRS also announced that the standard deduction for 2022 was increased to the following Married couples filing jointly 25 900 Single taxpayers and married Web Dec 2 2021 nbsp 0183 32 2022 Income Tax Brackets 2021 Income Tax Tables Married Filing Jointly amp Single Click on image to enlarge The most important updates for many Americans are the tax brackets the changes

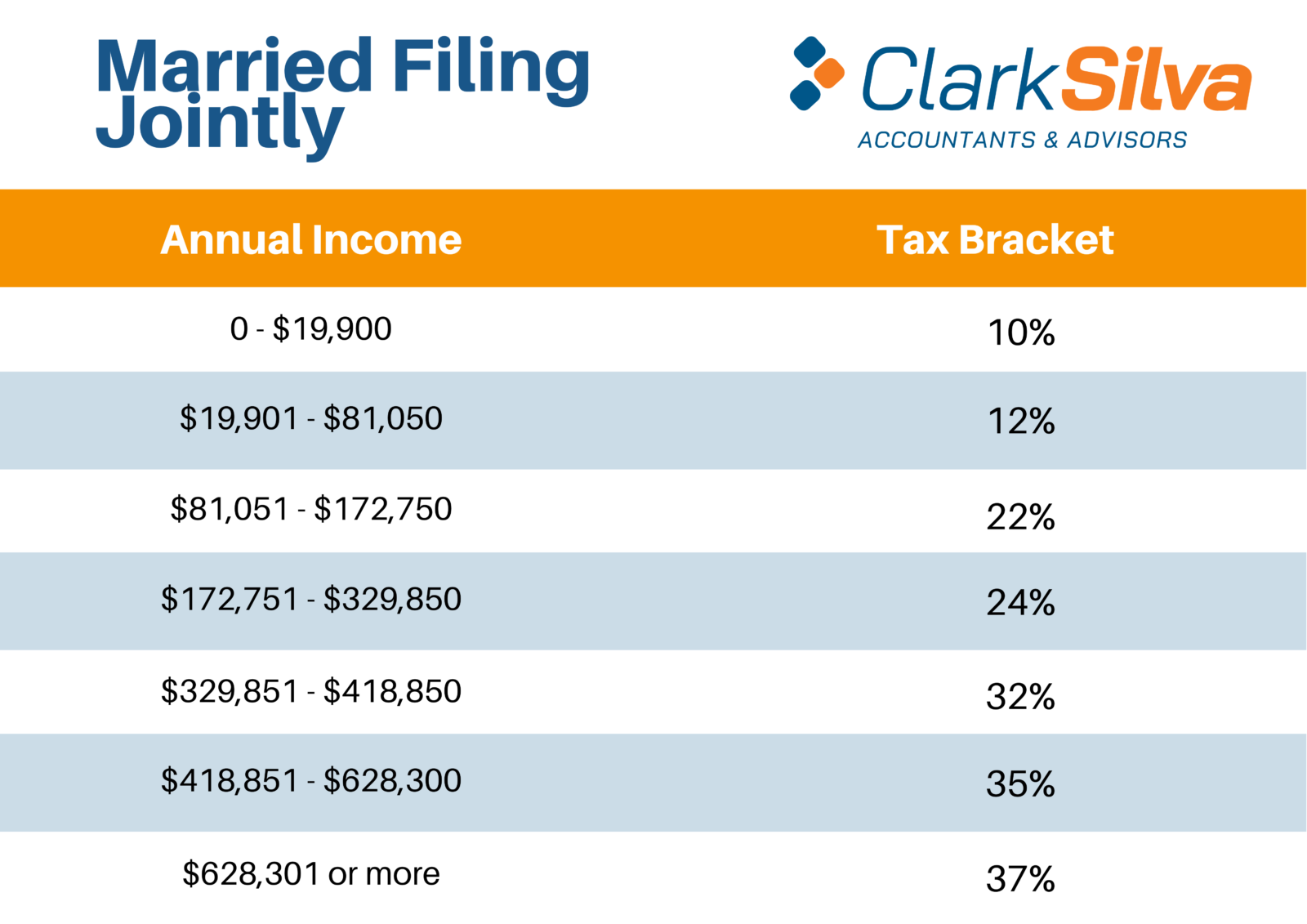

2022 Income Tax Table Married Filing Jointly

2022 Income Tax Table Married Filing Jointly

2022 Income Tax Table Married Filing Jointly

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

Web Jan 29 2024 nbsp 0183 32 The seven federal income tax brackets for 2023 and 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status

Templates are pre-designed files or files that can be used for numerous functions. They can save time and effort by offering a ready-made format and layout for developing different kinds of content. Templates can be used for individual or expert jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

2022 Income Tax Table Married Filing Jointly

2022 Tax Tables Married Filing Jointly Printable Form Templates And

IRS 2021 Tax Tables Deductions Exemptions Purposeful finance

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

2022 Tax Tables Married Filing Jointly Printable Form Templates And

Irs Tax Table 2022 Married Filing Jointly Latest News Update

2022 Tax Brackets Married Filing Jointly California Kitchen Cabinet

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households Tax Rate For Single Filers For

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web Jan 31 2024 nbsp 0183 32 Married filing jointly or qualifying surviving spouse Married filing separately Head of household See the tax rates for the 2024 tax year Taxable income Page Last

https://www.morganstanley.com/content/dam/msdotcom/...

Web Jan 18 2022 nbsp 0183 32 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing

https://www.irs.gov/pub/irs-pdf/i1040tt.pdf

Web Tax Table below to figure your tax At Least But Less Than SingleMarried ling jointly Married ling sepa rately Head of a house hold Your taxis 25 200 25 250 25 300 25 350

https://www.investopedia.com/irs-announce…

Web Nov 11 2021 nbsp 0183 32 The maximum Earned Income Tax Credit EITC in 2022 for single and married filing jointly filers is 560 if the filer has no children The maximum credit is 3 733 for one qualifying child 6 164

Web Feb 4 2024 nbsp 0183 32 Due to inflation these brackets were adjusted significantly from the 2022 tax brackets also included below Taxable Income Married Filing Jointly 10 Up to Web Aug 29 2023 nbsp 0183 32 Married Filing Jointly is a tax filing status available to couples who are legally married as of December 31st of the tax year When filing jointly both spouses

Web Oct 27 2023 nbsp 0183 32 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and