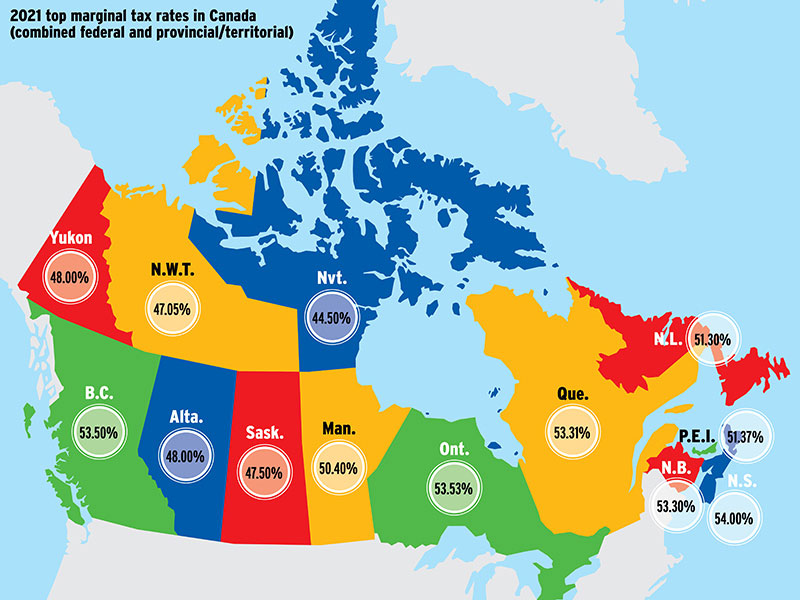

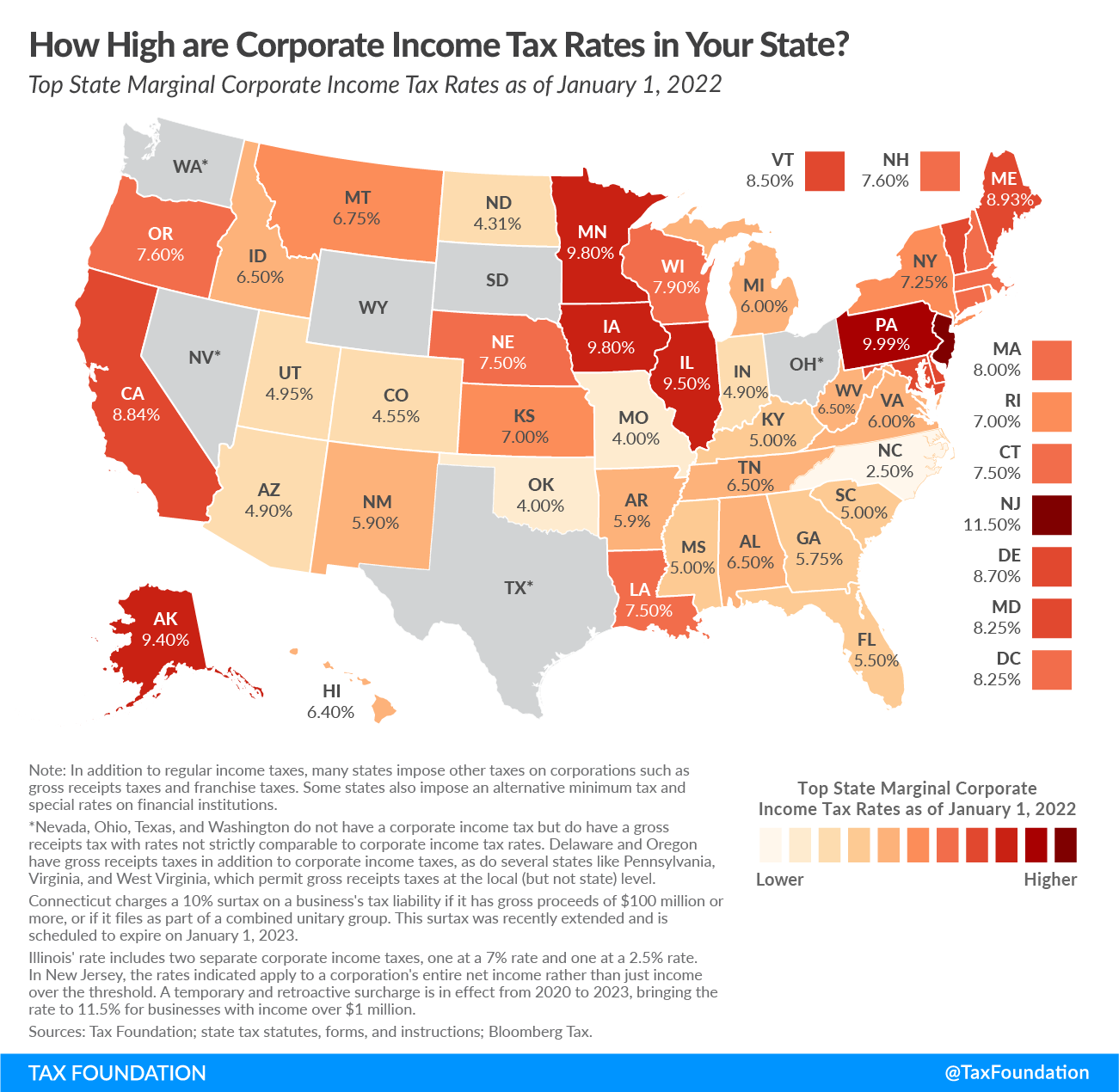

2022 Corporate Tax Rate Canada The percentages shown in the table below reflect the combined federal and provincial territorial corporate rates general as well as manufacturing and processing M amp P for a 12 month

Sep 30 2022 nbsp 0183 32 The rates shown are nominal tax rates as at April 16 2024 Add federal and provincial territorial rates to get a combined rate Rate and amount changes are set out in the notes and should be prorated for taxation years that Summary of corporation tax rates provincial and territorial corporation tax and tax credits Get federal provincial or territorial rates and learn when to apply the lower or higher rate What s

2022 Corporate Tax Rate Canada

2022 Corporate Tax Rate Canada

2022 Corporate Tax Rate Canada

https://www.investmentexecutive.com/wp-content/uploads/sites/3/2021/11/map-2021-top-marginal-tax-rates-in-Canada.jpg

Dec 5 2024 nbsp 0183 32 The corporate statistical tables provide key tax and accounting information as of June 30 2024 for all T2 returns that were assessed or reassessed for corporations with tax

Pre-crafted templates provide a time-saving option for creating a varied range of files and files. These pre-designed formats and layouts can be utilized for various personal and expert projects, including resumes, invites, flyers, newsletters, reports, presentations, and more, enhancing the content creation procedure.

2022 Corporate Tax Rate Canada

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-11]

[img_title-12]

https://www.taxtips.ca › smallbusiness › corporatetax

The following table shows the general and small business corporate income tax rates federally and for each province and territory for 2022 The small business rates are the applicable rates

https://kpmg.com › ca › en › home › service…

Dec 31 2024 nbsp 0183 32 Get the latest rates from KPMG s corporate tax tables

https://taxsummaries.pwc.com › canada › corporate › ...

Dec 10 2024 nbsp 0183 32 For the 2022 taxation year a one time 15 tax based on the average of the corporation s taxable income for taxation years ending in 2020 and 2021 A CAD 1 billion

https://rsmcanada.com › content › dam › rsm › insights › ...

