2021 To 2022 Tax Thresholds Verkko 3 maalisk 2021 nbsp 0183 32 General description of the measure This measure will maintain the Personal Allowance and basic rate limit at their 2021 to 2022 levels up to and including

Verkko 30 jouluk 2022 nbsp 0183 32 On 20 December 2022 the Finnish Tax Administration published the withholding tax rates table on dividends investment fund profit shares and royalties Verkko 25 maalisk 2021 nbsp 0183 32 Tax brackets for the year 2021 22 were once again updated following this year s Budget on 6 March 2021 Note if you would like to view the 2022 23 tax

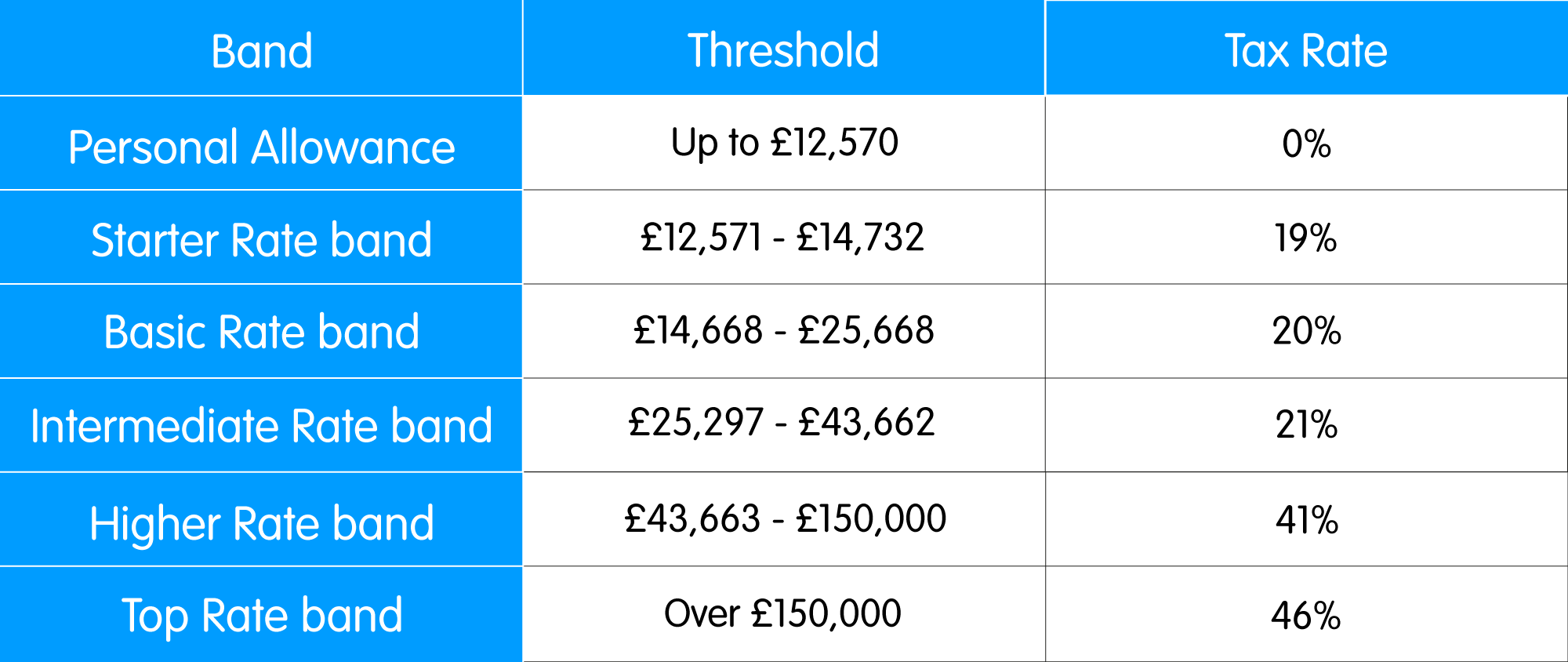

2021 To 2022 Tax Thresholds

2021 To 2022 Tax Thresholds

2021 To 2022 Tax Thresholds

https://deandorton.com/wp-content/uploads/2021/12/Blog-Image-Template-1-1024x546.png

Verkko 11 marrask 2021 nbsp 0183 32 Vuoden 2022 ty 246 el 228 kevakuutusmaksut vahvistettu Sosiaali ja terveysministeri 246 on vahvistanut 11 11 2021 vuoden 2022 ty 246 el 228 kevakuutusmaksut

Pre-crafted templates provide a time-saving service for creating a diverse range of files and files. These pre-designed formats and layouts can be utilized for numerous personal and professional jobs, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, simplifying the material creation procedure.

2021 To 2022 Tax Thresholds

Preparing For The Tax Year 2022 23 PayStream

Medicare IRMAA 2022 Updated Thresholds And Surcharges

Budget 2021 Income Tax Thresholds To Rise To 12 570 And 50 270

Tax Rates And Thresholds For 2022 23 BrightPay Documentation

Lodgment Rates And Thresholds Guide 2021 2022

HMRC Confirms 2022 23 NI Rates Activpayroll

https://www.gov.uk/.../income-tax-rates-and-allowances-current-and-past

Verkko 2022 to 2023 Income after allowances 2021 to 2022 Income after allowances 2020 to 2021 Starting rate for savings 10 Up to 163 5 000 Up to 163 5 000 Up to 163 5 000 Up to

https://www.veronmaksajat.fi/.../valtion-tuloveroasteikko-2022

Verkko 29 jouluk 2021 nbsp 0183 32 82 900 11 351 50 31 25 Palkansaajan v 228 hennykset ty 246 tulov 228 hennys ja muut viran puolesta automaattisesti teht 228 v 228 t v 228 hennykset

https://atotaxrates.info/individual-tax-rates-resident/ato-tax-rates-2022

Verkko 30 kes 228 k 2022 nbsp 0183 32 Tax Rates 2021 2022 Year Residents Tax Scale For Year Ended 30 June 2022 Taxable IncomeTax On This Income 0 to 18 200 Nil 18 201 to 45 000

https://www.gov.uk/income-tax-rates

Verkko Current rates and allowances How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your

https://www.ntu.org/.../detail/income-tax-brackets-for-2021-and-2022

Verkko 12 marrask 2021 nbsp 0183 32 Income Tax Brackets for 2021 and 2022 by Andrew Lautz November 12 2021 The Internal Revenue Service has released 2022 inflation adjustments for

Verkko Published 27 October 2021 This annex includes Autumn Budget 2021 announcements of the main rates and allowances It also covers all announcements made at Spring Verkko 28 syysk 2023 nbsp 0183 32 About tax rates for Australian residents Use these tax rates if you were both an Australian resident for tax purposes for the full year entitled to the full tax

Verkko 28 marrask 2023 nbsp 0183 32 From April 2022 to April 2023 the national insurance rate was increased by 1 25 taking employees NI contributions from 12 to 13 25 Earnings