2022 California Tax Rate Tables 12 950 12 950 25 900 19 400 Blind or over 65 add 1 400 if married 1 750 if unmarried and not a surviving spouse qualified to use joint tax rates

2022 California Tax Table To Find Your Tax Read down the column labeled If Your Taxable Income Is to find the range that includes your taxable income from Form 540 line 19 Federal tax deduction Annual wage limit 145 600 Rate 1 1 Maximum Tax 1 601 60

2022 California Tax Rate Tables

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png) 2022 California Tax Rate Tables

2022 California Tax Rate Tables

https://www.thebalancemoney.com/thmb/ZkCvYf5Rle7jVPSpxSKeKFEfflo=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png

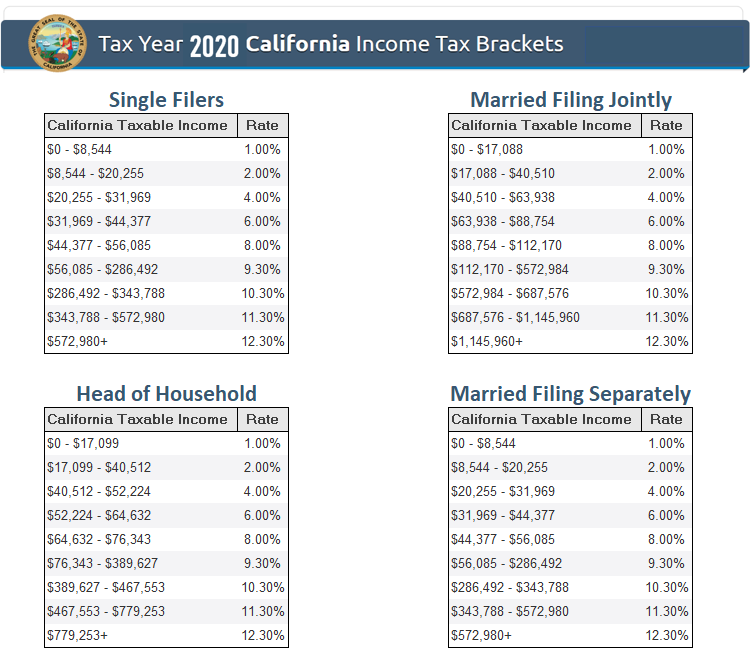

Review the latest income tax rates thresholds and personal allowances in California which are used to calculate salary after tax when factoring in social security contributions pension

Pre-crafted templates use a time-saving option for creating a diverse range of documents and files. These pre-designed formats and designs can be made use of for various individual and professional tasks, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, simplifying the material development procedure.

2022 California Tax Rate Tables

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Here Are The Federal Tax Brackets For 2023 Vs 2022

Tax Brackets 2024 2025 Single Lenee Shoshana

Income Tax Rates Australia 2022 TAX

California Individual Tax Rates Tables 2021 22 Brokeasshome

Tax Return 2022 Direct Deposit Dates Latest News Update

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png?w=186)

https://ca-us.icalculator.com › income-tax-r…

The Income tax rates and personal allowances in California are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the

https://www.paycheckcity.com › ...

Consult a tax advisor CPA or lawyer for guidance on your specific situation Your free and reliable 2022 California payroll and historical tax resource

https://sweeneymichel.com › blog

May 17 2022 nbsp 0183 32 Below is a quick reference table for California and Federal Income Taxes Note the list of things not included such as deductions credits deferred income and specialty dividends capital gains or other income You can find a

https://www.halfpricesoft.com

Check the 2022 California state tax rate and the rules to calculate state income tax 5 Calculate your state income tax step by step

https://edd.ca.gov › siteassets › files › pdf_pub_ctr

METHOD A provides a quick and easy way to select the appropriate withholding amount based on the payroll period filing status and number of withholding allowances regular and

Find prior year tax rate schedules using the Forms and Publications Search Calculate your tax using our calculator or look it up in a table of rates This table gives you credit of 10 404 for your standard deduction 280 for your personal exemption credit and 433 for each dependent exemption you are entitled to claim

2022 Federal Tax Rate Schedules If taxable income is Over But not over 0 10 275