2021 To 2022 Income Tax Brackets Web Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022 tax brackets have been changed since 2021 to adjust for inflation

Web In 2023 and 2024 there are seven federal income tax rates and brackets 10 12 22 24 32 35 and 37 Taxable income and filing status determine which federal tax rates apply to Web Jun 30 2022 nbsp 0183 32 The legislation is here The modified rates lifted the 32 5 rate ceiling from 87 000 to 90 000 from 1 July 2018 This was further modified by Budget 2020 announcements to lift the 19 rate ceiling from 37 000 to 45 000 and the 32 5 tax bracket ceiling from 90 000 to 120 000

2021 To 2022 Income Tax Brackets

2021 To 2022 Income Tax Brackets

2021 To 2022 Income Tax Brackets

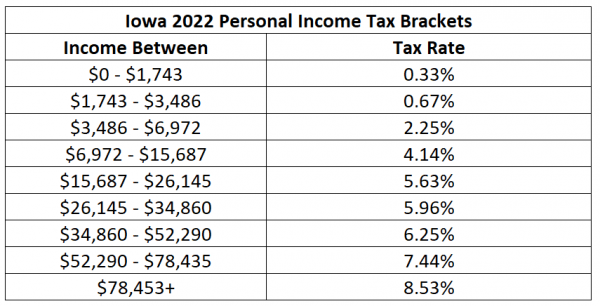

https://arnoldmotewealthmanagement.com/wp-content/uploads/2020/10/Iowa-2022-income-tax-brackets-e1634243001926.png

Web Last updated 28 September 2023 Print or Download About tax rates for Australian residents Use these tax rates if you were both an Australian resident for tax purposes for the full year entitled to the full tax free threshold These rates don t include the Medicare levy see Income thresholds and rates for the Medicare levy surcharge

Templates are pre-designed documents or files that can be utilized for different functions. They can save time and effort by providing a ready-made format and layout for producing different kinds of content. Templates can be used for individual or professional projects, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

2021 To 2022 Income Tax Brackets

Federal Income Tax Brackets 2021 Vs 2022 AngelsOlfe

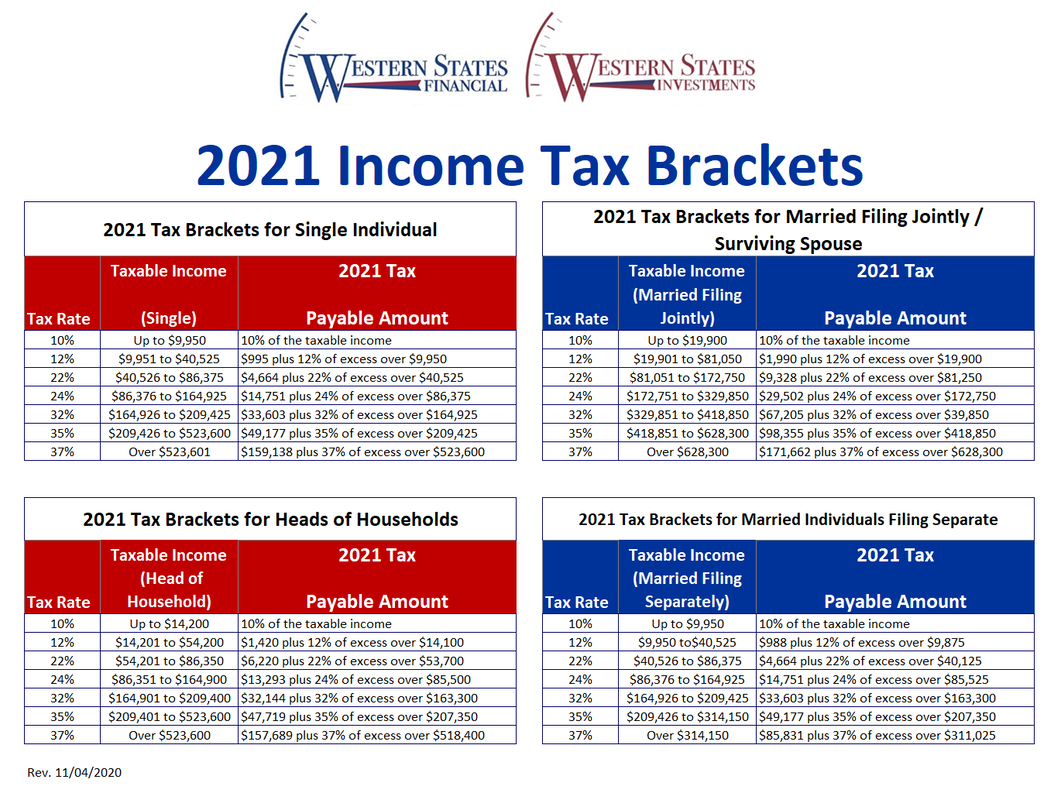

2021 Federal Tax Brackets Tax Rates Retirement Plans Western

Federal Income Tax Brackets 2021 Vs 2022 Mumuabc

Your First Look At 2021 Tax Rates Projected Brackets Standard

New 2021 IRS Income Tax Brackets And Phaseouts

Tax Brackets 2022 Chart

https://www.gov.uk/guidance/rates-and-thresholds...

Web Feb 2 2021 nbsp 0183 32 PAYE tax rates and thresholds 2021 to 2022 Employee personal allowance 163 242 per week 163 1 048 per month 163 12 570 per year English and Northern Irish basic tax rate

https://www.gov.uk/government/publications/rates...

