2022 Combined Federal And Ontario Corporate Income Tax Rates This article lists the federal and provincial corporate tax rates in Canada in 2022 for Canadian Controlled Private Corporations It also explains how corporate taxes work for CCPCs

Jul 1 2010 nbsp 0183 32 Generally corporations carrying on business through a permanent establishment in Ontario are subject to both federal and Ontario corporate income taxes The tax rates apply to Jun 9 2021 nbsp 0183 32 Please refer to our tables below for federal provincial and territorial tax rates in effect for individuals and corporations as well as annual contributions to deferred income plans

2022 Combined Federal And Ontario Corporate Income Tax Rates

2022 Combined Federal And Ontario Corporate Income Tax Rates

2022 Combined Federal And Ontario Corporate Income Tax Rates

https://files.taxfoundation.org/20210303101855/2021-combined-federal-and-state-corporate-income-tax-rates.-Do-corporataions-pay-state-and-federal-taxes.png

Corporate Income Tax Rates Combined Federal and Provincial Small Business Rate Based on Calendar Year End

Pre-crafted templates provide a time-saving option for creating a diverse variety of documents and files. These pre-designed formats and designs can be made use of for different personal and expert projects, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, streamlining the material creation procedure.

2022 Combined Federal And Ontario Corporate Income Tax Rates

Tax Brackets Canada 2022 Blog Avalon Accounting

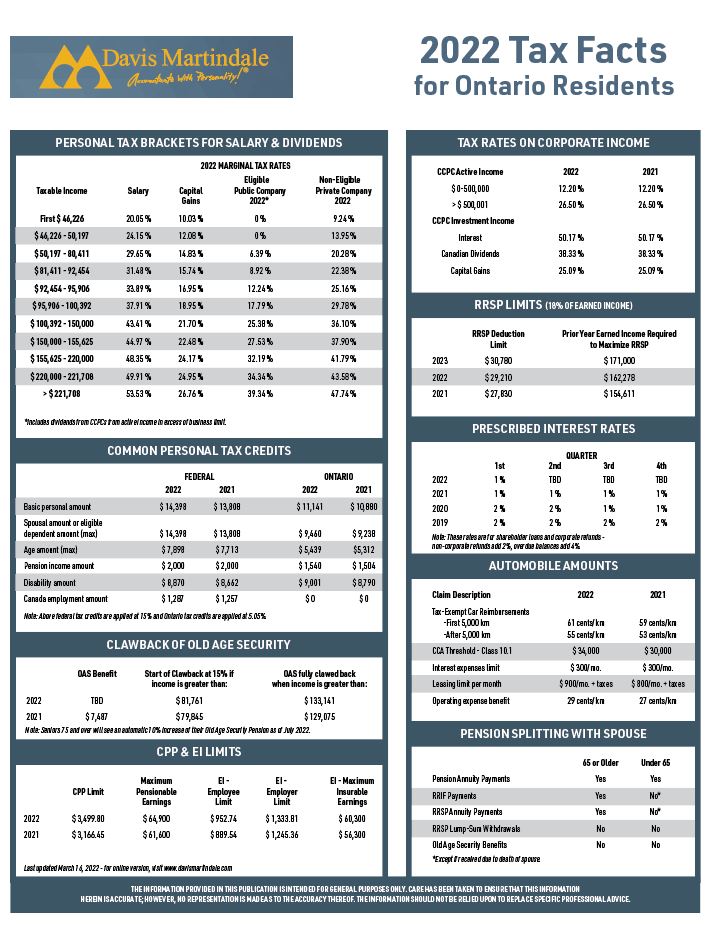

2022 Tax Facts For Ontario Residents Davis Martindale

Corporate Income Tax Rates 2019 Alyokhin CPA

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Taxes Payable By Individuals At Various Income Levels Ontario 2019

Chapter 5 Section A

https://kpmg.com › ca › en › home › services › tax › tax-facts › ...

Mar 31 2025 nbsp 0183 32 Federal and Provincial Territorial Tax Rates for Income Earned by a General Corporation 2025 and 2026 Current as of March 31 2025

https://www.canada.ca › en › revenue-agency › services...

Federal rates The basic rate of Part I tax is 38 of your taxable income 28 after federal tax abatement After the general tax reduction the net tax rate is 15 For Canadian controlled

https://hsacpa.ca › wp-content › uploads

The percentages shown in the table below reflect the combined federal and provincial territorial corporate rates general as well as manufacturing and processing M amp P for a 12 month

https://taxsummaries.pwc.com › canada › corporate › ...

Dec 10 2024 nbsp 0183 32 For small CCPCs the net federal tax rate is levied on active business income above CAD 500 000 a federal rate of 9 applies to the first CAD 500 000 of active business

https://rsmcanada.com › content › dam › rsm › insights › ...

In Canada both the federal government and the provincial territorial governments levy corporate income taxes The tables below summarizes the federal and provincial territorial tax rates

As of January 15 2022 Ontario and New Brunswick are the only provinces that have enacted legislation confirming that they will not parallel the federal SBD reduction with respect to Nov 27 2022 nbsp 0183 32 Ontario Ontario s corporate income tax rate is 11 5 which is reduced to 3 2 on the first 500 000 for small businesses that qualify for the Ontario small business deduction

Calculate your Federal Provincial and Total Corporate Taxes and see your Marginal and Effective Corporate Tax Rates Please note that these figures are estimates based on the