2022 Federal Tax Tables Married Filing Jointly WEB Federal Married Filing Jointly Tax Brackets TY 2023 2024 What is the Married Filing Jointly Income Tax Filing Type Married Filing Jointly is the filing type used by taxpayers who are legally married including common law marriage and file a combined joint income tax return rather than two individual income tax returns

WEB filers or head of households 250 000 for married couples filing jointly and 125 000 for married couples filing separately TAXABLE INCOME SINGLE FILERS MARRIED FILING JOINTLY HEAD OF HOUSEHOLD MARRIED FILING SEPARATELY 0 0 41 675 83 350 55 800 15 41 676 459 750 83 351 517 200 55 801 WEB Nov 10 2021 nbsp 0183 32 The standard deduction amounts will increase to 12 950 for individuals and married couples filing separately 19 400 for heads of household and 25 900 for married couples filing jointly

2022 Federal Tax Tables Married Filing Jointly

2022 Federal Tax Tables Married Filing Jointly

2022 Federal Tax Tables Married Filing Jointly

https://www.ntu.org/Library/imglib/2021/11/2021-22-married-tax-brackets-2-.png

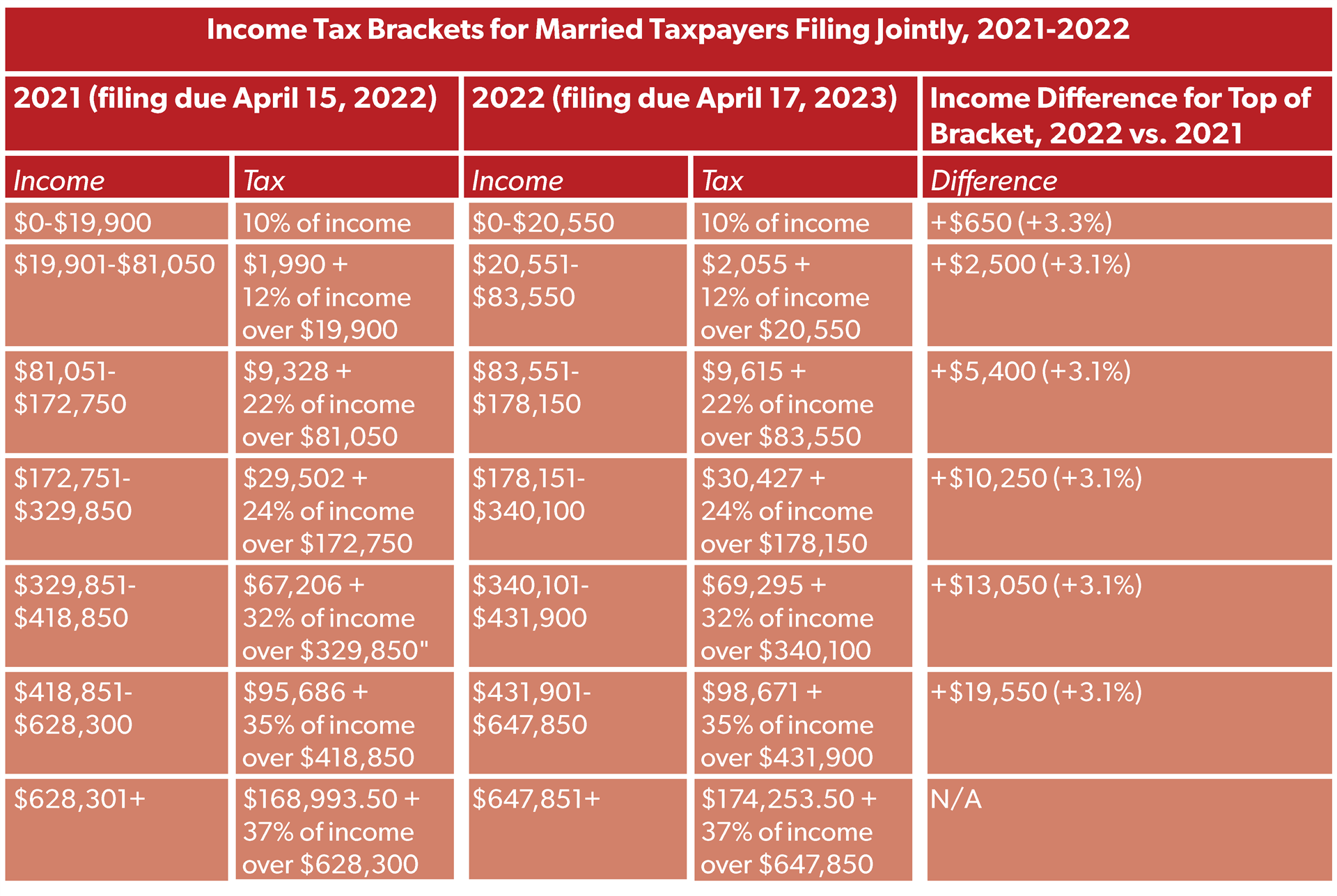

WEB Nov 13 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2022 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your

Pre-crafted templates offer a time-saving option for creating a diverse variety of documents and files. These pre-designed formats and layouts can be made use of for numerous personal and expert projects, including resumes, invitations, flyers, newsletters, reports, presentations, and more, simplifying the content creation process.

2022 Federal Tax Tables Married Filing Jointly

What Are The Tax Brackets For 2022 Married Filing Jointly Printable

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2022 Tax Tables Married Filing Jointly Printable Form Templates And

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

2022 Tax Tables Married Filing Jointly Printable Form Templates And

Irs Tax Table 2022 Married Filing Jointly Latest News Update

2022 Tax Brackets Married Filing Jointly Myrtle Parsons Viral