In Canada both the federal government and the provincial territorial governments levy corporate income taxes The tables below summarizes the federal and provincial territorial tax rates

https://tradingeconomics.com › canada › co…

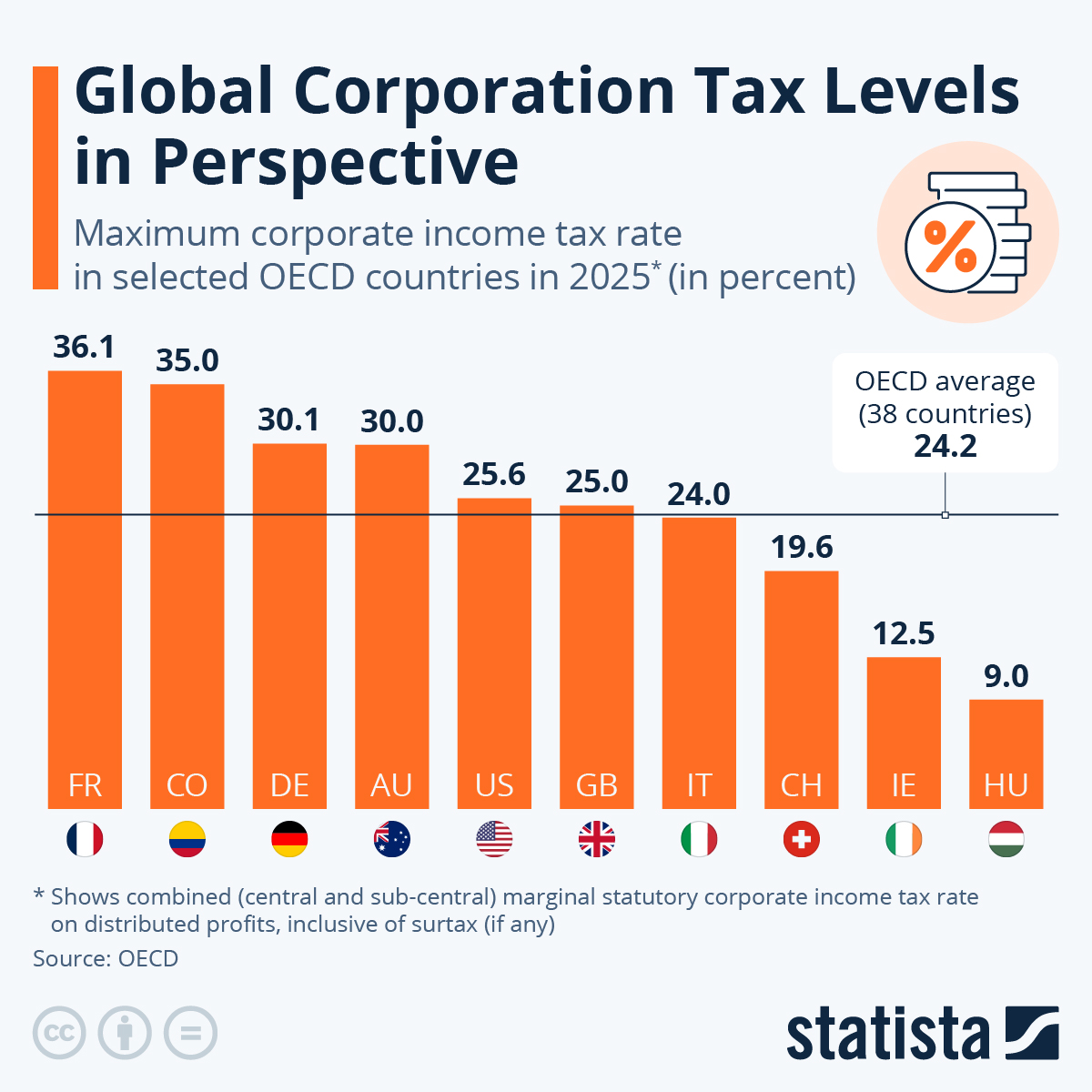

The Corporate Tax Rate in Canada stands at 26 50 percent This page provides Canada Corporate Tax Rate actual values historical data forecast chart statistics economic calendar and news

This article lists the federal and provincial corporate tax rates in Canada in 2022 for Canadian Controlled Private Corporations It also explains how corporate taxes work for CCPCs Stay on top of your company tax filing obligations and payments for the 2022 tax year Calculate your Federal Provincial and Total Corporate Taxes and see your Marginal and Effective

The following tables show the general and small business corporate income tax rates federally and for each province and territory as well as the small business limits 2024 Corporate