Web The Personal Allowance goes down by 163 1 for every 163 2 of income above the 163 100 000 limit It can go down to zero Personal Allowances for people born before 6 April 1948 People born before 6 April

https://www.gov.uk/income-tax-rates

Web Current rates and allowances How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income falls within each

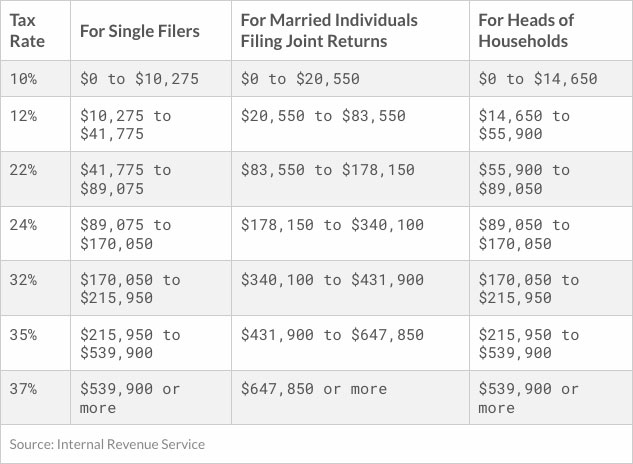

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539 900 for single filers and above 647 850 for married couples filing jointly

https://www.bankrate.com/taxes/2021-tax-bracket-rates

Web Jan 17 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2021 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your tax bracket

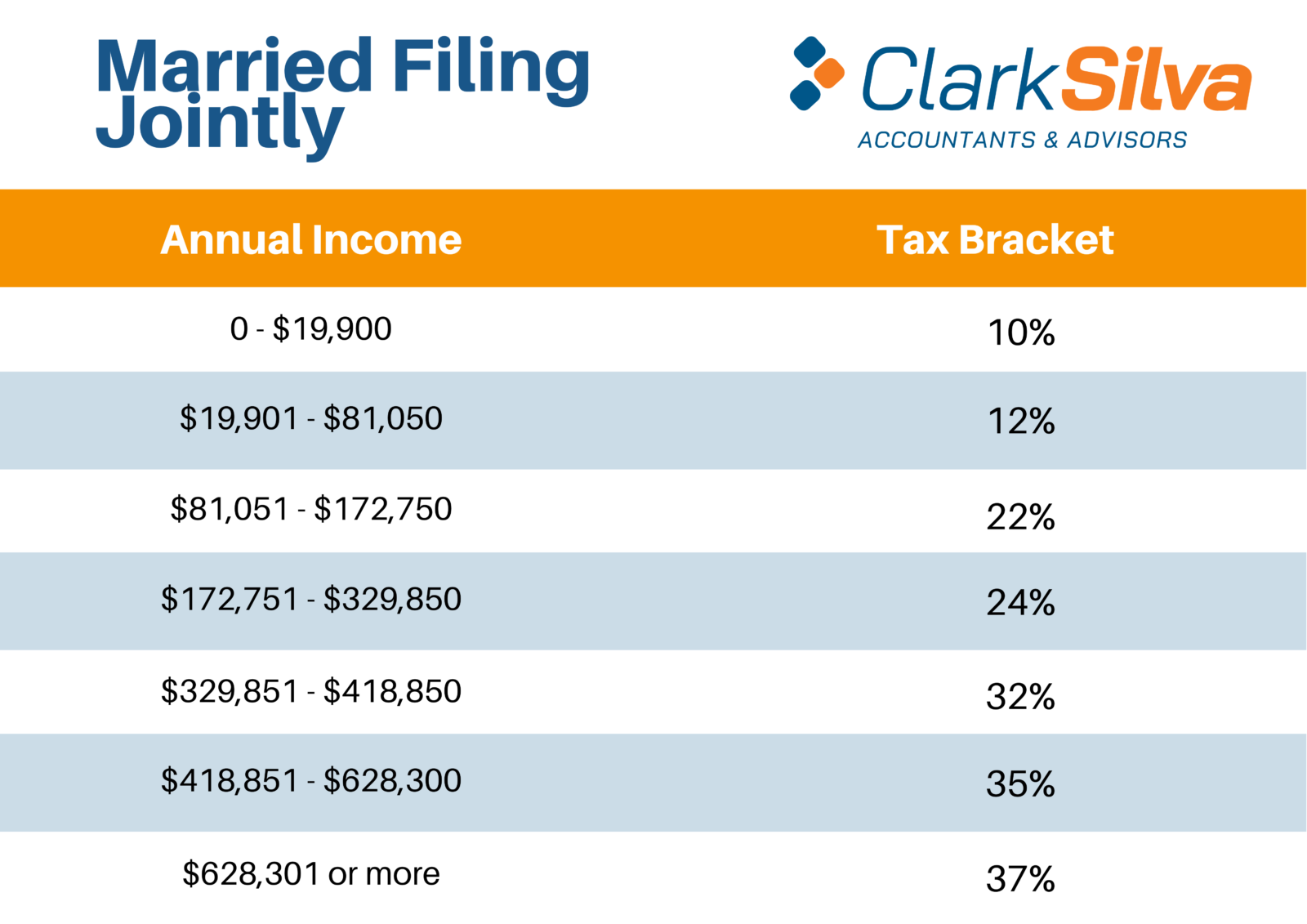

Web Feb 22 2024 nbsp 0183 32 2021 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households Tax Rate For Single Filers Taxable Income For Married Individuals Filing Joint Returns Taxable Income For Heads of Households Taxable Income 10 Up to 9 950 Up to 19 900 Up to 14 200 12 Web Nov 11 2021 nbsp 0183 32 The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021 for taxpayers with three or more qualifying children Basic exclusion for decedents who die in

Web 5 days ago nbsp 0183 32 Federal income tax rates and brackets You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income