2022 Income Tax Rate Schedule WEB Nov 11 2021 nbsp 0183 32 The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021 for taxpayers with three or more qualifying children Basic exclusion for

WEB IR 2021 219 November 10 2021 WASHINGTON The Internal Revenue Service today announced the tax year 2022 annual inflation adjustments for more than 60 tax WEB Jan 18 2022 nbsp 0183 32 2022 Tax Rate ScheduleTax Rates on Long Term Capital Gains and Qualified Dividends 2022 Edition TAXABLE INCOME BASE AMOUNT OF TAX

2022 Income Tax Rate Schedule

2022 Income Tax Rate Schedule

2022 Income Tax Rate Schedule

https://i2.wp.com/www.bsbllc.com/wp-content/uploads/2020/11/BSB-2020-Federal-Income-Tax-Rate-Brackets-1024x617.png

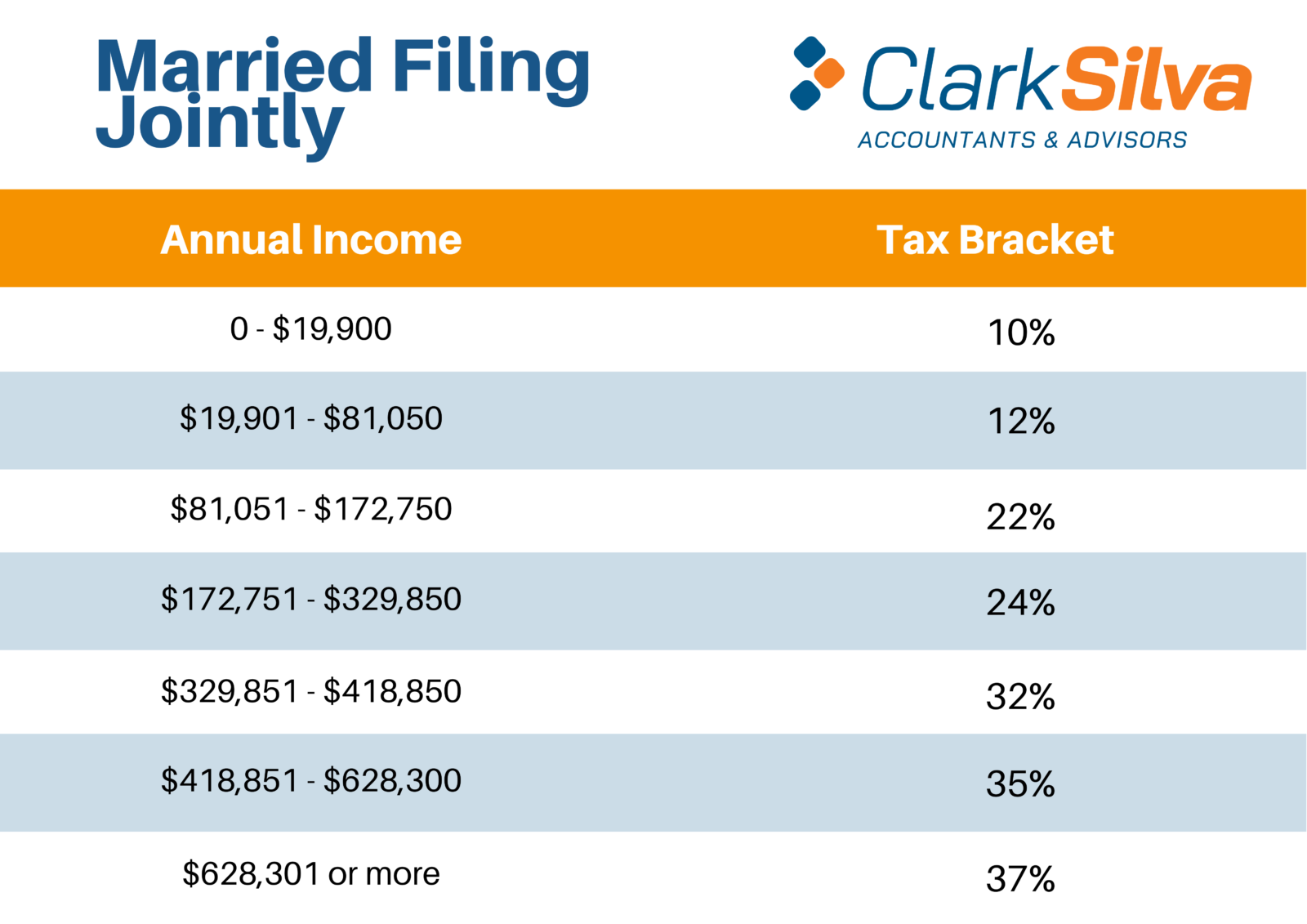

WEB Nov 10 2021 nbsp 0183 32 There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status Single tax rates 2022 AVE Joint tax rates

