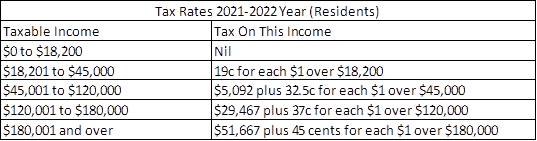

2022 Australian Tax Rates WEB The tax rates for 2022 23 and 2023 24 excluding the 2 Medicare levy are as follows 2022 23 and 2023 24 income year Non residents foreign residents Taxpayers who are not Australian residents are taxed at different rates The current rates for non residents for 2022 23 and 2023 24 are 2022 23 and 2023 24 income year Working Holiday Makers

WEB Jul 1 2018 nbsp 0183 32 The legislation is here There were further amendments in 2019 Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1 July 2022 to 30 June 2024 which include an expansion of the 19 rate initially to 41 000 and lifting the 32 5 band ceiling to 120 000 WEB 1 minutes On this page Helps you work out how much Australian income tax you should be paying what your take home salary will be when tax and the Medicare levy are removed your marginal tax rate This calculator can also be

2022 Australian Tax Rates

2022 Australian Tax Rates

2022 Australian Tax Rates

https://www.downundercentre.com/wp-content/uploads/2022/02/Tax-Rates-2021-2022.png

WEB Mar 6 2024 nbsp 0183 32 Under the new tax rate schedule the 19 marginal tax rate will be reduced to 16 and apply to taxable income between AUD 18 200 and AUD 45 000 a 30 marginal tax rate will apply to taxable income between AUD 45 000 and AUD 135 000 a 37 marginal tax rate then will apply up to AUD 190 000 after which the top marginal tax rate

Pre-crafted templates offer a time-saving option for producing a varied variety of documents and files. These pre-designed formats and designs can be made use of for various individual and professional jobs, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, improving the material creation process.

