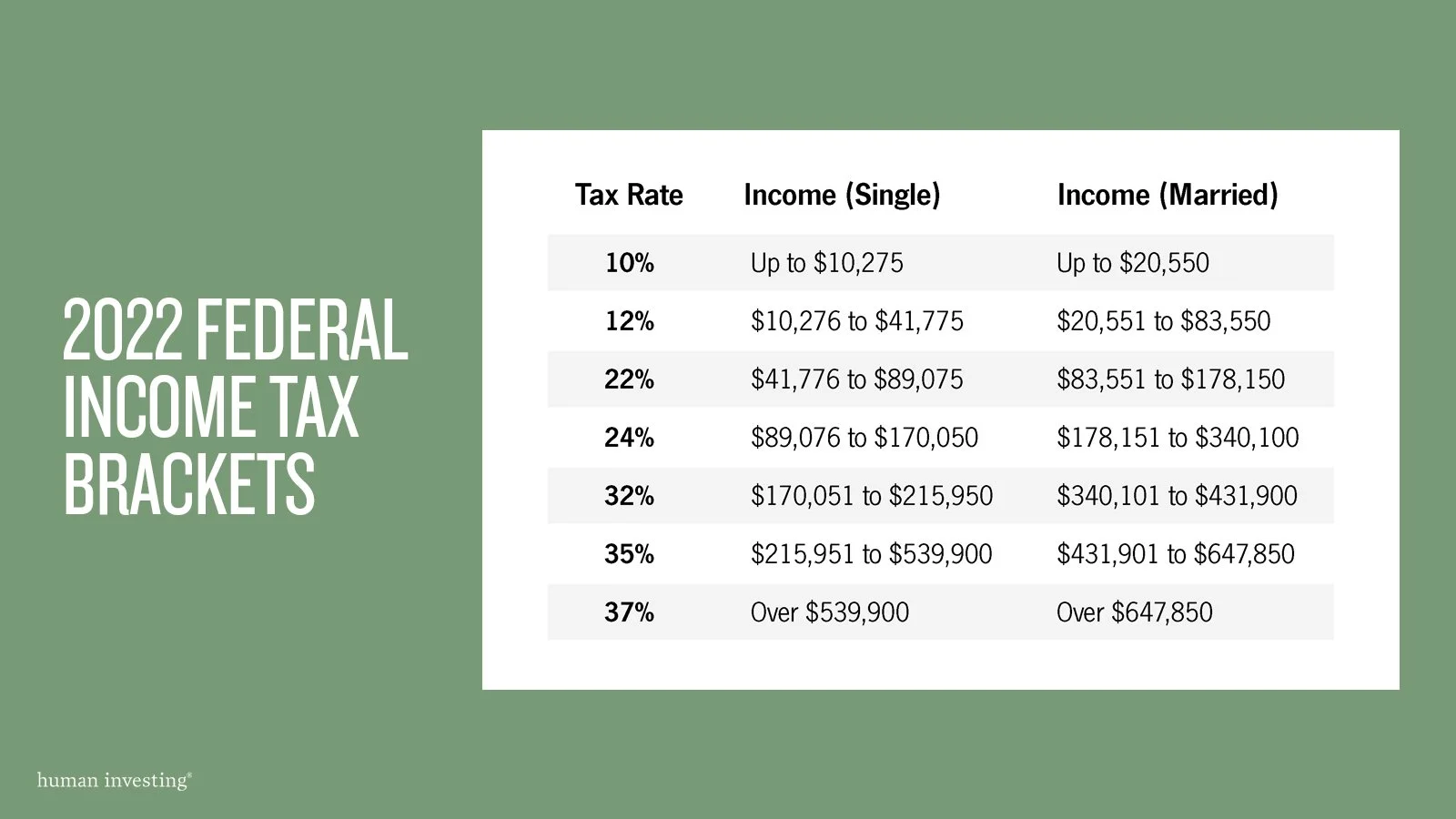

2022 Income Tax Rate Tables Web 4 days ago nbsp 0183 32 There are seven federal income tax rates and brackets in 2023 and 2024 10 12 22 24 32 35 and 37

Web 25 Income from P 156 000 01 and above Botswana Non residents Income Tax Tables in 2022 Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 5 Income from P 0 000 00 Web Sep 27 2022 Cat No 24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040 SR FreeFile is the fast safe and free way to prepare and e le your taxes See IRS gov FreeFile Pay Online It s fast simple and secure Go to IRS gov Payments