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB Mar 18 2024 nbsp 0183 32 Married filing jointly or qualifying surviving spouse Married filing separately Head of household See the Related Page Last Reviewed or Updated 18 Mar 2024 See current federal tax brackets and rates based on

https://taxfoundation.org/data/all/federal/2022-tax-brackets

WEB Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households Tax Rate For Single Filers For Married Individuals Filing Joint Returns For Heads of Households 10 0 to 10 275 0 to 20 550 0 to 14 650 12 10 275 to 41 775 20 550 to 83 550 14 650 to

https://www.morganstanley.com/content/dam/msdotcom/...

WEB Married Filing Jointly and covered by a plan at work 109 000 or Less Fully Deductible 109 001 128 999 Partially Deductible 129 000 or More Not Deductible Married Filing Jointly not covered by a plan at work and spouse is covered by a plan at work 204 000 or Less Fully Deductible 204 001 213 999 Partially Deductible

https://www.irs.com/en/2022-federal-income-tax...

WEB Feb 21 2022 nbsp 0183 32 Married Filing Jointly or Qualifying Widow er 25 900 Married Filing Separately 12 950 Head of Household 19 400

https://www.irs.gov/instructions/i1040tt

WEB A married couple are filing a joint return Their taxable income on Form 1040 line 15 is 25 300 First they find the 25 300 25 350 taxable income line Next they find the column for married filing jointly and read down the column

WEB Jan 12 2024 nbsp 0183 32 Head of Household What Are the Tax Brackets for 2022 for filing in 2023 Single Married Filing Jointly or Qualifying Widow Widower Married Filing Separately Head of Household TurboTax Tip There are different tax rate schedules for long term capital gains than for other income WEB Your filing status is married filing jointly or qualifying surviving spouse and your modified AGI is at least 218 000 You can t make a Roth IRA contribution if your modified AGI is 228 000 or more

WEB Tax Rate Single filers Married filing jointly or qualifying surviving spouse Married filing separately Head of household 10 0 to 10 275 0 to 20 550 0 to 10 275 0 to 14 650 12 10 276 to 41 775 20 551 to 83 550 10 276 to 41 775 14 651 to 55 900 22 41 776 to 89 075 83 551 to 178 150 41 776 to 89 075 55 901