2022 Australian Tax Rates

Tax Brackets Australia Beyondearheadphonescenter

Comparing Tax Rates In Australia And The US Accounting Taxes And

2021 Tax Changes Kesilall

SMSF Audit Requirements 2022 Atotaxrates info Atotaxrates info

2021 Tax Brackets Au NEWREAY

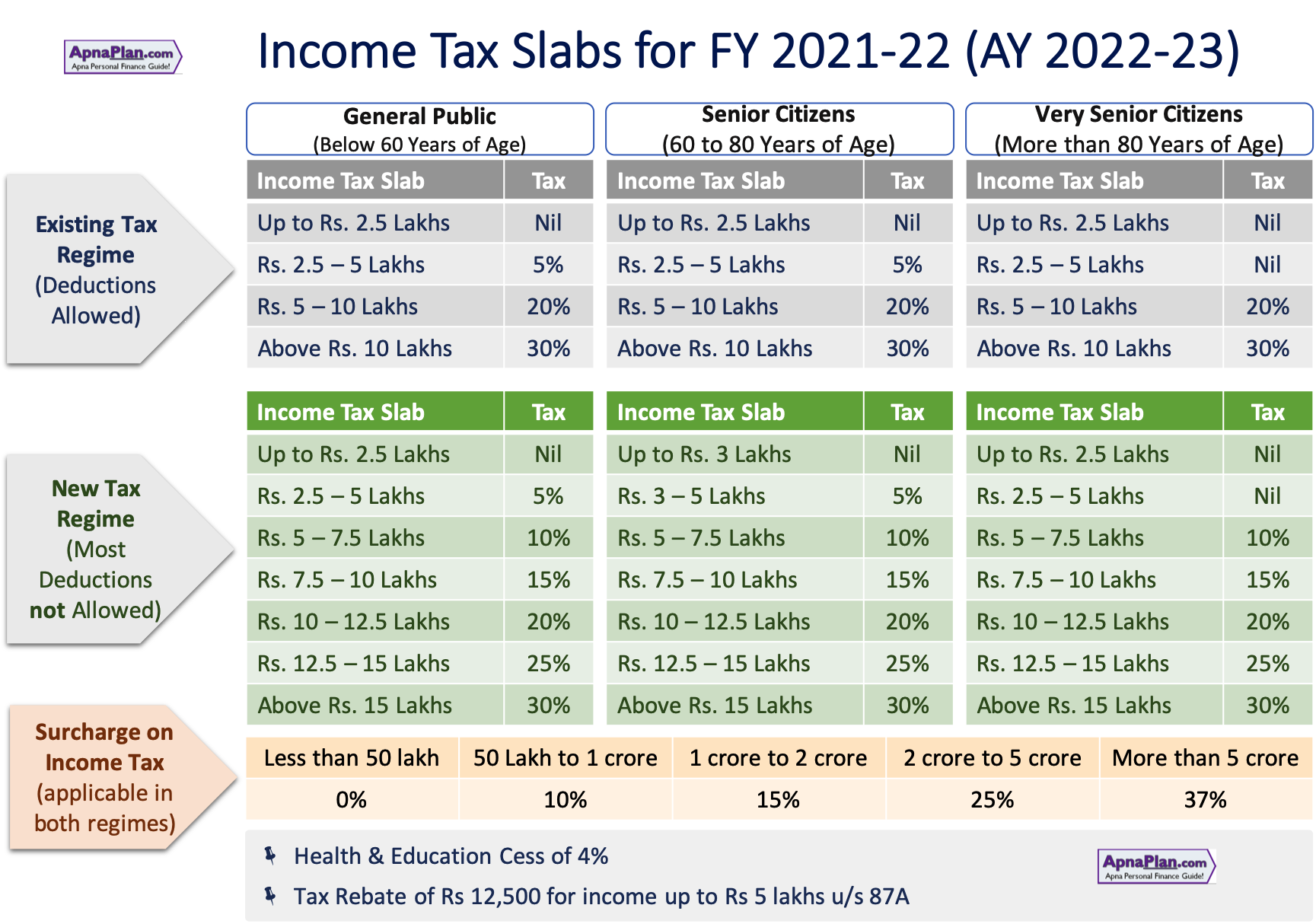

Personal Income Tax Slab For Fy 2020 21 Return Standard Deduction 2021

https://atotaxrates.info/.../ato-tax-rates-2022

WEB Jun 30 2022 nbsp 0183 32 free tax calculator The 2022 financial year in Australia starts on 1 July 2021 and ends on 30 June 2022 The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year This tax table reflects the last amended tax brackets from as at 6 October 2020

https://au.icalculator.com/income-tax-rates/2022.html

WEB Discover the Australia tax tables for 2022 including tax rates and income thresholds Stay informed about tax regulations and calculations in Australia in 2022

https://www.ato.gov.au/tax-rates-and-codes

WEB Find our most popular tax rates and codes listed below or use search and then refine your results using the filters Individual income tax rates Tax tables Weekly tax table Fortnightly tax table Monthly tax table Estimated tax savings

https://www.superguide.com.au/how-super-works/income-tax-rates

WEB Mar 31 2024 nbsp 0183 32 The 32 5 tax rate decreases to 30 The threshold above which the 37 tax rate applies increases from 120 000 to 135 000 The threshold above which the top 45 tax rate applies increases from 180 000 to 190 000 The income tax brackets and rates for Australian residents for next financial year and subsequent financial years are

https://www.ato.gov.au/tax-rates-and-codes/tax...

WEB Last updated 28 September 2023 Print or Download On this page About foreign resident tax rates Foreign residents tax rates 2023 to 2024 Foreign residents tax rates 2011 to 2022 Foreign residents tax rates 2000 to 2010 Foreign residents tax rates 1988 to 1999 About foreign resident tax rates

WEB Tax Rates for 2022 2023 Australian Residents Medicare Levy of 2 applies not applicable to low income earners Low and middle income tax offset LMITO to be removed in this year Non Residents Summary Tax and salary calculator for the 2022 2023 financial year Also calculates your low income tax offset HELP SAPTO and WEB Aug 21 2023 nbsp 0183 32 Australian income tax rates for 2022 23 residents Australian income tax rates for 2021 22 residents Income tax rates for previous years Australian income tax rates for 2018 19 and 2019 20 residents Australian income tax rates for 2016 17 and 2017 18 residents How income tax is calculated What is the tax free threshold

WEB Last updated 4 June 2023 Print or Download On this page Companies Life insurance companies RSA providers other than life insurance providers Pooled development funds Credit unions Not for profit companies that are base rate entities The following rates of tax apply to companies for the 2022 23 income year Companies