Templates are pre-designed documents or files that can be utilized for different functions. They can conserve effort and time by providing a ready-made format and layout for developing various sort of material. Templates can be utilized for individual or expert projects, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

2022 Income Tax Rate Schedule

2022 Tax Brackets PersiaKiylah

2022 Tax Brackets JeanXyzander

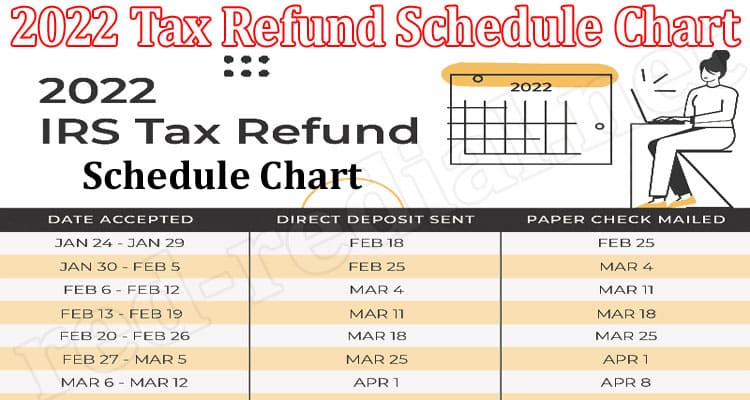

2022 Tax Refund Schedule Chart Mar A Precise Info

California Individual Tax Rate Table 2021 2022 Brokeasshome

2022 Tax Brackets Irs Married Filing Jointly Unblocked 2022

2022 Federal Tax Brackets And Standard Deduction Printable Form

https://www.irs.com/en/2022-federal-income-tax...

WEB Feb 21 2022 nbsp 0183 32 Different tax brackets or ranges of income are taxed at different rates These are broken down into seven 7 taxable income groups based on your federal

https://www.morganstanley.com/content/dam/msdotcom/...

WEB 2022 Tax Rate Schedule Standard Deductions amp Personal Exemption HEAD OF HOUSEHOLD For taxable years beginning in 2022 the standard deduction amount

https://www.irs.gov/pub/irs-prior/i1040gi--2022.pdf

WEB 2022 Tax Table General Information Refund Information Instructions for Schedule 1 Instructions for Schedule 2 Instructions for Schedule 3 Tax Topics Disclosure Privacy

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB Mar 18 2024 nbsp 0183 32 Page Last Reviewed or Updated 18 Mar 2024 See current federal tax brackets and rates based on your income and filing status

https://www.cnbc.com/2021/11/10/2022-income-tax...

WEB Nov 10 2021 nbsp 0183 32 Twenty 20 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the

WEB 3 days ago nbsp 0183 32 In 2023 and 2024 there are seven federal income tax rates and brackets 10 12 22 24 32 35 and 37 Taxable income and filing status determine WEB Jan 12 2024 nbsp 0183 32 Tax rate schedules can help you estimate the amount of tax that you will owe when you prepare your taxes There are different tax rate schedules based on your

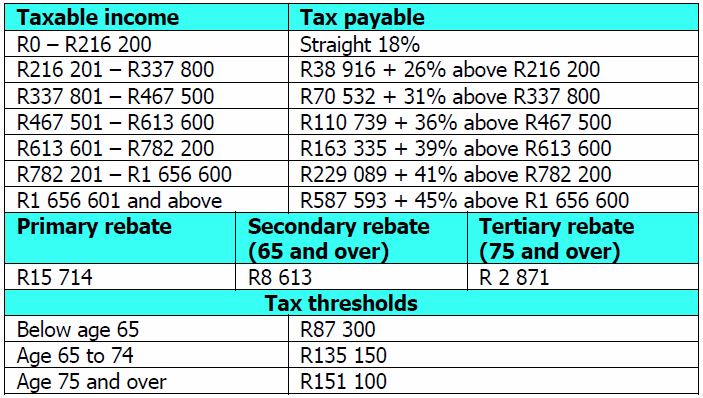

WEB 2022 California Tax Rate Schedules 0 10 099 0 00 1 00 0 10 099 23 942 100 99 2 00 10 099 23 942 37 788 377 85 4 00 23 942 37 788 52 455