2022 Income Tax Rate Tables

2022 Income Tax Rate Tables

2022 Income Tax Rate Tables

https://i1.wp.com/www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-1024x719.png

Web Nov 10 2021 nbsp 0183 32 The tax year 2022 maximum Earned Income Tax Credit amount is 6 935 for qualifying taxpayers who have three or more qualifying children up from 6 728 for tax year 2021 The revenue procedure contains a table providing maximum EITC amount for other categories income thresholds and phase outs

Templates are pre-designed files or files that can be used for numerous purposes. They can save effort and time by providing a ready-made format and layout for producing different kinds of material. Templates can be utilized for personal or expert jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

2022 Income Tax Rate Tables

2022 Tax Brackets Irs Married Filing Jointly Unblocked 2022

Federal Income Tax Brackets 2021 Vs 2022 Orangerilo

2022 Tax Brackets Irs Married Filing Jointly Unblocked 2022

2022 Tax Brackets JeanXyzander

Federal Income Tax Withholding 2022 Latest News Update

T11 0091 Baseline Tables Distribution Of Income And Taxes Baseline

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg?w=186)

https://www.hasil.gov.my/.../tax-rate

Web Category Chargeable Income Calculations RM Rate Tax RM A 0 5 000 On the First 5 000 0 0 B 5 001 20 000 On the First 5 000 Next 15 000 1 0 150 C

https://www.morganstanley.com/content/dam/msdotcom/...

Web Jan 18 2022 nbsp 0183 32 Tax Tables 2022 Edition 2022 Tax Rate Schedule Standard Deductions amp Personal Exemption HEAD OF HOUSEHOLD For taxable years beginning in 2022 the standard deduction amount under 167 63 c 5 for an individual Kiddie Tax all net unearned income over a threshold amount of 2 300 for 2022 is taxed using the brackets and

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 The Internal Revenue Service has announced annual inflation adjustments for tax year 2022 meaning new tax rate schedules and tax tables and cost of living adjustments for various tax

https://www.sars.gov.za/tax-rates/income-tax/rates-of-tax-for-individuals

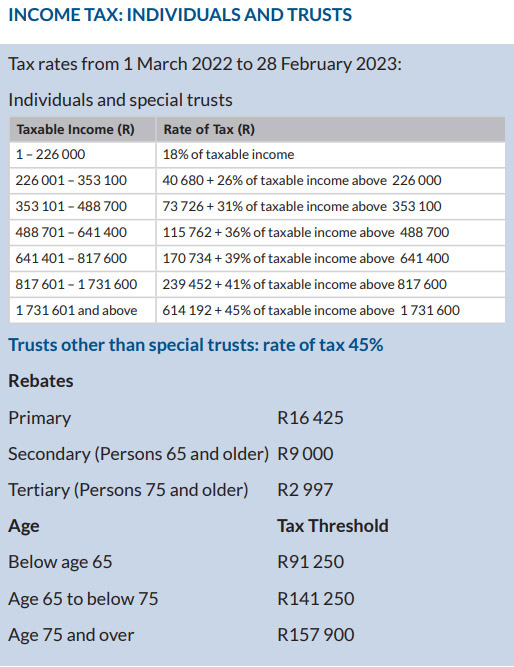

Web 3 days ago nbsp 0183 32 Taxable income R Rates of tax R 1 226 000 18 of taxable income 226 001 353 100 40 680 26 of taxable income above 226 000 353 101 488 700 73 726 31 of taxable income above 353 100 488 701 641 400 115 762 36 of taxable income above 488 700 641 401 817 600 170 734 39 of taxable income above 641

Web Sep 17 2023 nbsp 0183 32 Income Tax Rates under TRAIN from 2018 2022 The first part of the approved TRAIN tax reform law implemented from 2018 until 2022 adopted major changes from the then existing Philippine taxation system as follows i Those earning an annual salary of P250 000 or below will no longer pay income tax zero income tax Web Sep 28 2023 nbsp 0183 32 Australian residents tax rates 2022 23 The above rates do not include the Medicare levy of 2 Australian residents tax rates 2021 22 The above rates don t include the Medicare levy of 2 Australian residents tax rates 2020 21 Australian residents tax rates 2019 20 Australian residents tax rates 2010 to 2019

Web Nov 11 2021 nbsp 0183 32 Standard deductions and about 60 other provisions have been adjusted for inflation to avoid bracket creep The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021